China Tax Lawyer Review (Volume 12)

China Tax Lawyer Review is a professional and continuous publication in the tax industry edited by the Finance and Taxation Law Committee of the All China Lawyers Association and edited by Hwuason Law Firm attorney Liu Tianyong. It has been published in 12 consecutive volumes so far, and the first 11 volumes have received wide attention and favorable comments in the legal community and the finance and taxation community.

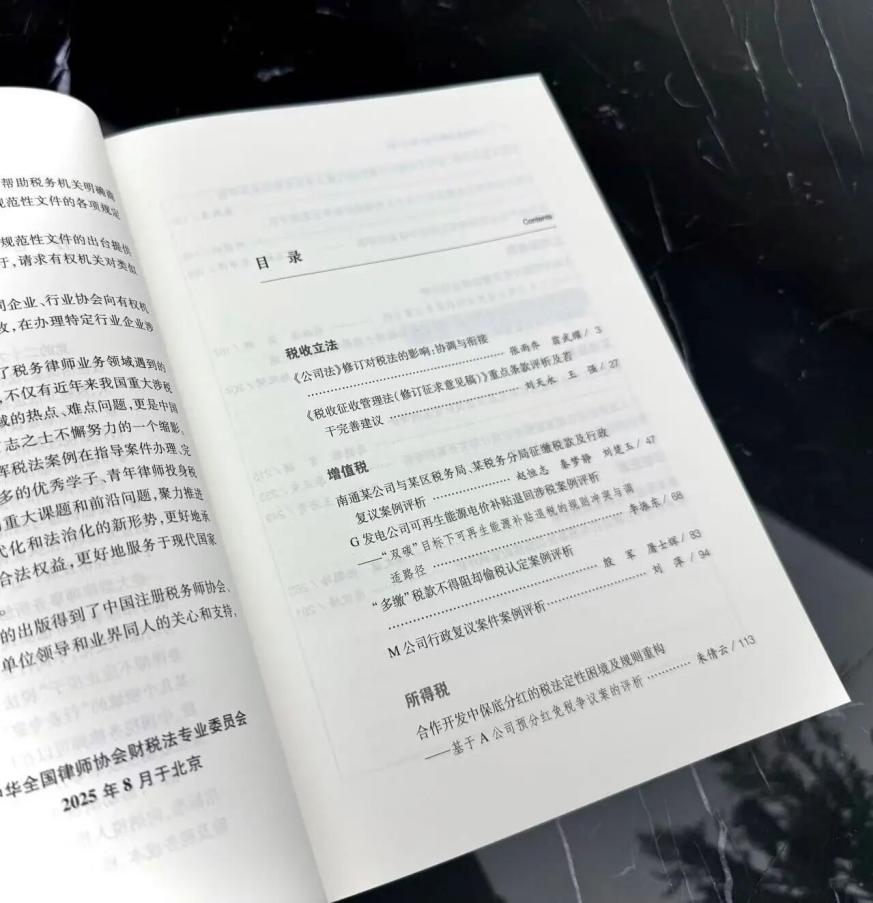

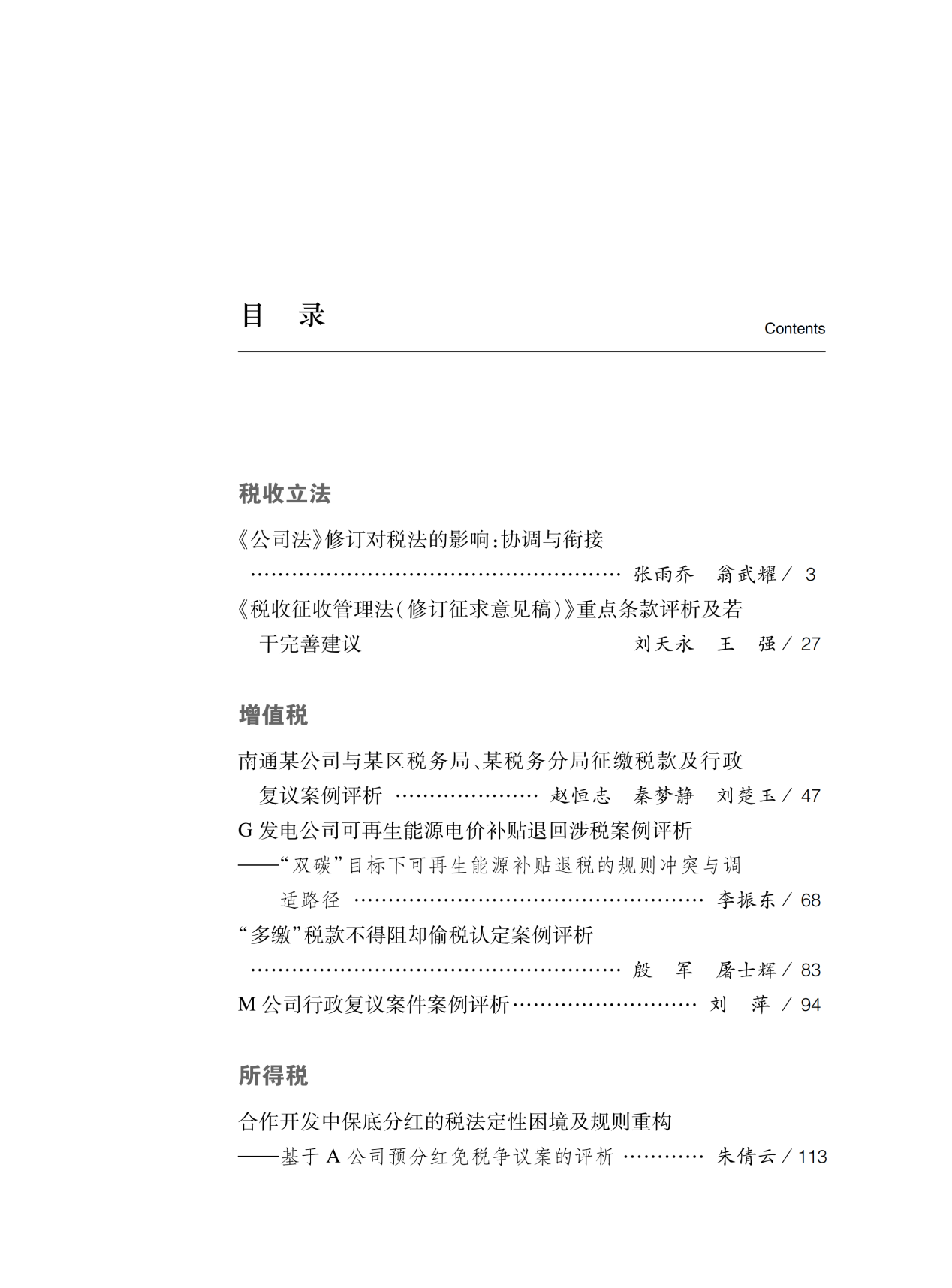

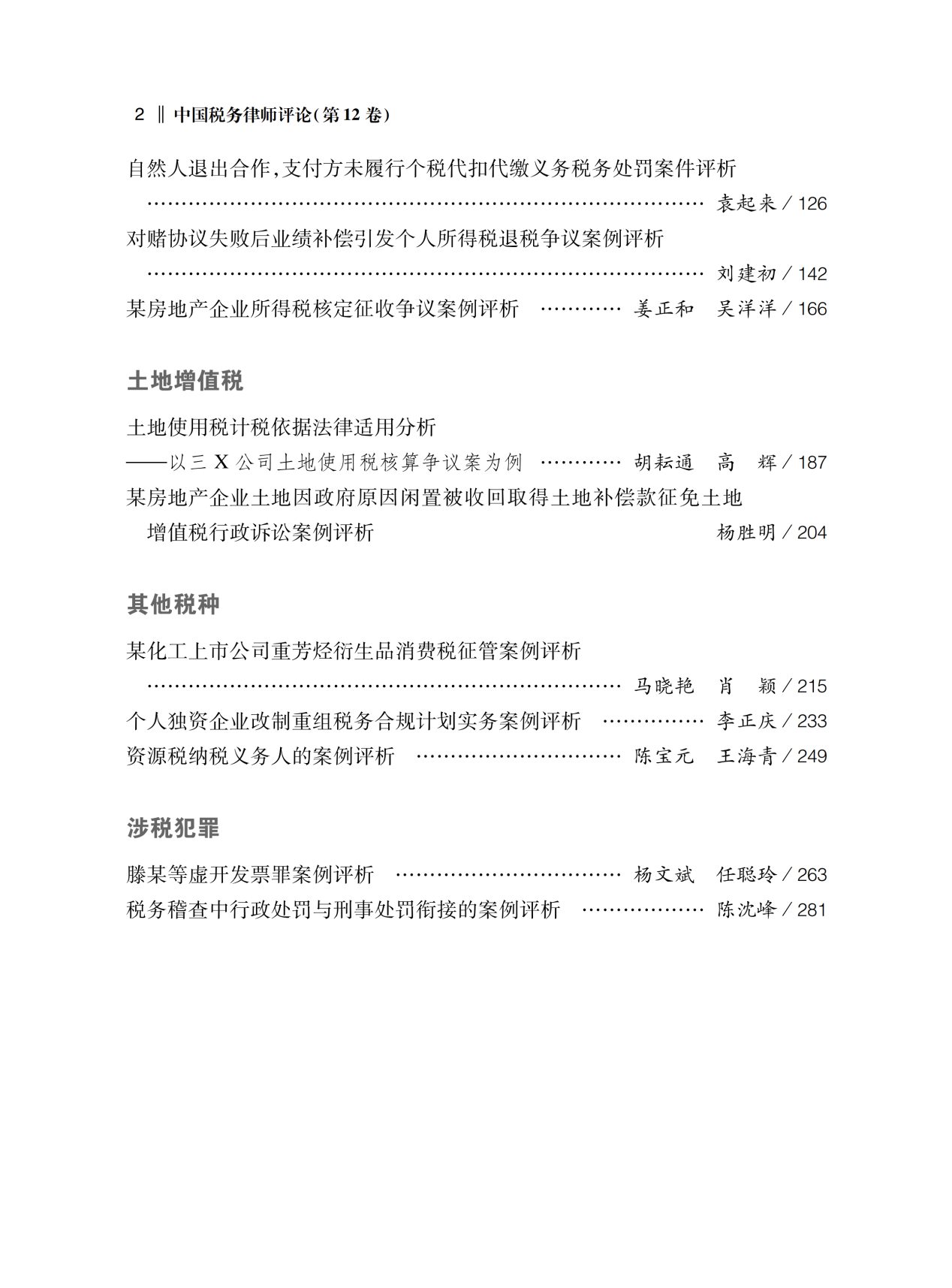

Volume 12 of this publication contains the outstanding works of the“2025 National Top Ten Excellent Tax Law Case Papers”. After expert evaluation, 10 “2025 National Top Ten Excellent Tax Law Case Papers” were finally selected to be included in this book. They are:

Zhao Hengzhi, Qin Mengjing and Liu Chuyu: “Case Commentary on a Nantong Company’s Tax Collection and Administrative Review Dispute with a District Tax Bureau and a Tax Branch”.

Yin Jun and Tu Shihui: “Case Commentary on the Principle that ‘Overpaid’ Taxes Do Not Preclude a Finding of Tax Evasion”.

