Coal Industry Tax-Related Criminal Risk Report (2022)

As the basic energy of China's national economy, coal has important strategic significance. Due to the special nature of coal resources, the state's management of the coal industry has a large degree of administrative dominance, the voice of coal enterprises of different natures in the industry chain is light and heavy, private coal enterprises are not standardized, management is not perfect, risk control is not sufficient, and many other reasons, so that the private coal enterprises are more likely to be involved in tax-related risks and criminal risks.

February 28, 2020, Inner Mongolia to carry out special rectification in the field of coal reverse 20 years of action, followed by a number of other provinces, including Shanxi, Yunnan, Sichuan, Xinjiang and other provinces have also launched the coal field of self-examination and self-correction. Multi-departmental coordination has led to the investigation and prosecution of a number of cases of tax violations by coal enterprises, which has led to further fermentation of tax-related and criminal risks of coal enterprises.

In March 2021, the Opinions on Further Deepening the Reform of Tax Levy and Administration issued by the Central and State Offices explicitly regarded coal and other industries as a key area of concern, and severely cracked down on illegal and criminal behaviors of false invoicing, tax cheating and tax evasion in coal and other industries, and the SAT made it clear that the SAT would be guided by tax risks, make full use of big data, accurately implement tax supervision, focus on key areas, and focus on investigating and dealing with tax-related illegal behaviors such as false and fraudulent invoices to cheat tax and concealment of income to evade tax. income tax evasion and other tax-related illegal behaviors, making the tax-related and criminal risks of coal enterprises the focus of attention and crackdown.

In October 2021, the fight against the three counterfeits was taken to a higher level, the Supreme Prosecutor and OFAC joined in, the four ministries were upgraded to six departments, the special action was upgraded to a regularized crackdown, the departments shared data and worked jointly to crack down on all kinds of false invoicing and tax fraud and related enterprises, and the tax and police jointly investigated and dealt with a number of big cases of false invoicing and tax fraud in the coal field, so that the tax-related criminal risks of the coal enterprises were triggered at the first instance.

Tax-related criminal cases have a low threshold of incrimination and heavy criminal liability, and entrepreneurs will be put behind bars if they are not careful. The tax-related criminal risk belongs to the "sword of Damocles" hanging over the heads of coal enterprises and entrepreneurs. But for the practice of coal enterprises outbreak of tax-related criminal cases, the facts of the case are not the same, some are the use of coal enterprises in the name of violent false tax fraud, some are enterprises in the process of operation there are management loopholes and by the staff fraud, customer fraud, some are the existence of imperfections in the management system of the enterprise and thus triggered the risk of tax-related, some based on the special nature of the coal industry, such as the truth on behalf of the opening, the business of the affiliation for the existence of these circumstances and was filed for criminal responsibility, and the case of the criminal liability. For enterprises and entrepreneurs who have been prosecuted for criminal liability due to these circumstances, special attention should be paid to avoiding tax-related criminal liability as far as possible by combining the provisions of tax law and criminal law.

The Report on Tax-Related Criminal Risks in Coal Industry (2022) is a summary of Huazhan's in-depth observation of the coal industry and its successful experience in representing coal enterprises in tax-related criminal cases, aiming at sorting out the latest tax policies in the coal industry, analyzing the tax-related criminal risks of coal enterprises in the judicial practice, and putting forward targeted response suggestions, with the aim of providing reference for coal enterprises to maximize the prevention of tax-related criminal risks.

