Foreign Trade Industry Tax Compliance Report (2023)

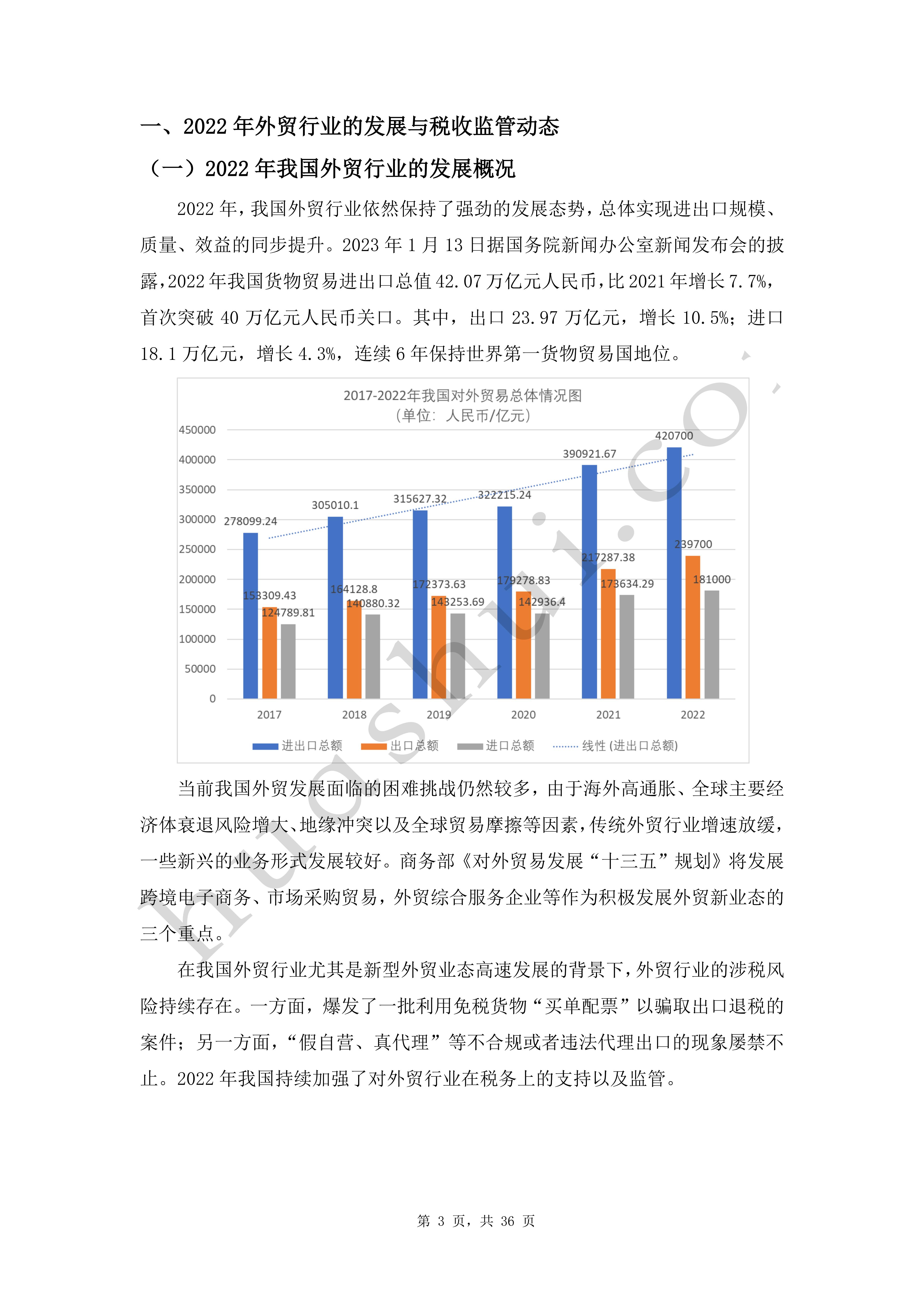

In recent years, China's foreign trade has maintained a strong development trend. It has maintained the status of the world's top goods trading country for six consecutive years since 2017, and the total value of imports and exports in 2022 exceeded the 40 trillion yuan mark for the first time. The rapid development of foreign trade cannot be separated from the support of the export tax rebate policy. Export tax rebate refers to a tax system in which the state refunds to export enterprises the import tax on raw materials of exported goods as well as indirect taxes such as value-added tax (VAT) and consumption tax (CST) that have been paid at various stages of domestic production and circulation, so that exported goods can enter the international market at a price that does not include indirect taxes and participate in international competition.Between 2016 and 2021, China's tax authorities handled an accumulated total of export tax rebates (exemptions) of 8.75 trillion yuan, the In the first 11 months of 2022, the country's cumulative export tax refund (exemption) exceeded 1.7 trillion yuan. Against the backdrop of the changing international situation, the country has further improved the efficiency of export tax refunds, which has effectively energized foreign trade enterprises and reduced their burden.

