Coal Industry Tax Compliance Report (2023)

Coal occupies a dominant position in primary energy production and consumption, and is the pillar of China's traditional industry and an important support for the development of the national economy. In recent years, the tax-related problems in the operation of coal enterprises have become more and more prominent, and triggered the risk of administrative and criminal liability, which not only led to the enterprise into the operation of the situation, but also put a number of entrepreneurs behind bars.

February 28, 2020, Inner Mongolia to carry out special rectification of the coal field of 20 years of action, followed by a number of other provinces, including Shanxi, Yunnan, Sichuan, Xinjiang and other provinces also launched the coal field of self-correction. Multi-departmental coordination has led to the investigation and prosecution of a number of cases of tax violations by coal enterprises, which has led to further fermentation of tax-related and criminal risks of coal enterprises.

In March 2021, the Central and State Offices of the People's Republic of China issued the Opinions on Further Deepening the Reform of Taxation Levy and Administration, which explicitly treats coal and other industries as a key area of concern, and severely cracks down on illegal and criminal behaviors of false invoicing, fraudulent tax evasion and other tax-related violations of the coal and other industries. income tax evasion and other tax-related illegal behaviors, making the tax-related and criminal risks of coal enterprises the focus of attention and crackdown. In October 2021, the fight against the three counterfeits was taken to a higher level, with the Supreme Prosecutor and the OFTA joining in, the four ministries upgraded to six departments, the special action upgraded to a regularized crackdown, the various departments sharing data, joint operations, and cracking down on various types of false invoicing and tax fraud and the related enterprises, and the tax police jointly investigating and dealing with a number of major cases of false invoicing and tax fraud in the coal field, so that the criminal risk of tax-related risks of the coal enterprises was triggered at the first sight.

In 2022, with the continuous promotion of the pilot program of "all-electric invoice" and the completion of the development of "Golden Tax IV", the tax supervision is completing the transition from "controlling tax by votes" to "ruling tax by numbers". Tax supervision is completing the transformation from "tax control by invoices" to "tax control by numbers". Relying on big data to realize precise and classified supervision, the risk of false invoicing can be effectively investigated and can be further traced upstream and downstream along the invoice chain, and the risk of tax-related risks of coal enterprises is further aggravated.

Looking at the outbreak of tax-related criminal cases in recent years, not all the subjects involved in the case have the subjective intention of false invoicing, tax fraud, tax evasion, but due to some non-compliance operations in the business process, resulting in the objective appearance of tax-related criminal behavior. It is worthwhile for enterprises and entrepreneurs to be alerted to such cases. The Research Report on Tax Compliance in Coal Industry (2023) is a special report based on Huatax's in-depth observation of the coal industry and profound summarization of the experience in representing coal enterprises in tax-related criminal cases. It summarizes and analyzes the latest data on tax-related criminal and administrative cases of coal enterprises in 2022, reveals the status quo of the coal industry's tax-related criminal risks, causes and latest changes, and puts forward suggestions for enterprises to manage compliance on such basis, with a view to providing a better solution for enterprises and entrepreneurs. The report summarizes and analyzes the latest data on tax-related criminal and administrative cases of coal enterprises in 2022, revealing the current situation, causes and latest changes of tax-related criminal risks in the coal industry, and on the basis of which, it puts forward suggestions on corporate management compliance, with a view to providing reference for coal enterprises to avoid tax-related legal risks.

