Petrochemical Industry Tax-Related Criminal Risk Report (2022)

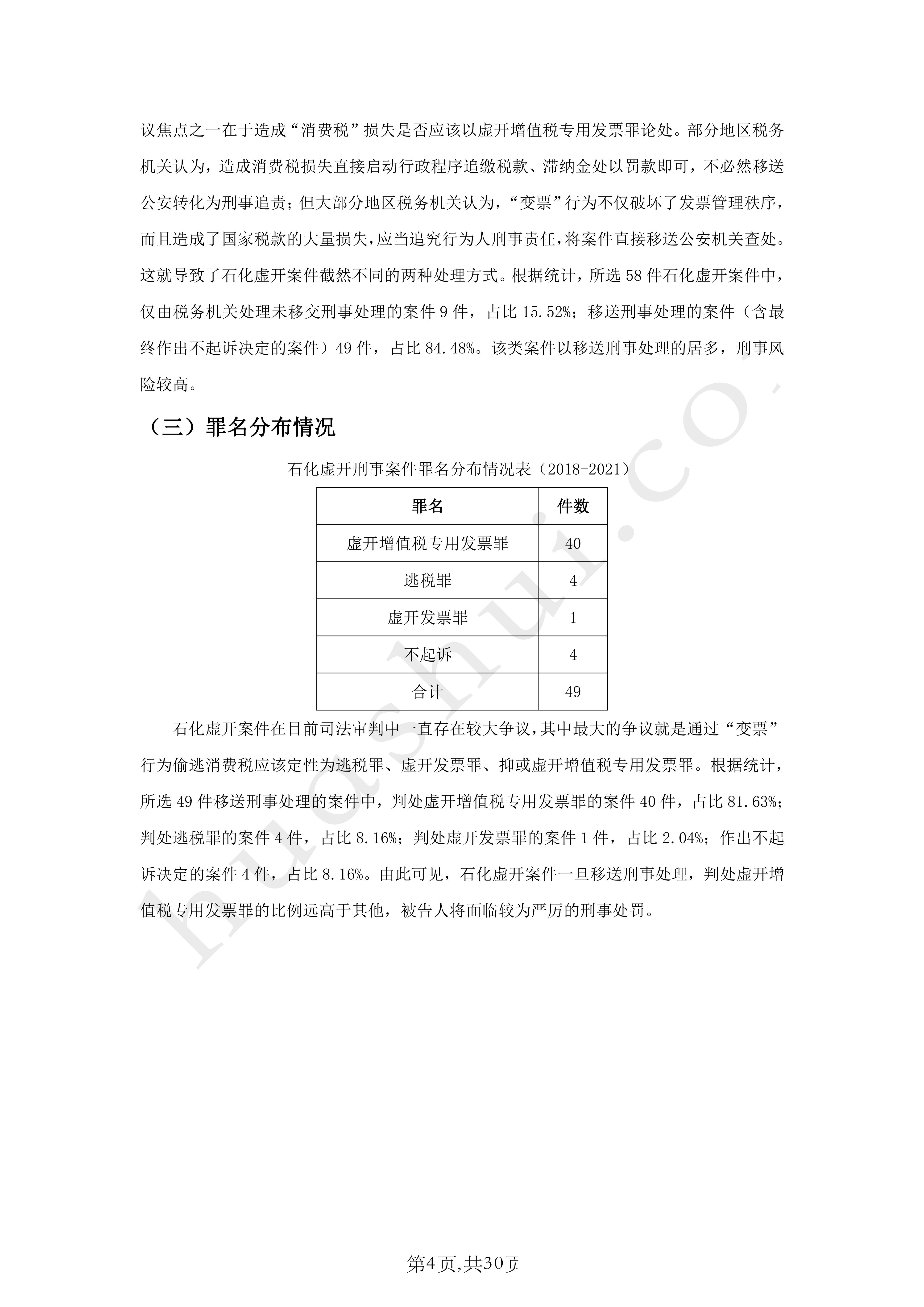

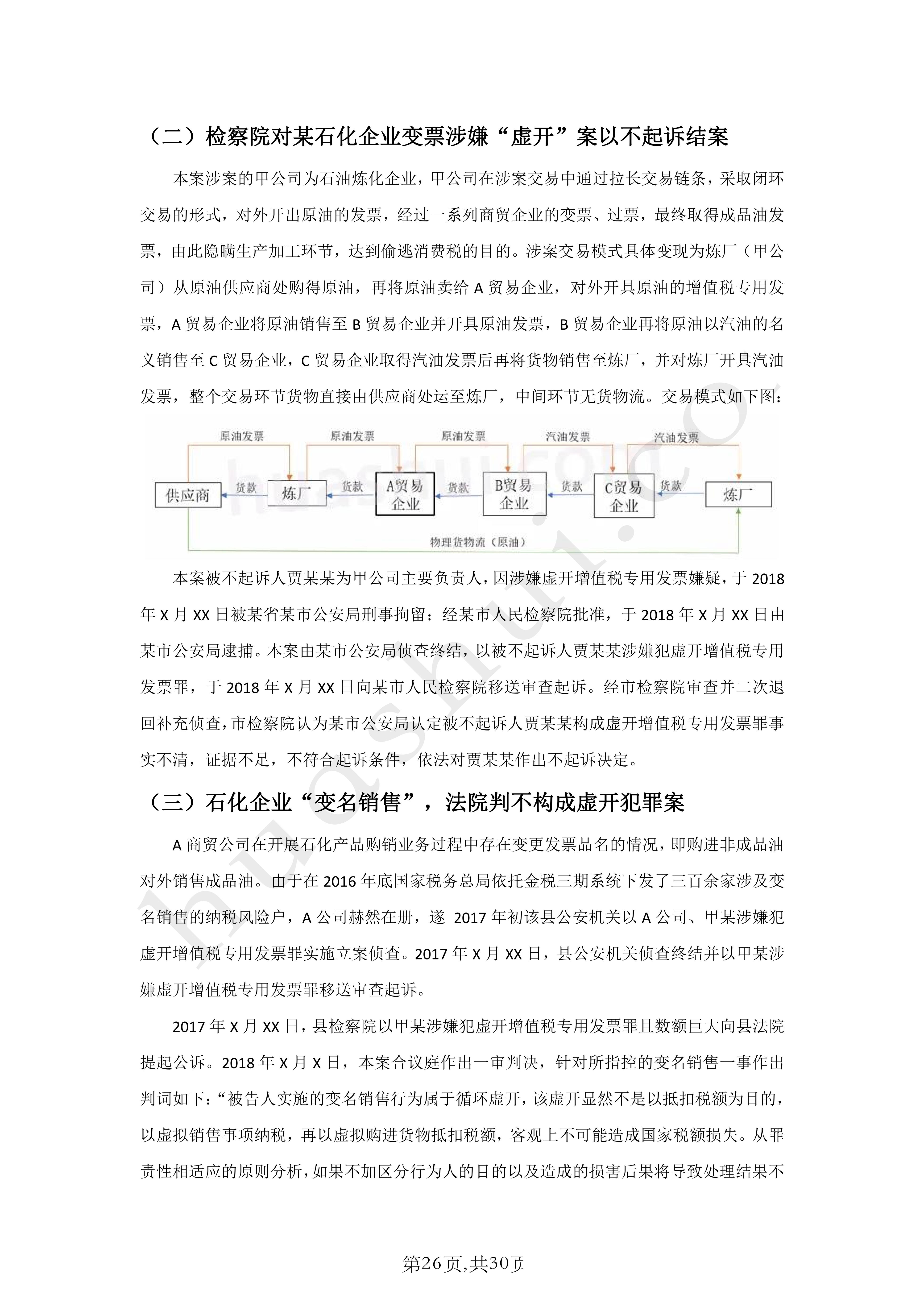

The petrochemical industry is one of the important economic pillars of China. Since the Golden Tax Phase III went online in 2015, the tax and judicial departments have made unprecedented efforts to investigate and deal with petrochemical enterprises' evasion of consumption tax by means of variable invoicing, and the criminal cases of variable invoicing and false invoicing in the petrochemical industry have erupted on a large scale across the country.At the beginning of 2018, the State Administration of Taxation (SAT) issued the "Announcement on the Relevant Issues on the Administration of the Levy and Collection of Consumption Tax on Refined Products Oil," and set up a module of refined products oil invoicing on the Golden Tax Phase III system, so as to eliminate the traditional Illegal invoice-changing behavior has been completely eliminated, but new types of invoice-changing transactions driven by consumption tax interests still continue to emerge, and various types of invoice-changing cases, such as industrial white oil, outsourced processing, and gasoline-to-transportation, driven by value-added tax interests, have shown regional and cyclical outbreaks. The criminal risk of false VAT invoicing by petrochemical enterprises remains severe. Based on the data analysis of criminal cases of false invoicing in petrochemical enterprises and the background observation of the normalized mechanism of the national action against "three counterfeits", this report analyzes the potential tax-related criminal risks of traditional and new types of invoice-variation transaction modes of petrochemical enterprises and combines with the analysis of the successful defense cases of Huazhong Tax Lawyers' team to provide guidance and reference for petrochemical enterprises on the tax-related criminal compliance for the year of 2022. The team also analyzed the successful defense cases and provided guidance and reference for petrochemical enterprises on tax-related criminal compliance in 2022.