In order to ensure the orderly development of the foreign trade industry and regulate the order of export tax rebates, the State has always taken a high-pressure stance to crack down on illegal and criminal behaviors such as fraudulent export tax rebates, and to curb the illegal and criminal offenses of tax cheating and fraudulent invoicing in the foreign trade industry, which has resulted in the outbreak of a number of major criminal cases. In addition, under the concept of "who exports, who collects foreign exchange, who refunds taxes, who is responsible for", the export enterprise bears most of the tax risk, or because of non-compliance with the documents can not be refunded, or involved in cases of fraudulent opening, tax fraud. Therefore, foreign trade enterprises need to strengthen tax compliance in 2023.

Based on the in-depth observation of foreign trade industry and the profound summarization of the agency experience of tax-related cases of foreign trade enterprises in recent years, Huatax team has prepared this "Tax Compliance Report of Foreign Trade Industry (2023)" to reveal the sources and causes of tax-related risks in foreign trade industry as well as the trend of tax compliance in 2023, and put forward the targeted defense strategies and compliance suggestions on the basis of which with a view to avoiding the tax administrative and criminal risks and achieving healthy tax compliance operation for the foreign trade enterprises, criminal risks and realize healthy development of compliant operation.

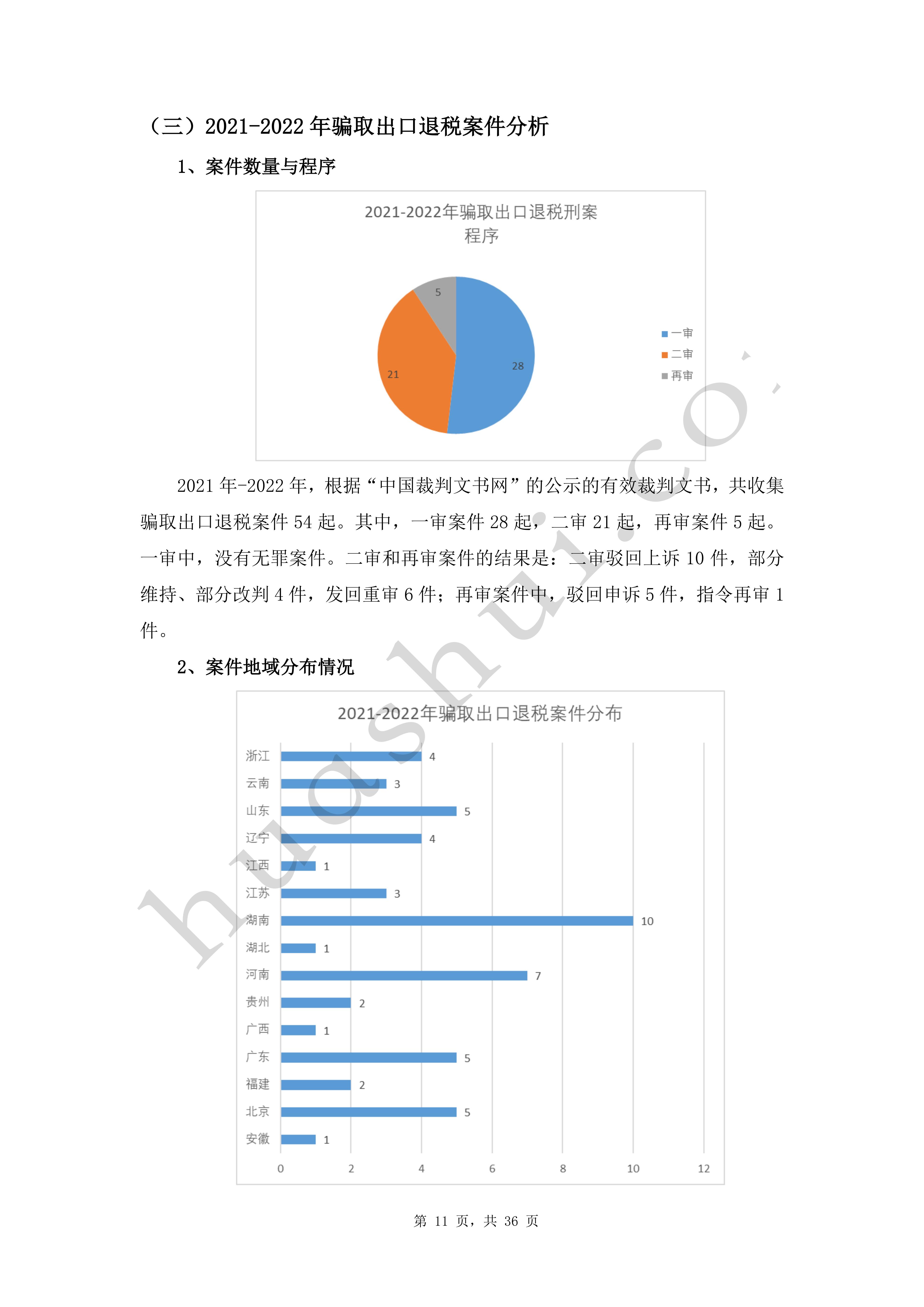

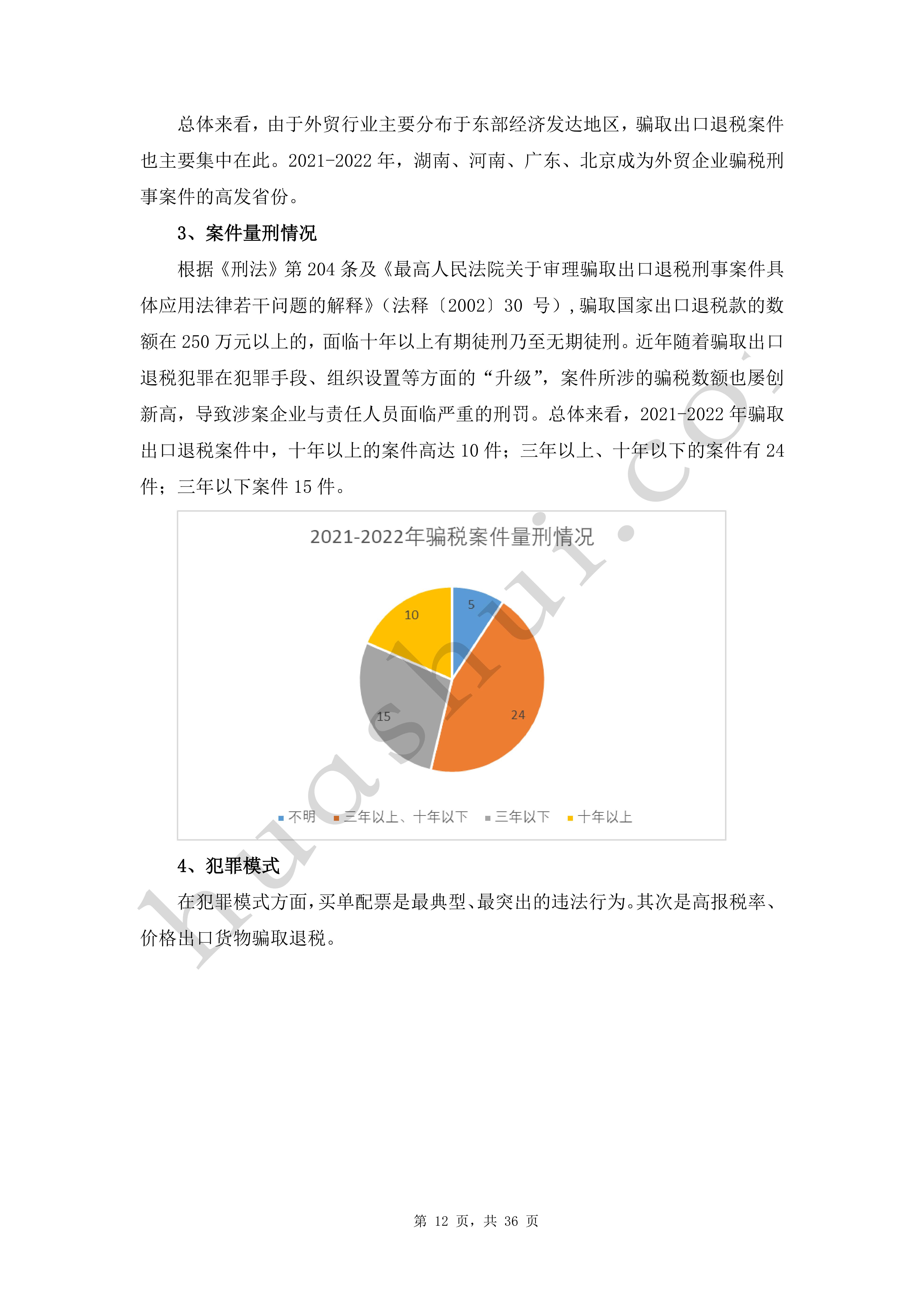

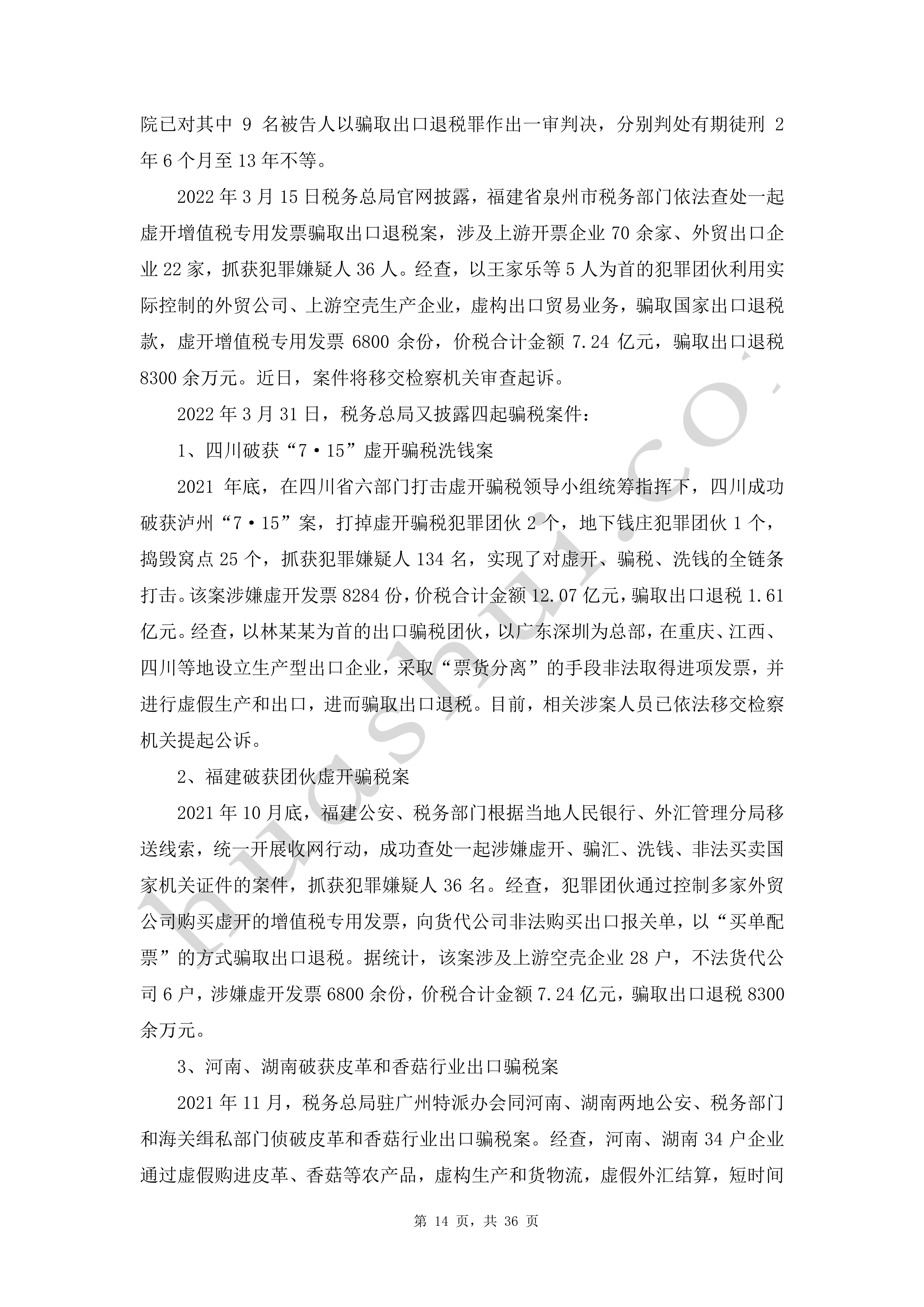

Click to download: Full Report of Foreign Trade Industry Tax Compliance Report (2023)