Petrochemical Industry Tax Compliance Report (2023)

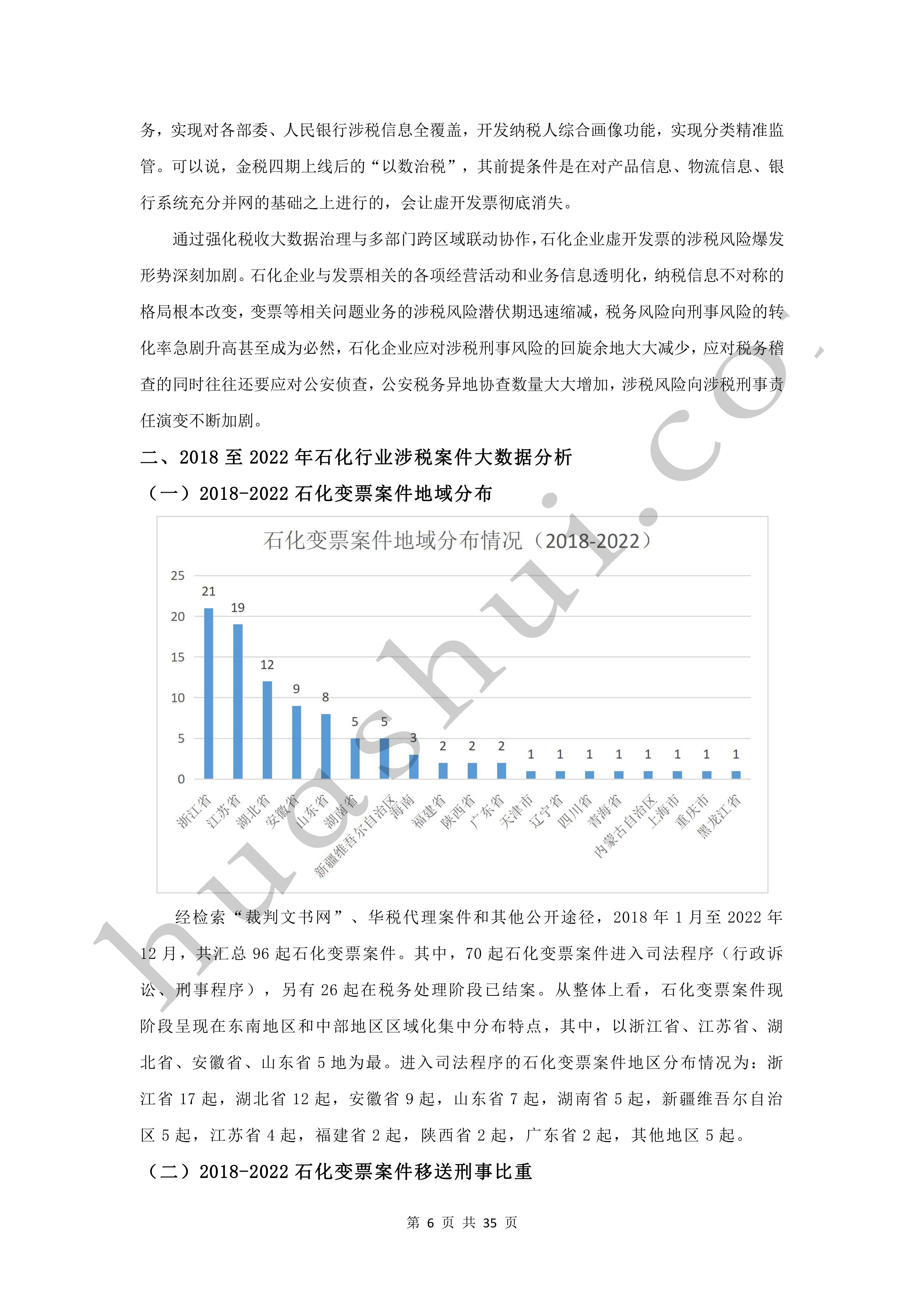

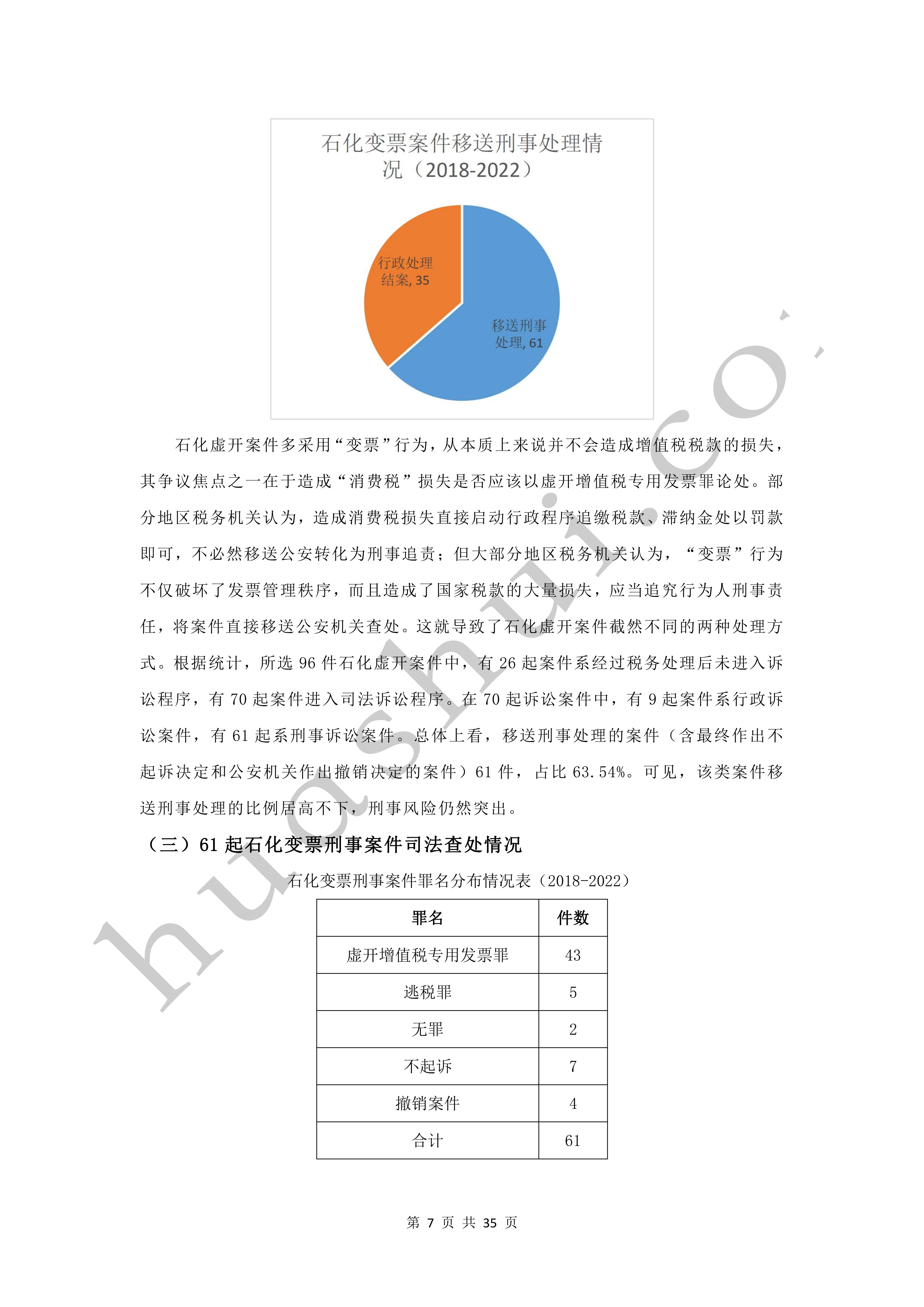

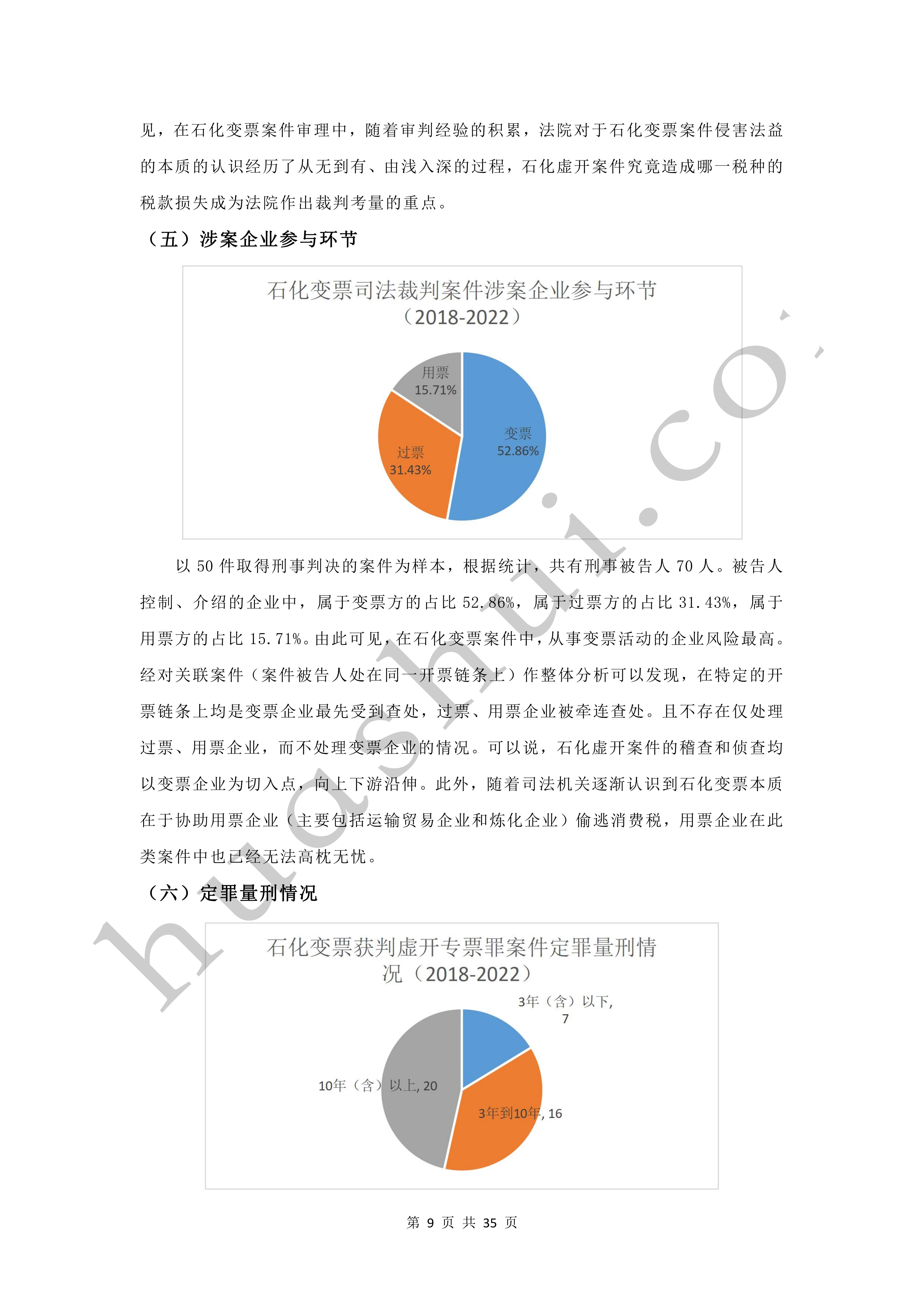

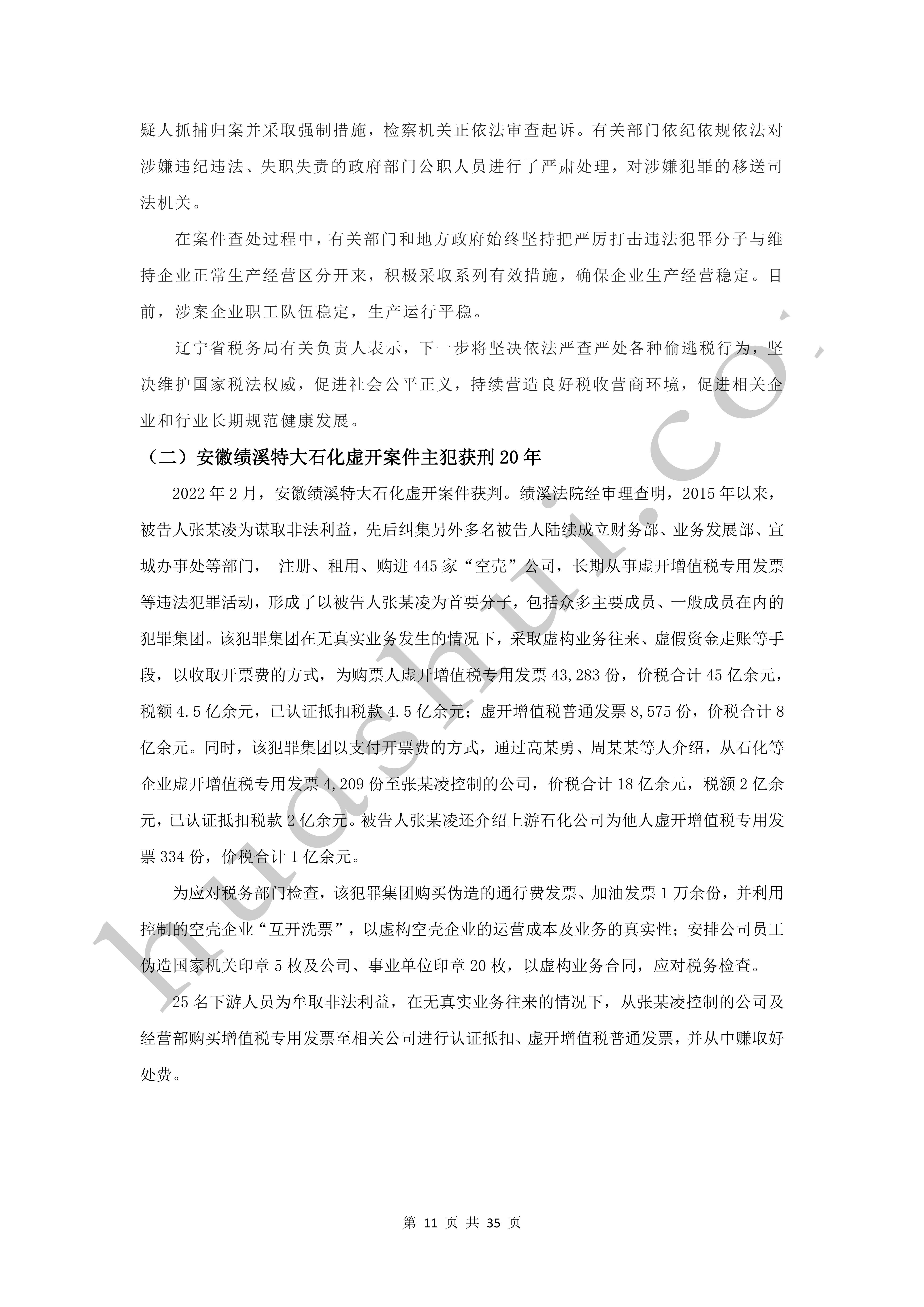

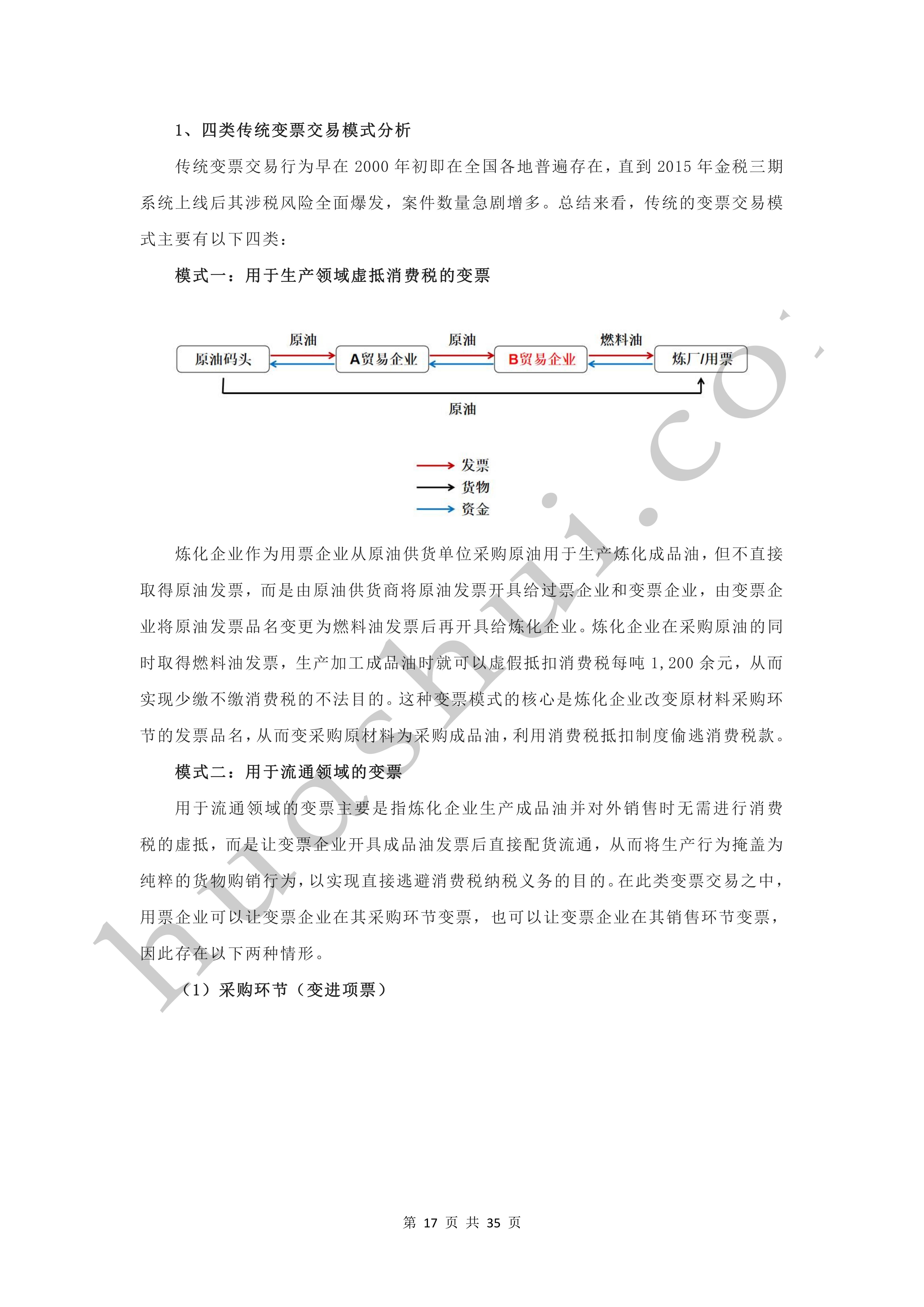

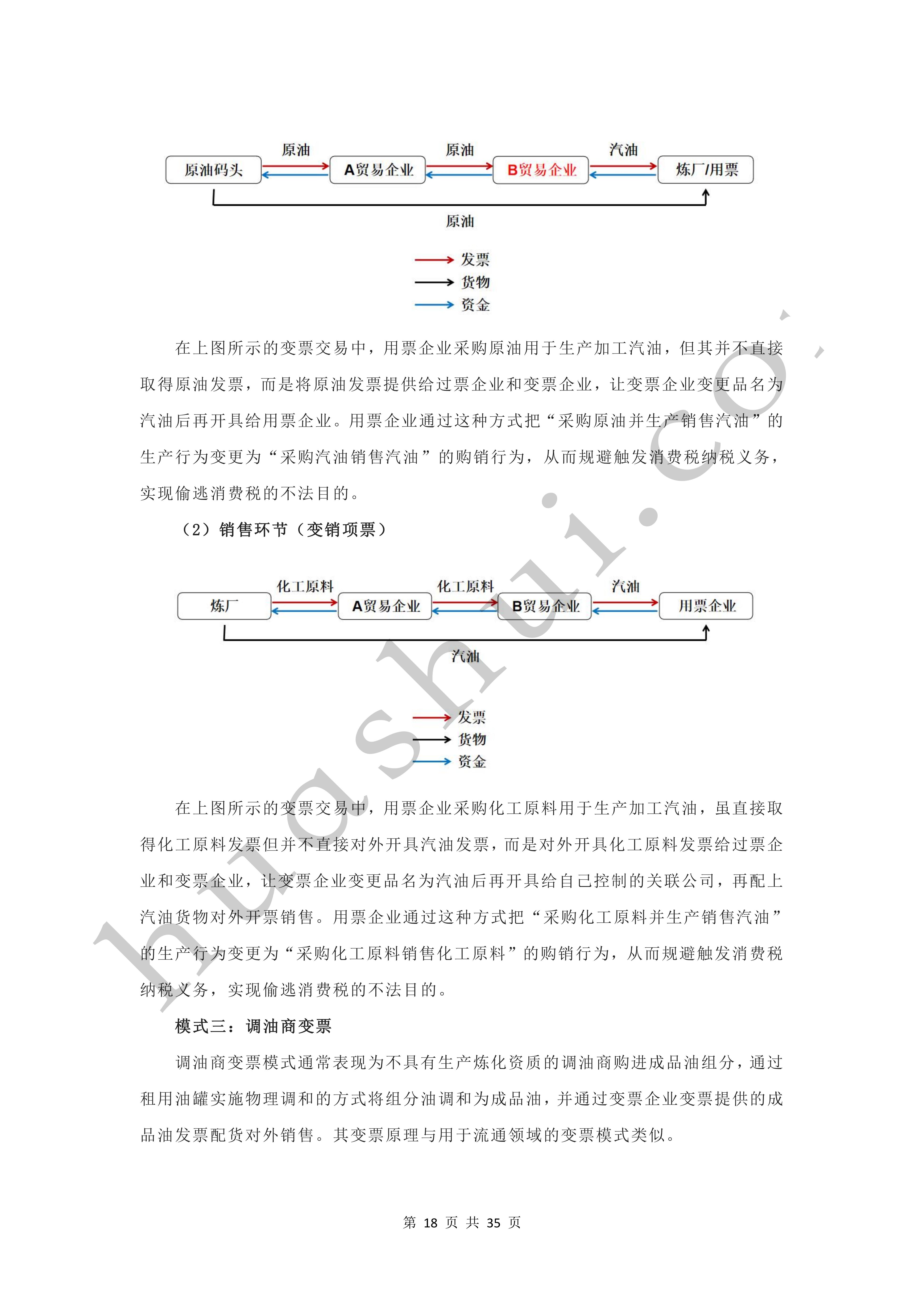

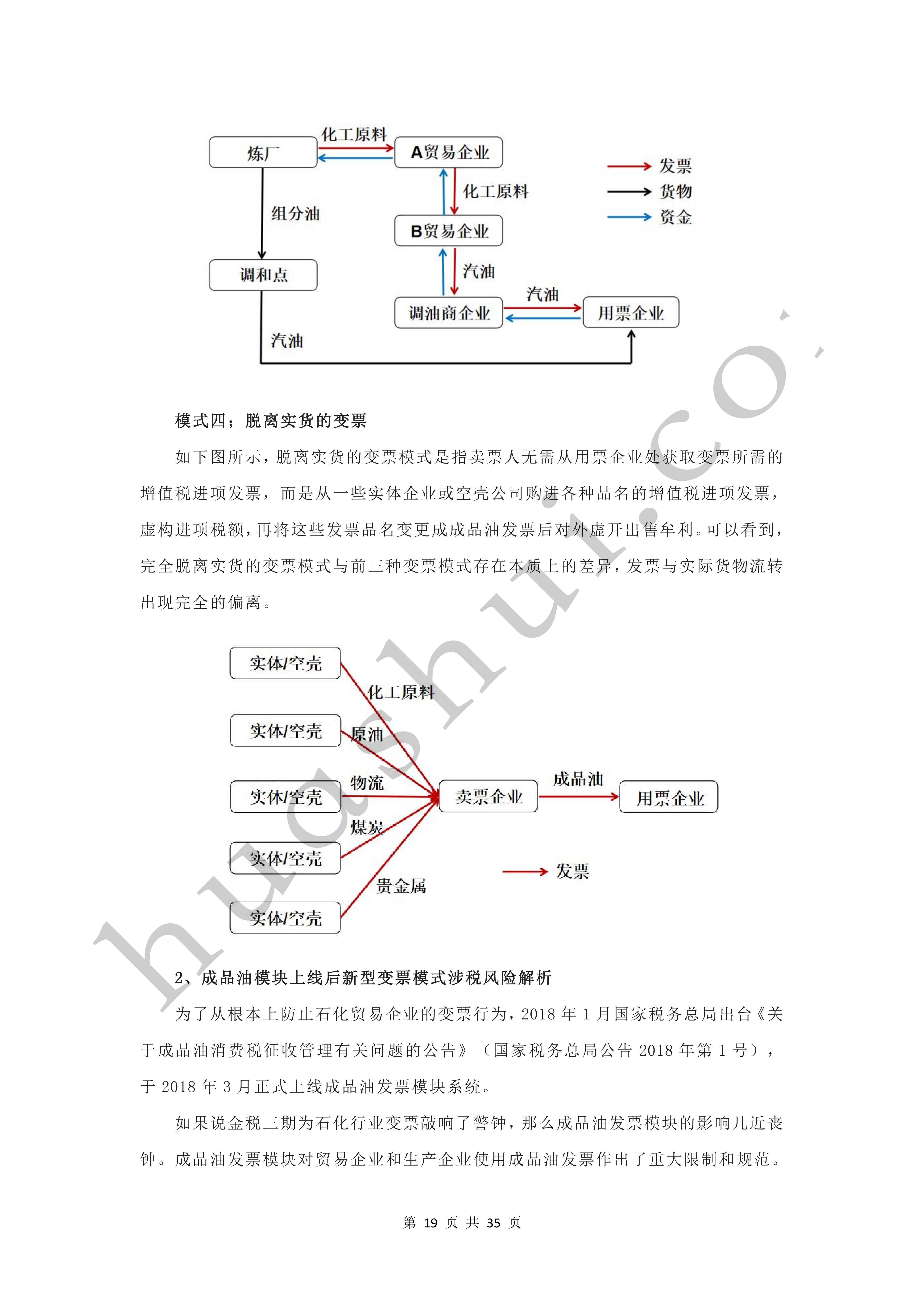

Since 2017, with the "Golden Tax Phase III" and refined oil products module