Hu Yuntong and Gao Hui: “Analysis of the Legal Application of the Land Use Tax Base—Taking the Land Use Tax Accounting Dispute of Company 3X as an Example”.

Zhu Qianyun: “The Tax Law Characterization Dilemma of Guaranteed Minimum Dividends in Cooperative Development and the Reconstruction of Rules—A Commentary Based on Company A’s Dispute over the Tax Exemption of Advance Dividend Distributions”.

Liu Jianchu: “Case Commentary on an Individual Income Tax Refund Dispute Triggered by Performance Compensation After the Failure of a Valuation Adjustment Mechanism (VAM) Agreement”.

Ma Xiaoyan and Xiao Ying: “Case Commentary on the Excise Tax Collection and Administration of Heavy Aromatics Derivative Products of a Listed Chemical Company”.

Yuan Qilai: “Case Commentary on a Tax Penalty Case Where, Upon a Natural Person’s Withdrawal from a Cooperation, the Paying Party Failed to Withhold and Remit Individual Income Tax”.

Yang Wenbin and Ren Congling: “Case Commentary on the Crime of Falsely Issuing Invoices in the Case of Mr. Teng and Others”.

Li Zhendong: “Tax-Related Case Commentary on the Return of Renewable Energy Tariff Subsidies by G Power Generation Company—Rule Conflicts and Adaptive Pathways for Subsidy Tax Refunds under the ‘Dual-Carbon’ Goals”.

Liu Ping: “Case Commentary on an Administrative Review Case of Company M”.

These papers cover typical tax-related cases across different industries, reflecting some representative issues encountered in the current practice of tax lawyers as well as successful practical experience in handling such matters. They include discussions on hot topics such as the revision of the Tax Collection and Administration Law, and provide innovative sorting and analysis of difficult and complex cases from the perspectives of multiple tax categories, including value-added tax, enterprise income tax, and land value-added tax. They also offer practical analyses of key disputed issues in tax-related criminal cases. It is sincerely hoped that this book will inspire more outstanding students and young lawyers to devote themselves to the field of tax law services, continue to explore major issues and frontier topics in the development of China’s tax rule of law, and jointly promote innovation and upgrading of tax-related professional services, contributing to the modernization and rule-of-law-based development of tax governance.