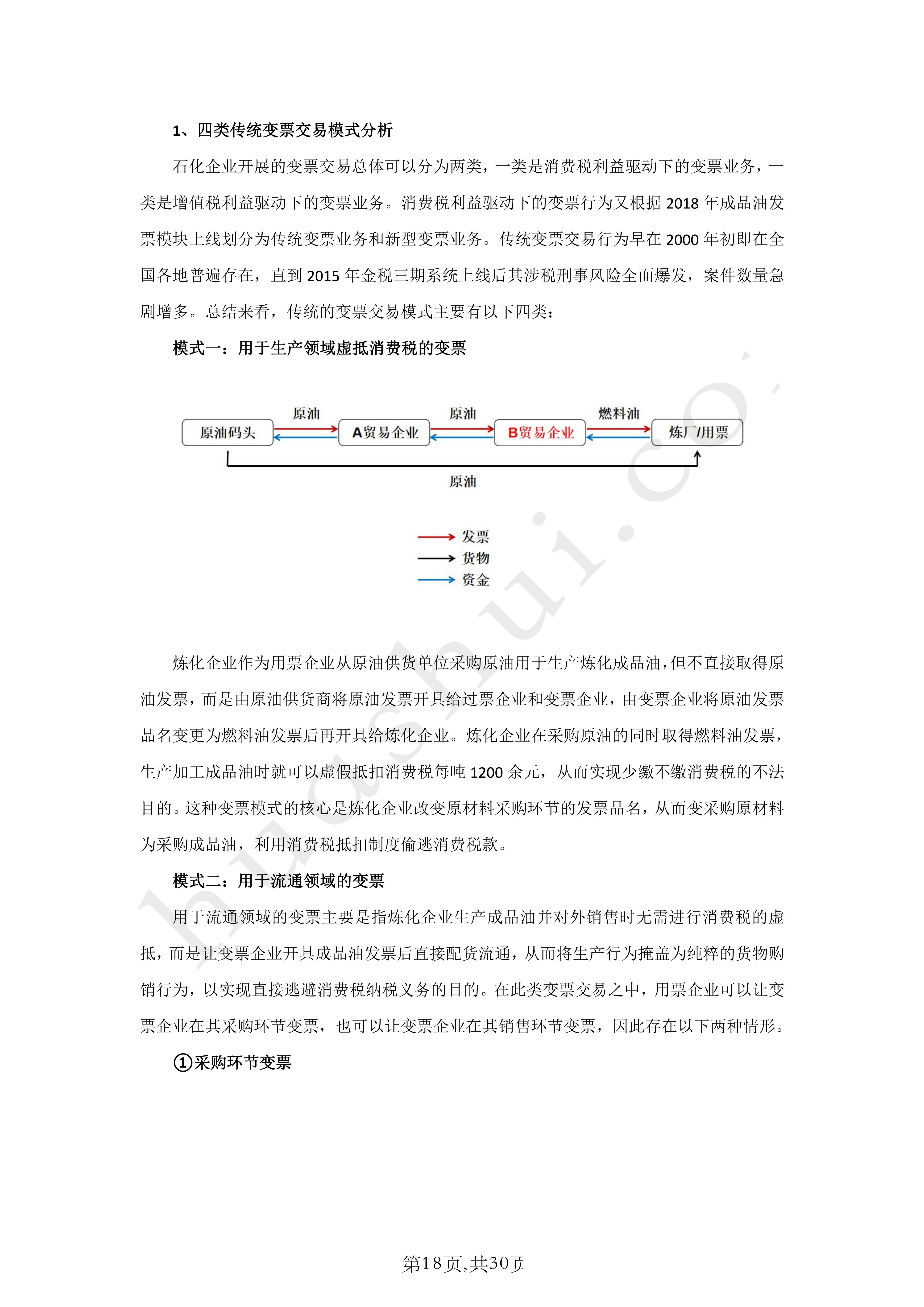

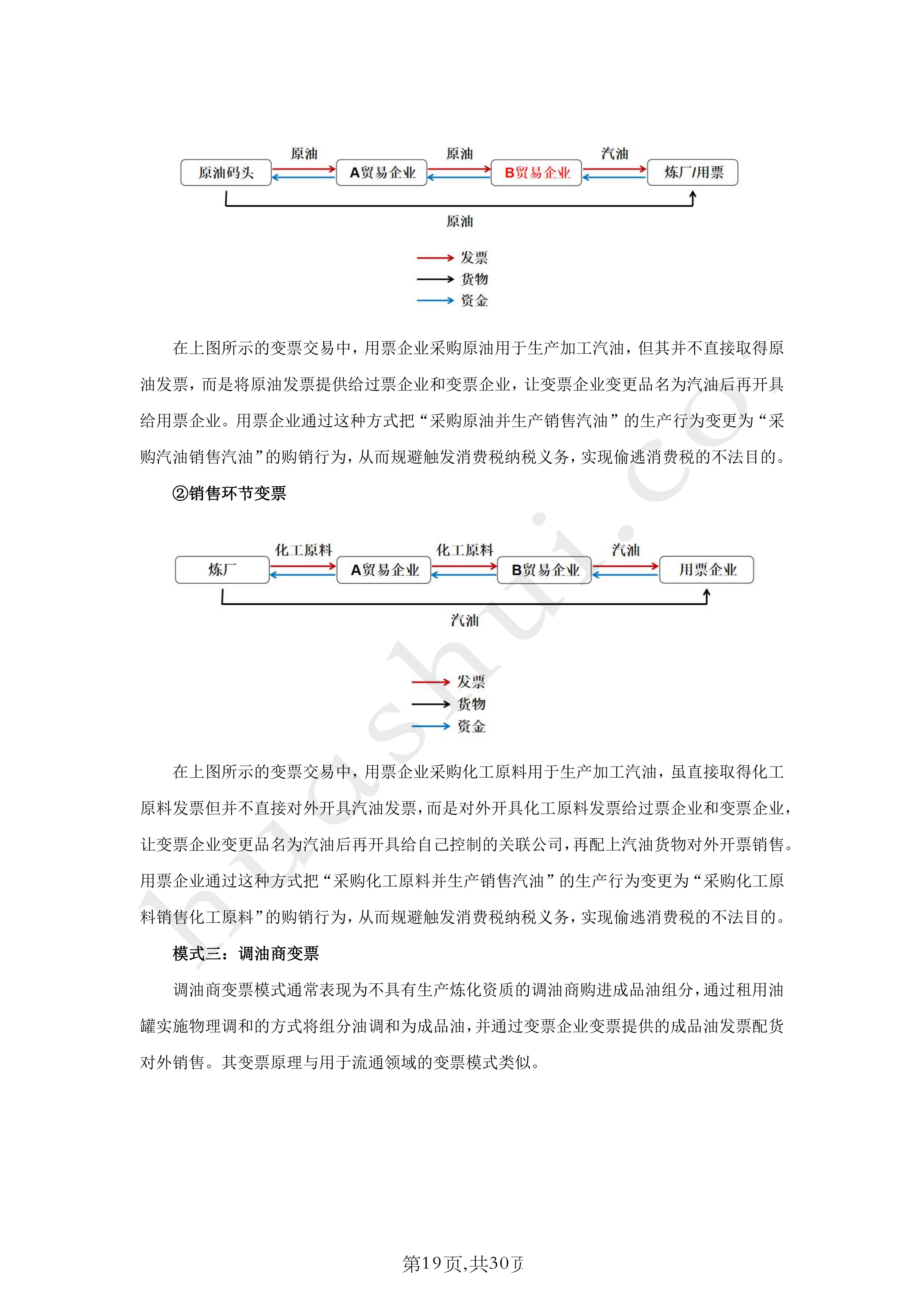