coming online one after another, tax audits have been rolled out for the petrochemical industry in various places, and a large number of petrochemical tax-related cases have gradually surfaced. Unlike other invoicing crimes committed mainly for the purpose of cheating VAT, petrochemical tax-related cases are industry-specific, mainly in the form of cheque-altering cases, in which the perpetrators not only do not underpay or underpay VAT, but also create VAT tax sources for the local area, and the perpetrators engage in cheating with the purpose of evading consumption tax. From the results of tax administrative and criminal cases in various places in recent years, this type of cases shows obvious regionalization characteristics. After the refined oil invoice module went on line, new types of bill-changing transactions continued to emerge, and various types of bill-changing cases, such as industrial white oil, outsourced processing, and gasoline-to-transportation, driven by VAT interests, erupted one after another, and the risk of tax-related risks for petrochemical enterprises remained severe. Since 2022, there have been some adjustments and changes in the tax collection and management situation and priorities, types of tax-related cases and tax-related risks in the petrochemical sector. The overlay of variable ticket risk and consumption tax compliance risk makes the tax-related risks that petrochemical enterprises need to prevent and respond to more complicated. The "Petrochemical Industry Tax Compliance Report (2023)" is a legal research report compiled based on Huatax's in-depth observation of the petrochemical industry and profound summary of its experience in representing petrochemical industry tax-related cases. It aims to reveal the current situation of petrochemical industry's tax-related case handling and investigation trends, analyze the behavioral pattern changes and tax-related risks of petrochemical industry's tax-related cases, and put forward professional strategies for tax-related dispute resolution and suggestions for complying with the operation in order to provide a comprehensive solution for the petrochemical enterprises to prevent and respond to tax-related risks. The report also proposes professional strategies for tax-related dispute resolution and recommendations for compliance management, with a view to providing useful guidance for petrochemical enterprises to prevent and respond to tax-related risks.

Click to download: Full Report of Petrochemical Industry Tax Compliance Report (2023)