Recycling Industry Tax-Related Criminal Risk Report (2022)

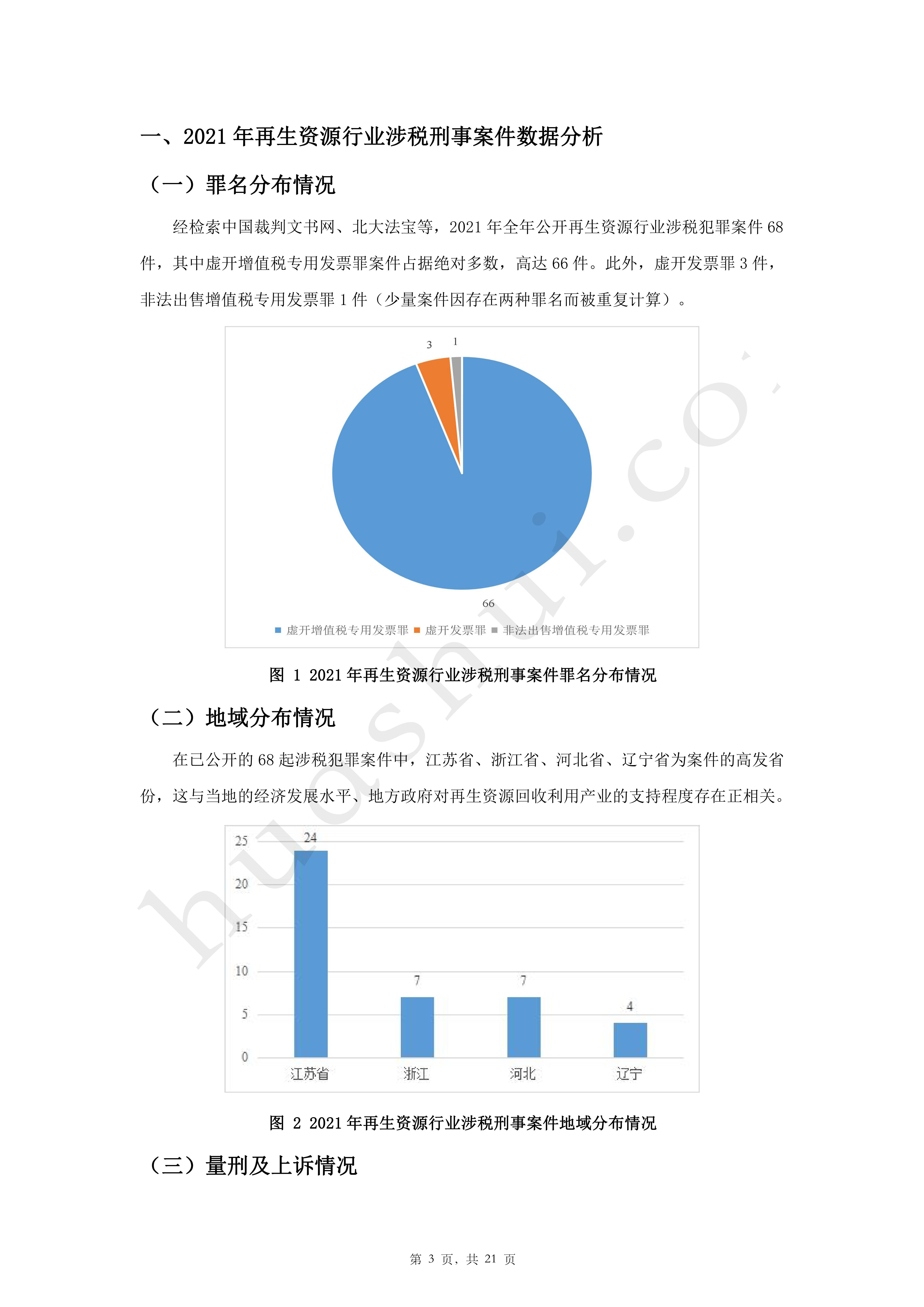

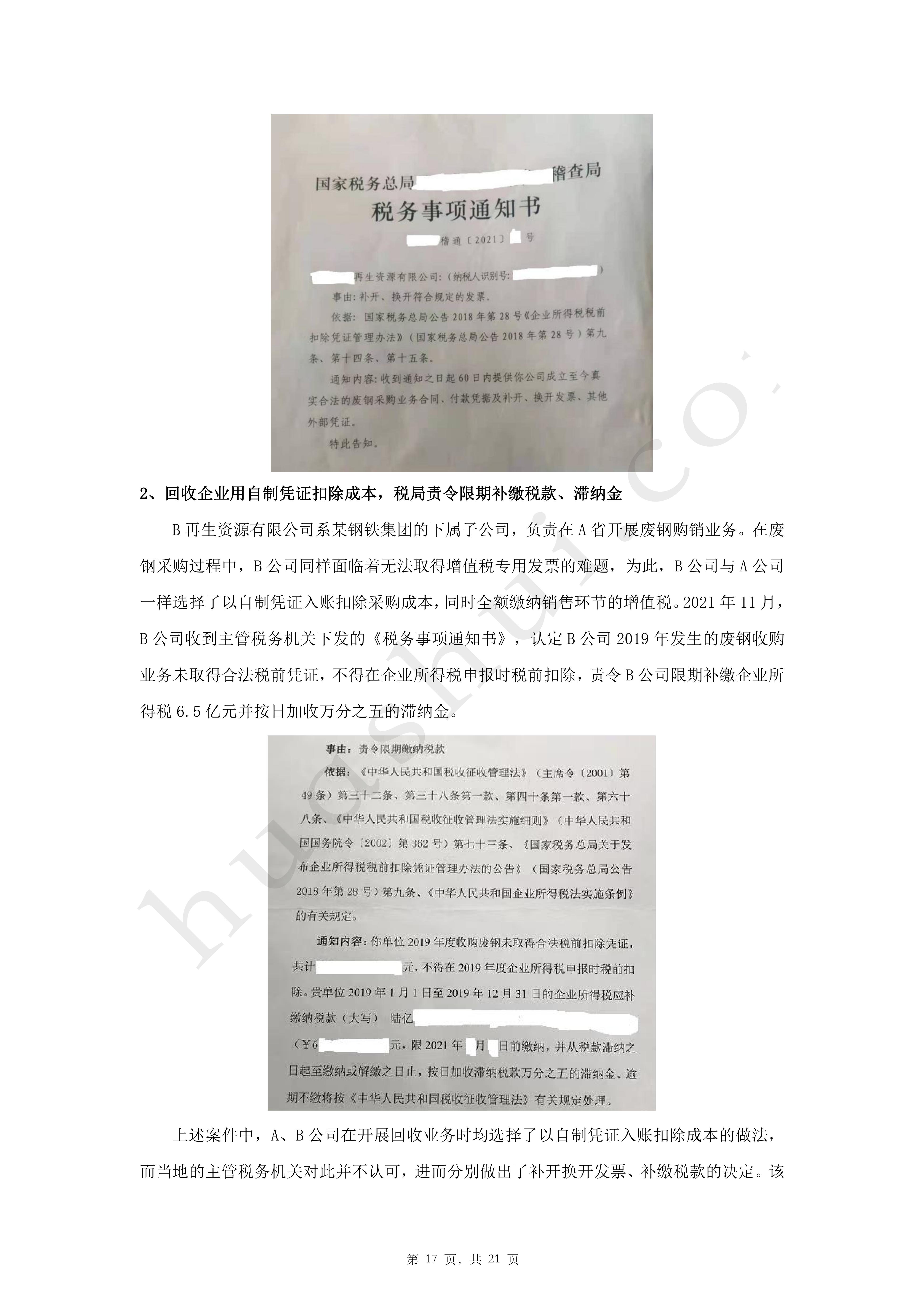

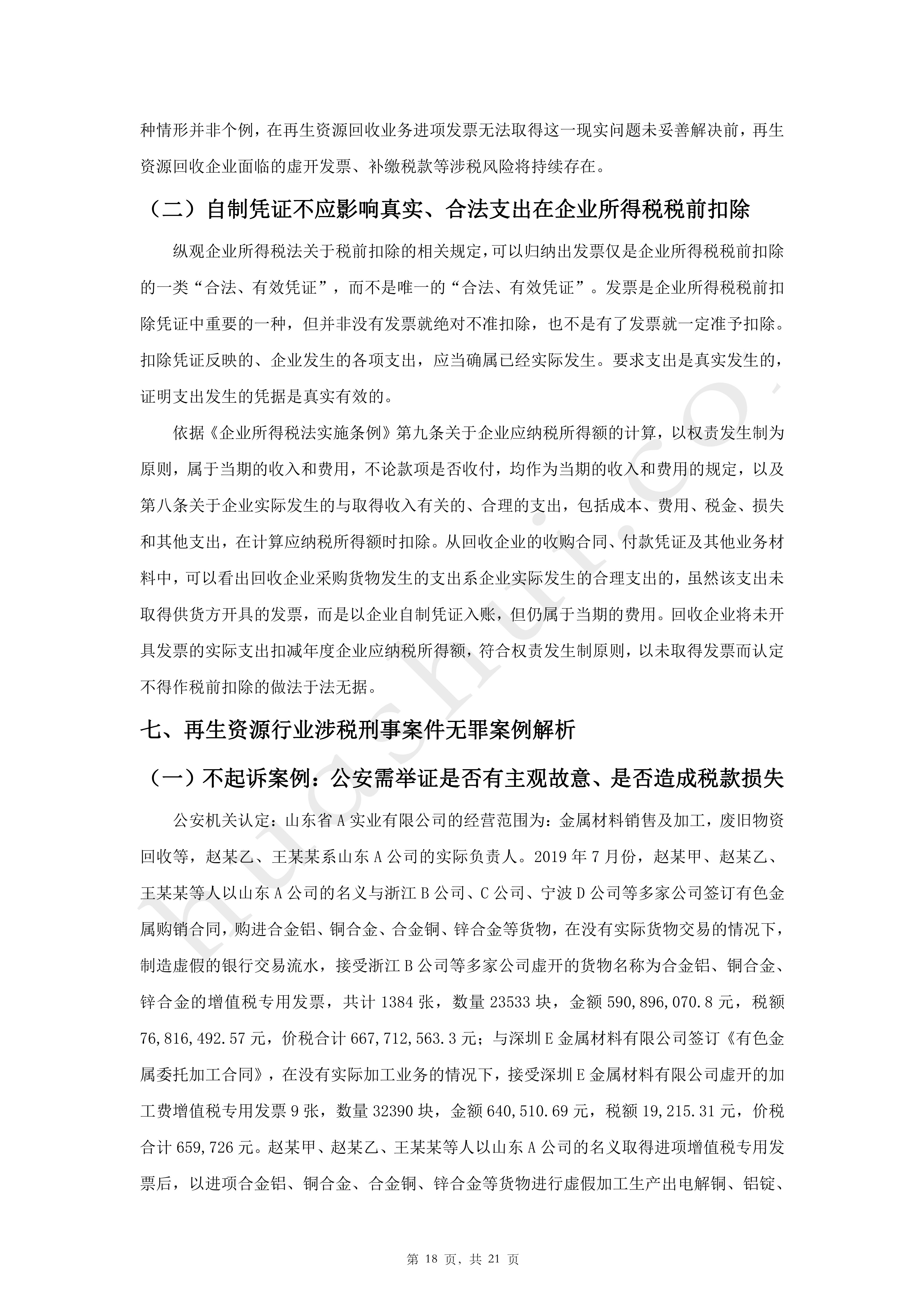

The renewable resources industry is an important part of the circular economy and an important way to improve the quality of the ecological environment and realize green and low-carbon development. Recycling, as the core link of the renewable resources industry, undertakes the task of "convergence" and primary processing of various dispersed waste materials, which is an important means of realization and development guarantee of the circular economy. However, since 2008, the abolition of the waste materials recycling business unit sales of waste materials exemption from value-added tax policy, renewable resources recycling enterprises have been caught in the lack of input votes and bear a large value-added tax burden, enterprise income tax deduction before the tax vouchers difficult to obtain the predicament of false openings is also becoming more serious. Since 2016, a number of domestic regions have broken out one after another renewable resources recycling enterprises false opening criminal cases, upstream and downstream involved in many enterprises, and the amount of