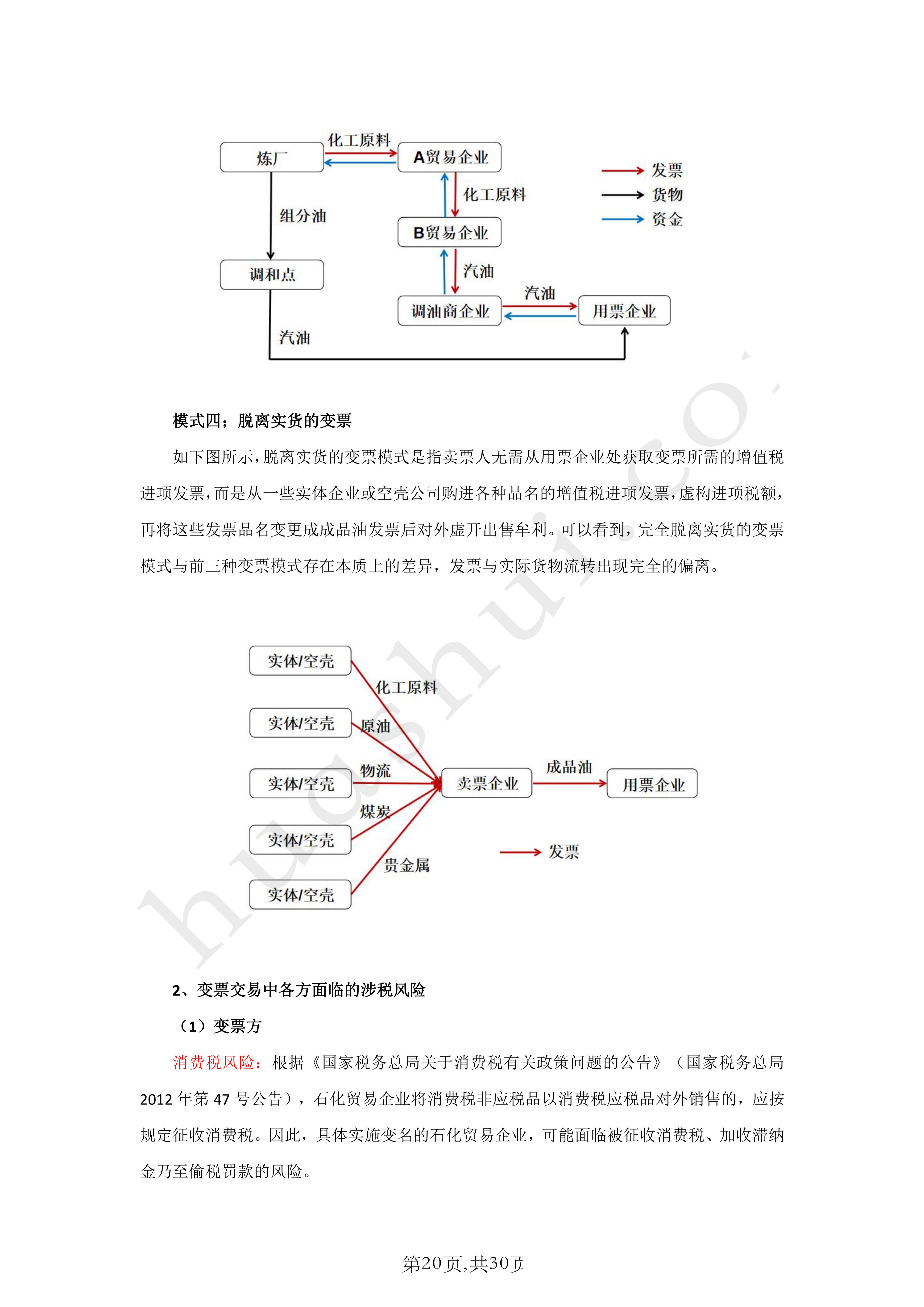