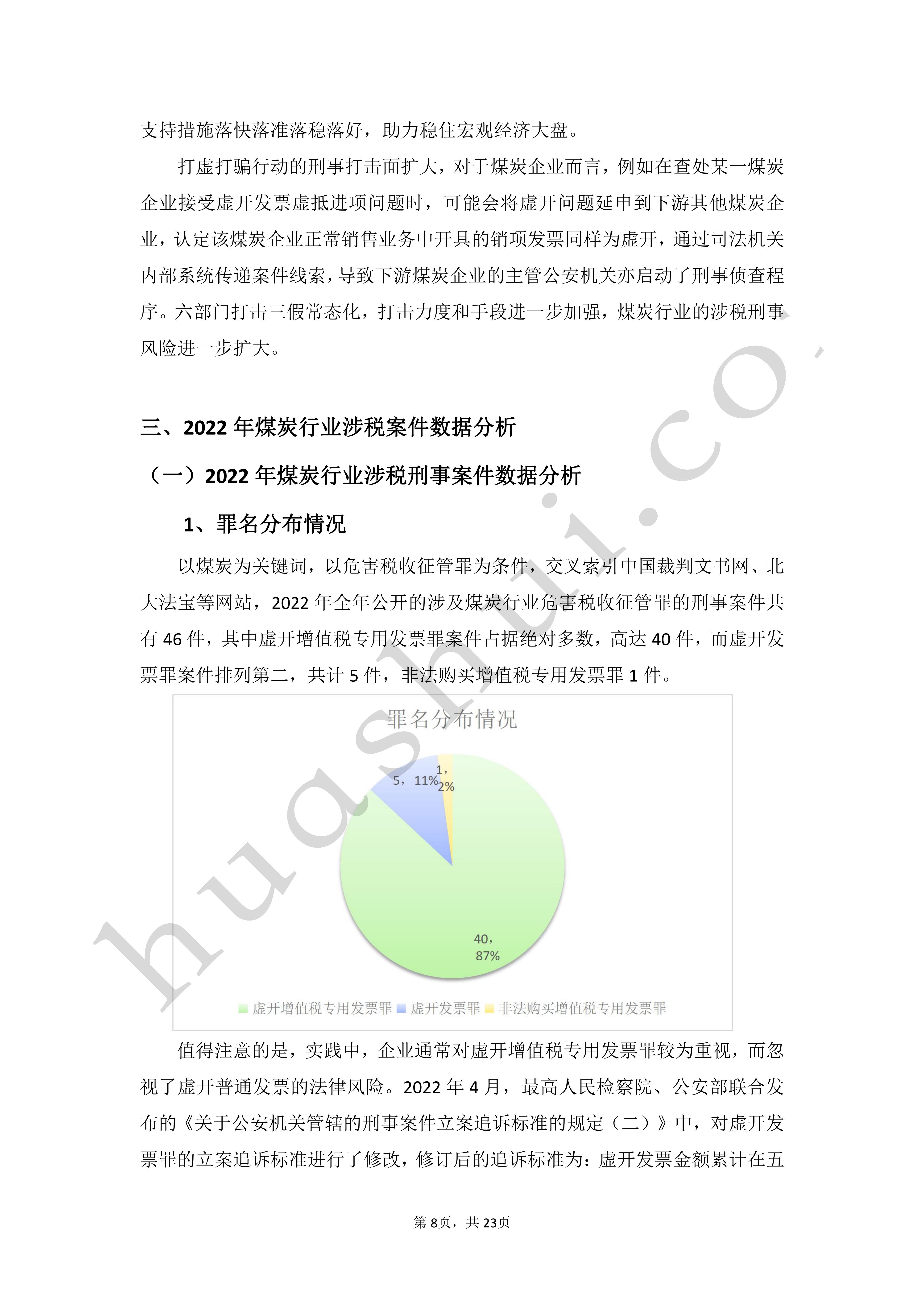

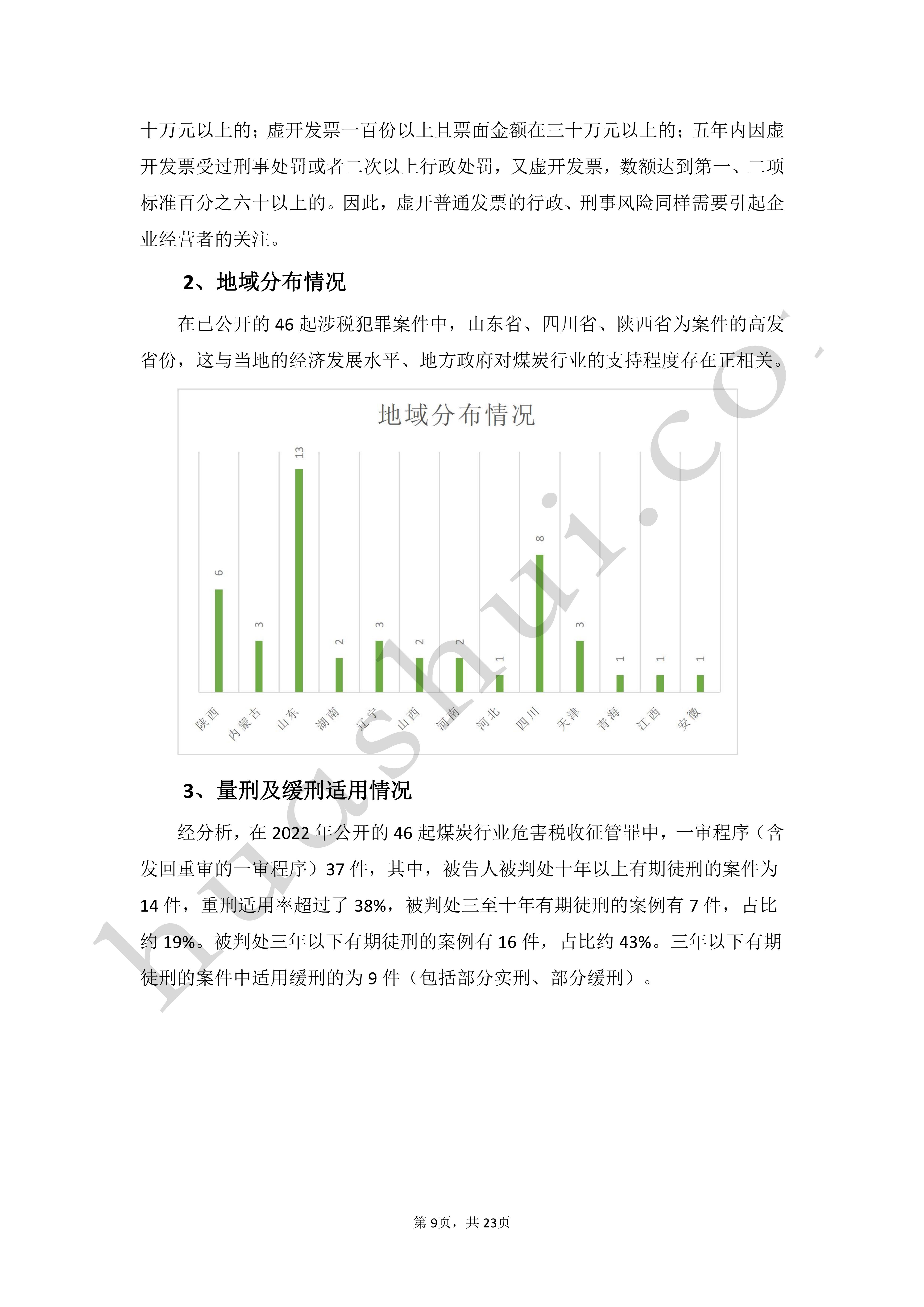

