Tax Compliance Report in Investment and Financing (2024)

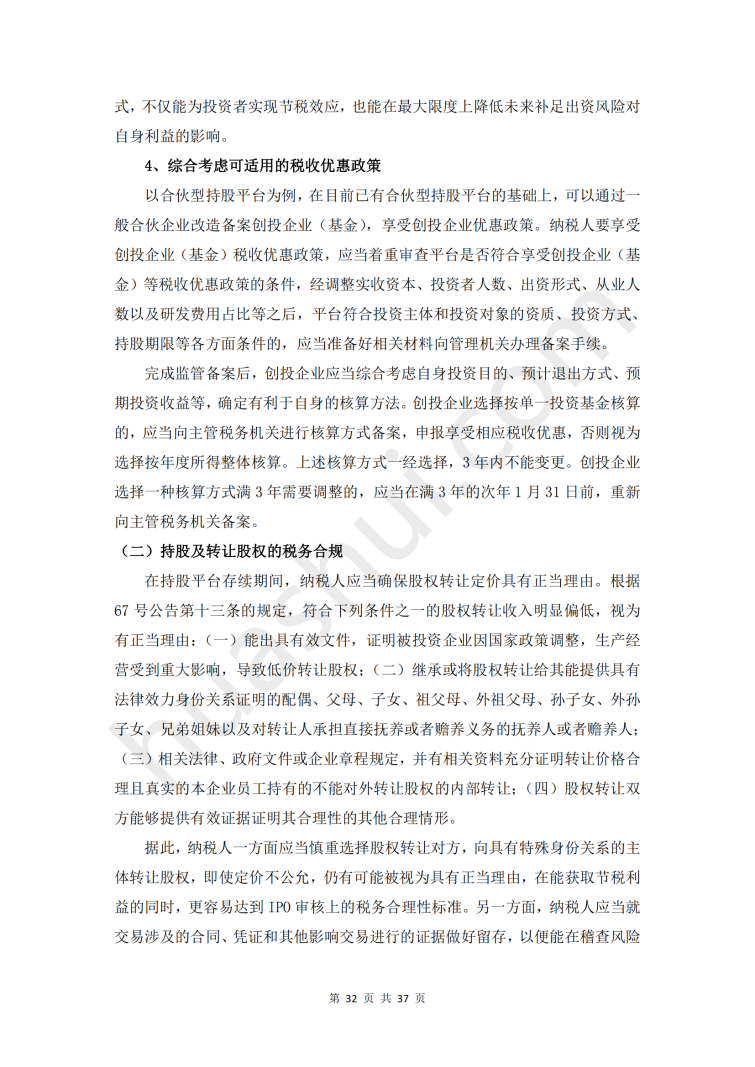

Along with China's economic development, the investment capacity of high net worth individuals (HNWIs) in Mainland China has strengthened. According to the China Private Wealth Report released by China Merchants Bank in 2023, as of 2022, the number of HNWIs in China reached 3.16 million, holding a total of RMB 101 trillion in investable assets, and corporate equity investment is also one of the main directions of HNWIs' cash outflow. However, direct shareholding by natural persons has a high tax burden, and individual investors are exploring other shareholding modes in order to reduce their tax burden. At this time, the shareholding platform, as a shareholding structure designed under the combined effect of local tax incentives and the stability of listed companies' shareholdings, has entered the vision of HNWIs and become an important tool for HNWIs' foreign investment. In recent years, with the tightening of tax regulation for HNWIs and the extensive and in-depth cleanup of local tax approvals and financial rebate policies for irregularities, the tax advantage of the shareholding platform is no longer available, and if the shareholding platform is not dismantled, it will face the situation that the tax burden for future equity transfers will not be reduced but rather increased, while the dismantling of the shareholding platform may immediately be burdened with a high level of tax. At the same time, HNWIs and their equity transfer behaviors have become an area of continuous attention and key investigation by tax supervision, and it has become a dilemma for HNWIs to dismantle or not to dismantle their shareholding platforms. In practice, it has been common for individual investors to dismantle their shareholding platforms, among which, the most common means of dismantling the shareholding platforms for HNWIs is to cancel the non-trading transfers of shares. However, this approach has also brought a lot of tax risks to HNWIs, which is evidenced by the cases of various back taxes and late payment liabilities penetrating into the shareholders and partners. In addition, the promulgation of the new company law on December 29, 2023 also has potential tax implications for individual investors through amendments to various aspects such as registered capital, governance structure, principal liability and establishment and exit.

The "Tax Compliance Report in Investment and Financing (2024)" is compiled by Hwuason based on the analysis and research of tax administration policies for HNWIs, combined with the tax-related typical cases in investment and financing that China Tax has been involved in in recent years, with the aim of revealing the major tax risk points of domestic investment and financing for HNWIs based on the characteristics of tax administration of HNWIs and putting forward targeted and feasible compliance suggestions on this basis, so as to Provide guidance and reference for the tax compliance of investment and financing business of HNWIs.

Click to download:《Tax Compliance Report in Investment and Financing》(2024)