Editor-in-Chief Profile:

Liu Tianyong is the founder of Hwuason, the Director of Beijing Hwuason Law Firm, and a senior tax lawyer. He holds a Doctor of Laws degree and is a postdoctoral researcher in economics. He is among the State Taxation Administration’s “first batch of National Leading Tax Talents” and serves as a legal expert in the Ministry of Finance Talent Pool. He also serves as the Director of the Finance and Taxation Law Committee of the All China Lawyers Association, a member of the Expert Committee on Supervision Cases of Civil and Administrative Litigation of the Supreme People’s Procuratorate, and a member of the Expert Committee on Filing and Review of Regulations and Rules of the Ministry of Justice. He is an adjunct professor at several universities, including Peking University, Renmin University of China, and China University of Political Science and Law. He has been invited multiple times by the Legislative Affairs Commission of the Standing Committee of the National People’s Congress, the State Council, and the Ministry of Justice, the Ministry of Finance, the State Taxation Administration, and other authorities to participate in legislative drafting and revision seminars on laws such as the Tax Collection and Administration Law, the Individual Income Tax Law, the Enterprise Income Tax Law, the Value-Added Tax Law, and the Consumption Tax Law. Over the years, he has successfully represented more than 200 tax-related criminal and administrative cases with significant social impact.

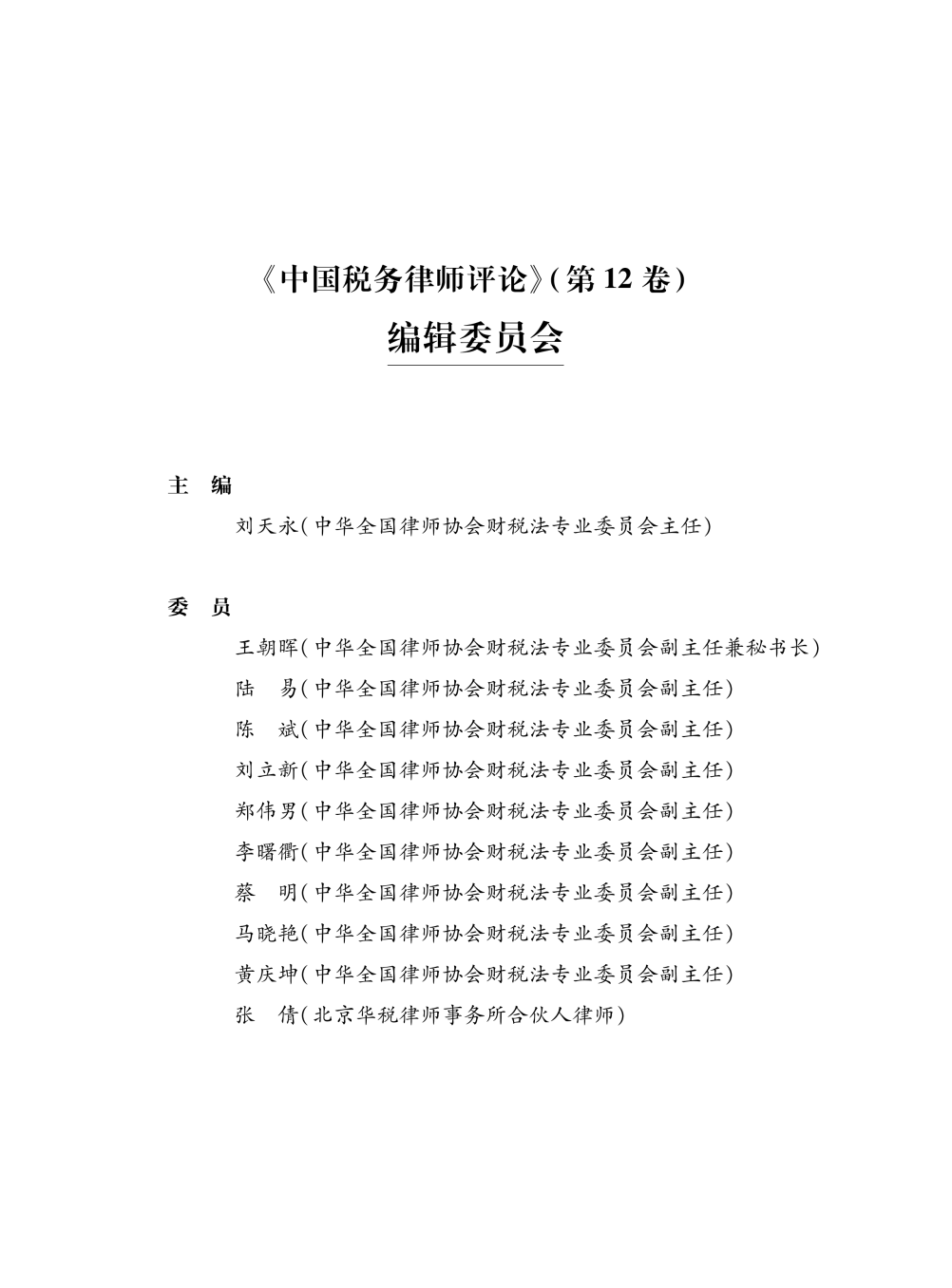

Editorial Committee:

Preface:

Catalogue:

Book access: recognize the QR code below to purchase.