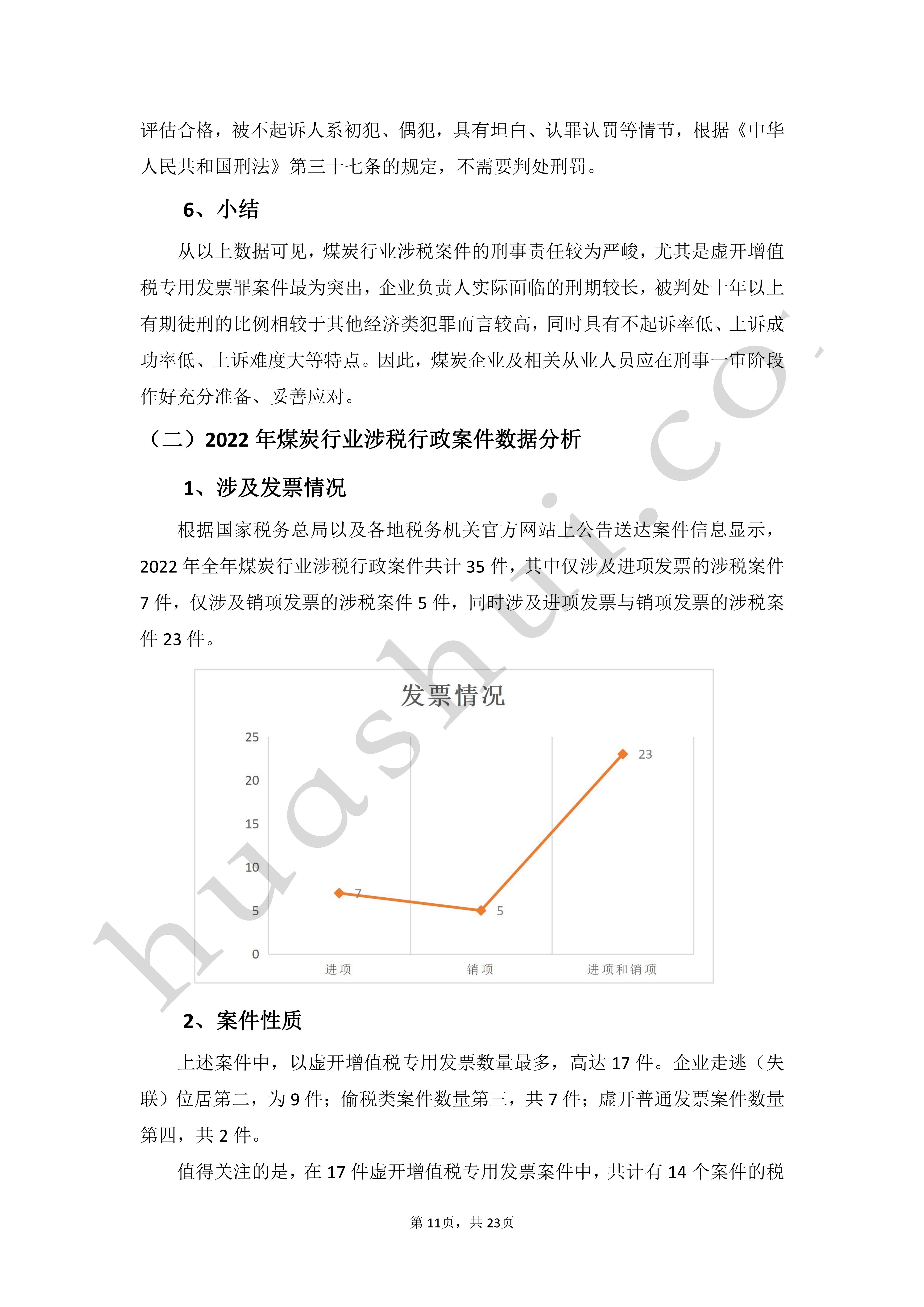

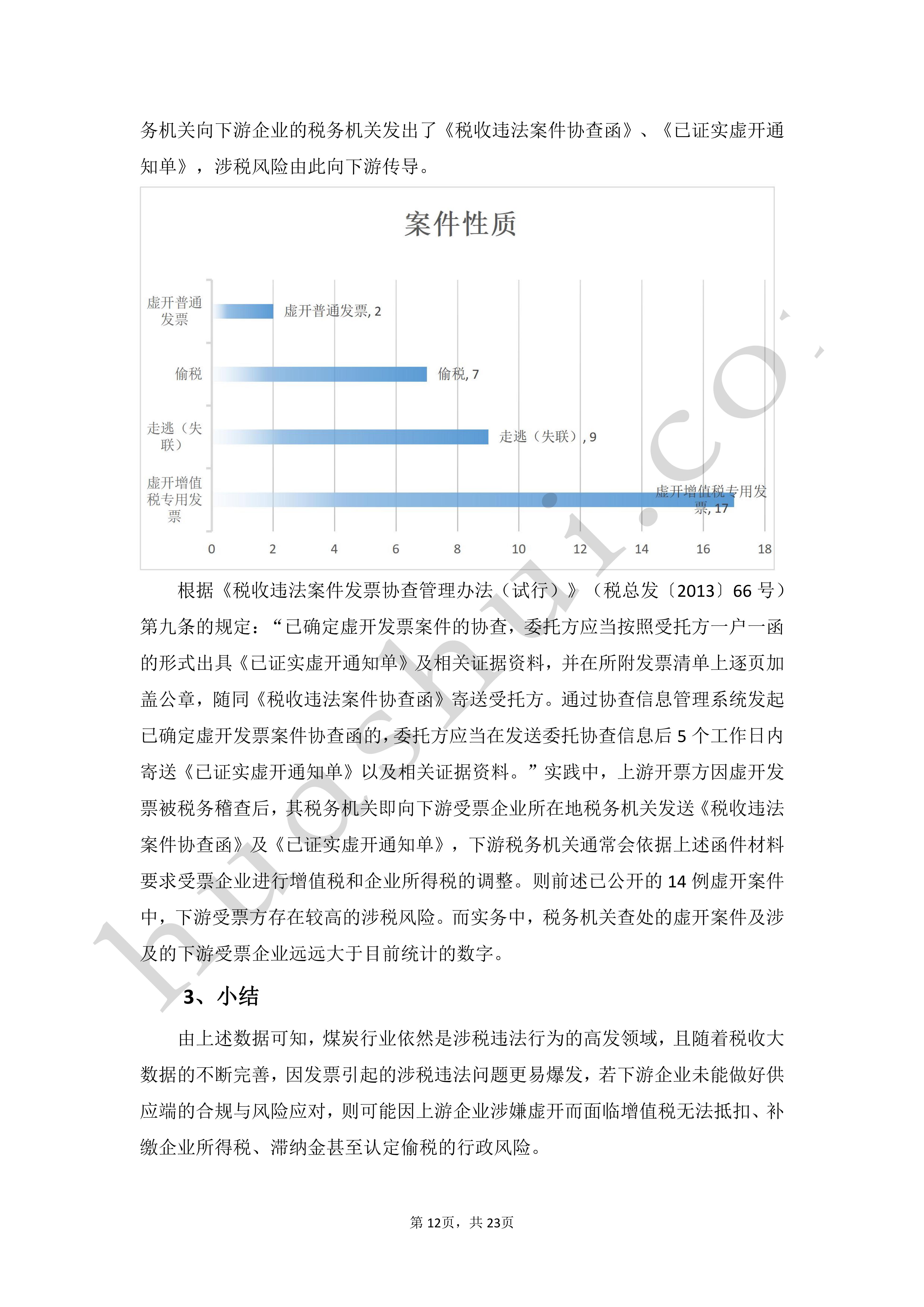

Click to download: Full Report of Coal Industry Tax Compliance Research Report (2023)