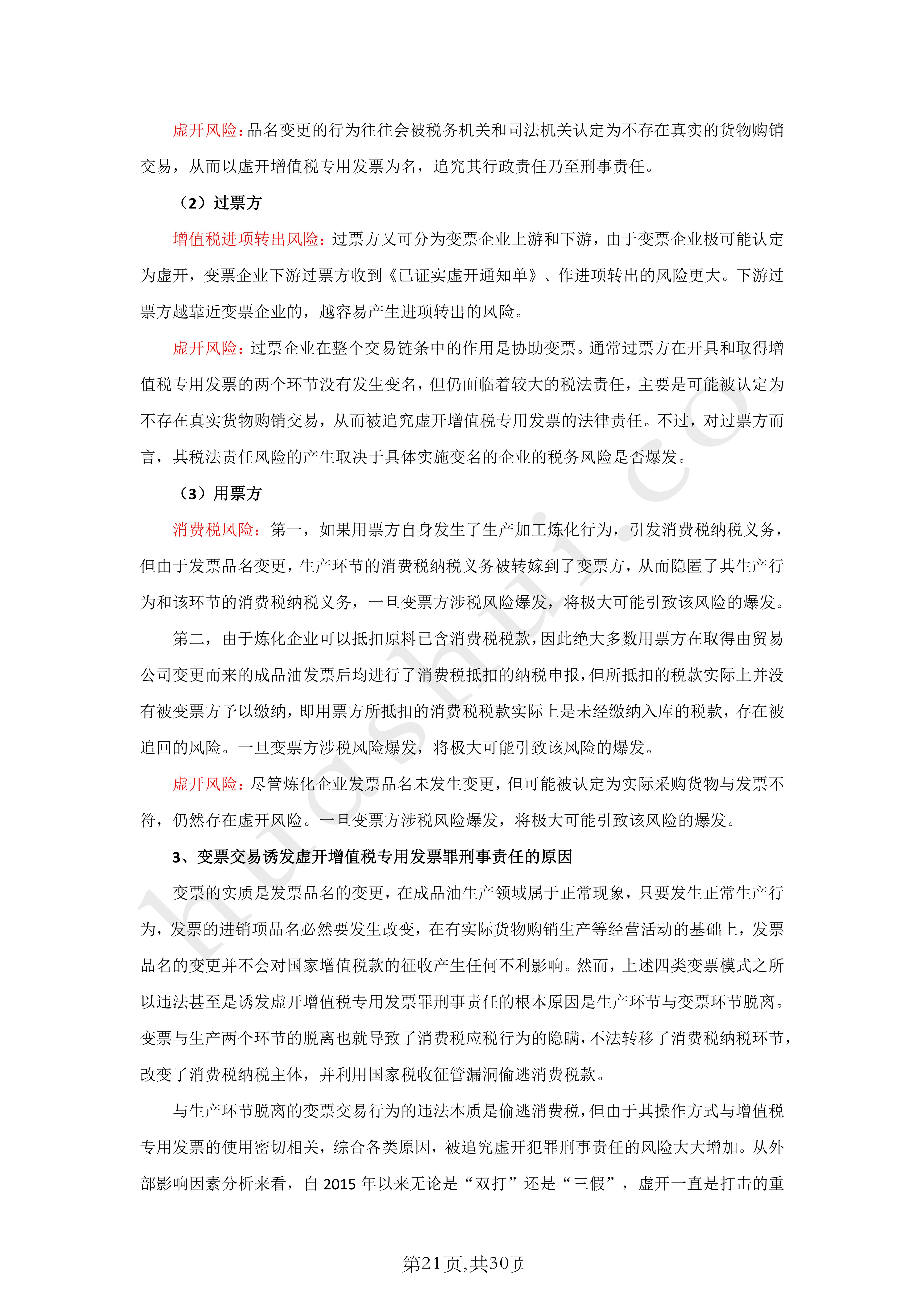

Click to download: Full of Report of Petrochemical Industry Tax-Related Criminal Risk Report (2022)