money involved in the case is huge, once the false opening charges are established, the enterprises and personnel involved in the case are required to bear serious criminal liability. With the closing of the "fight against fraud" special action, the six ministries and commissions of the normalization of the crackdown on the ground, in order to prevent the risk of fraudulent invoicing, many recycling enterprises choose to give up to obtain input invoices, full payment of VAT in the sales process, and homemade acquisition vouchers to account for the cost of accounting, which in turn gives rise to the cost of vouchers do not comply with the need to make up for the payment of corporate income tax, the tax risks of late fees. On December 30, 2021, the Ministry of Finance and the State Administration of Taxation ("SAT") jointly issued the Announcement on Improving VAT Policies on Comprehensive Utilization of Resources (Announcement No. 40 of the Ministry of Finance and the SAT of 2021), which stipulates that general taxpayers may choose the simplified tax method for the sales of renewable resources to calculate and pay the VAT according to the 3% levy rate, which will greatly alleviate the VAT burden in the recycling business. However, it is not clear how to deal with the deduction before enterprise income tax. Against this background, in order to enable the majority of renewable resources recycling and utilization enterprises to carry out tax management in compliance with the law, strengthen internal risk prevention and control and external risk isolation, and effectively respond to and resolve tax-related criminal risks, Huatax combines the successful experience of dealing with the cases of fraudulent invoicing in recent years to write this report, which provides an in-depth analysis on the tax environment of the renewable resources industry under the new situation of tax levy and administration, the key tax issues, the triggers of the tax-related criminal risks, and the compliance with the criminal risks, etc., with a view to providing a better solution for the renewable resources recycling business. This report analyzes the tax environment, key tax-related issues, tax-related criminal risk triggers, criminal risk compliance, etc. in the renewable resources industry under the new situation of tax collection and management, with a view to providing useful reference for renewable resources recycling enterprises.

Click to download: Full Report of Recycling Industry Tax-Related Criminal Risk Report (2022)