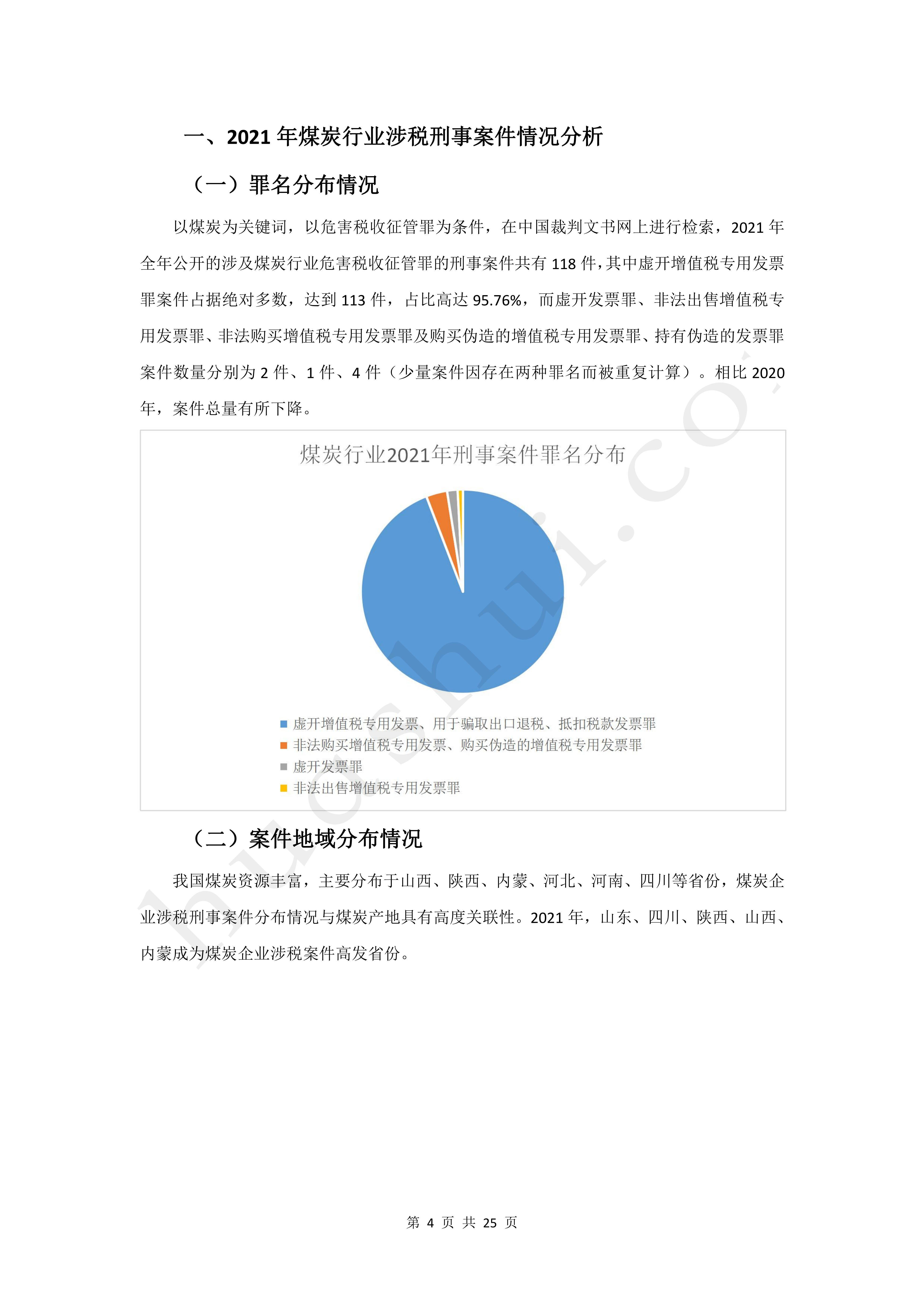

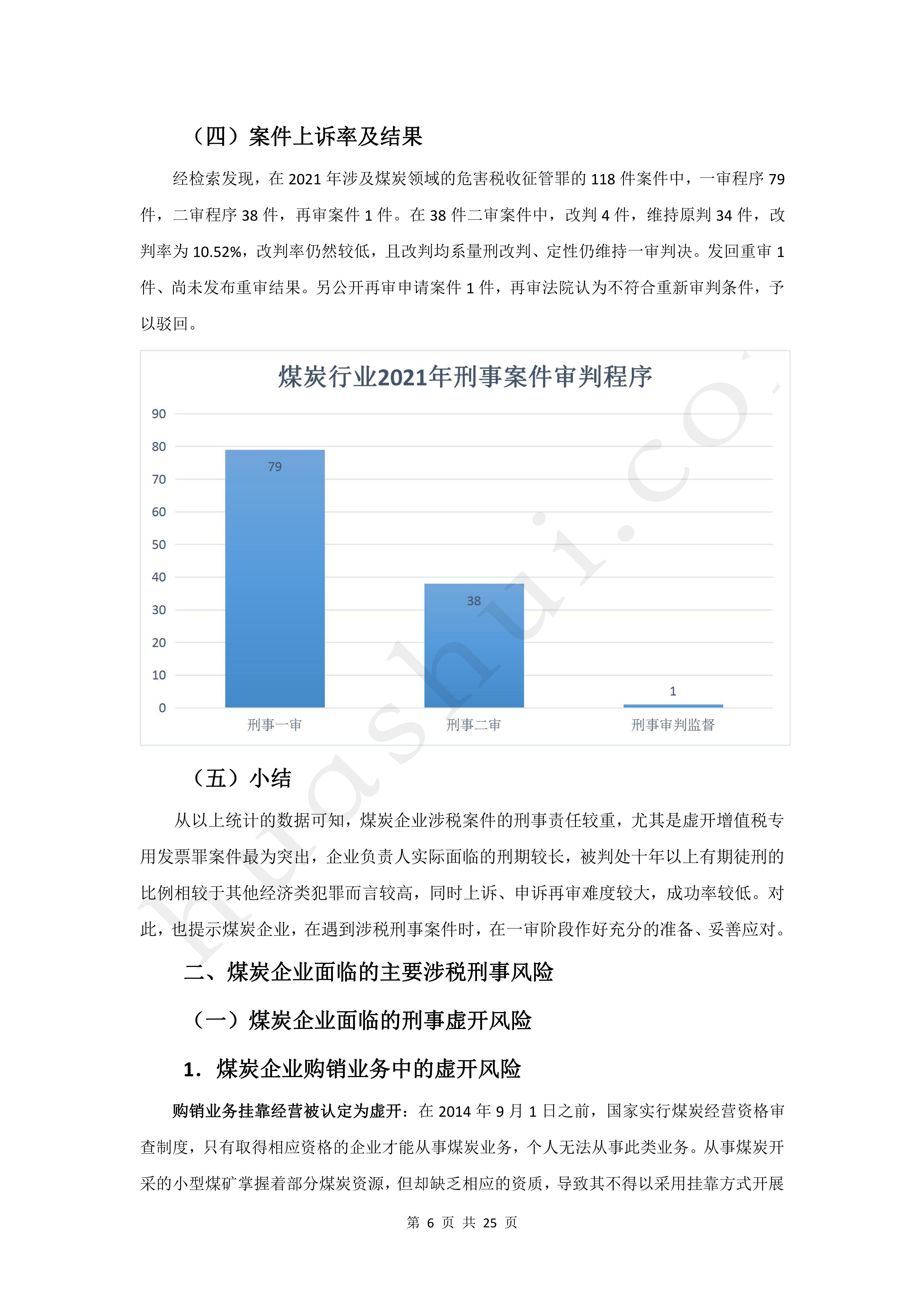

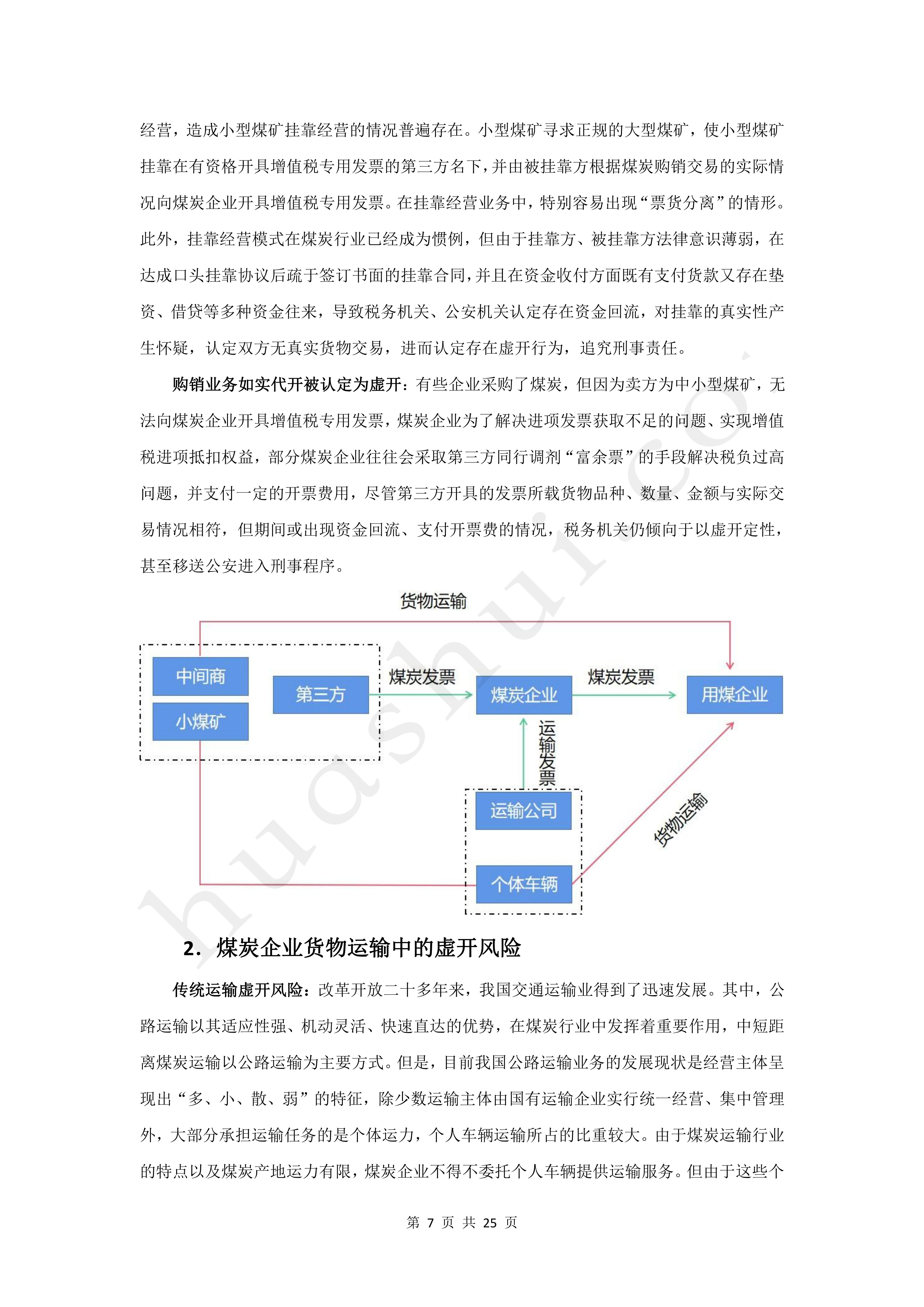

Click to download: Full Report of Coal Industry Tax-Related Criminal Risk Report (2022)