High Net Worth Individual Tax Compliance Report (2023)

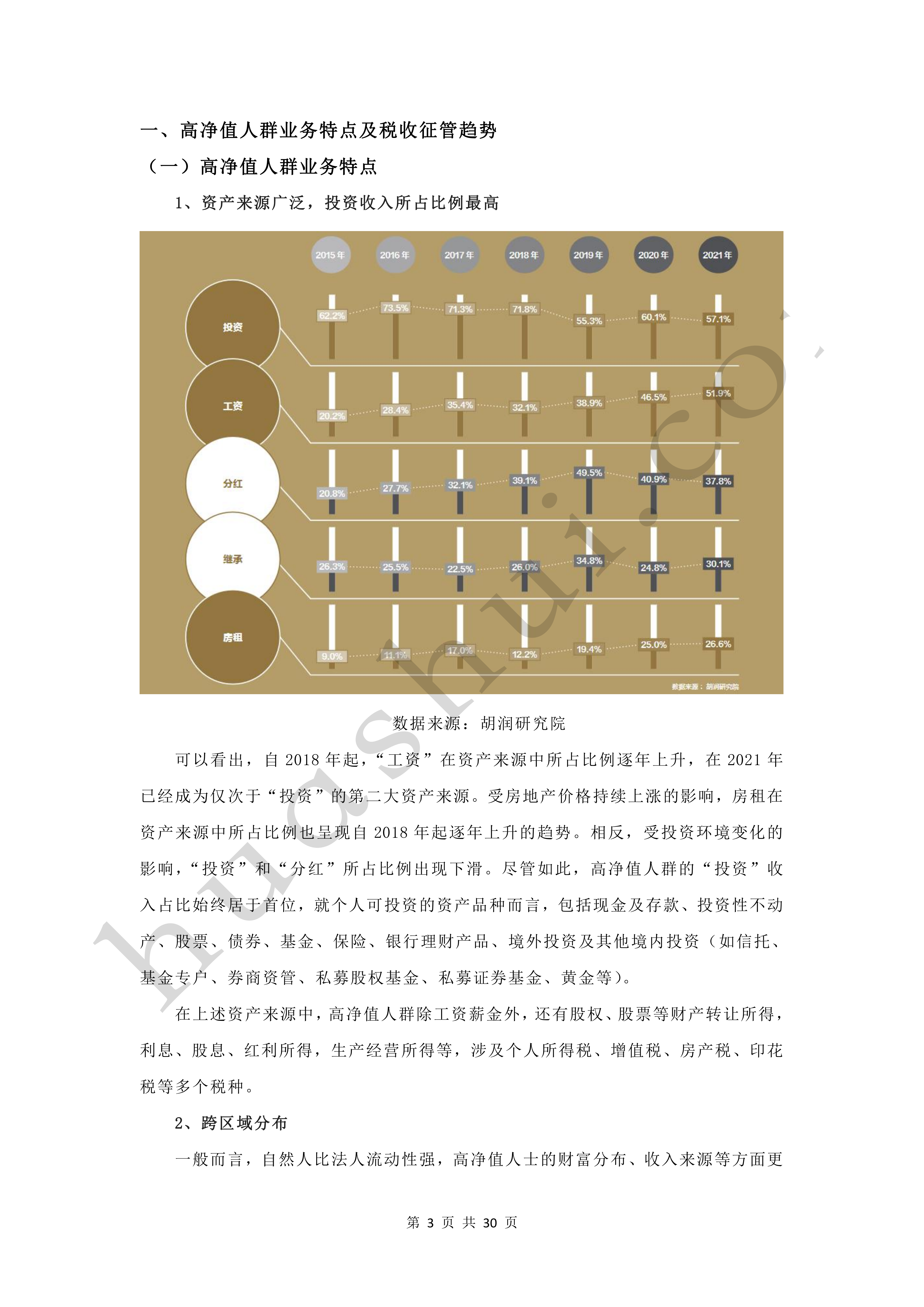

Along with China's economic development, the number of high net worth individuals in Mainland China continues to grow. According to the Hurun Report on HNWIs 2022, "HNWIs" are defined as those with disposable assets of more than $6 million. Among them, "disposable assets" include deposits, insurance, stocks, debts, investment trusts and other financial commodities, precious metals, etc. held by the entire household, but not including real estate currently residing. According to statistics, by 2020, there will be 805,350 "high net worth households" with disposable assets of RMB10 million to RMB100 million. With the rapid growth in the number of HNWIs in Mainland China, there is an increasing demand for tax planning to save tax. At the same time, tax authorities around the world have tightened their control over individual income tax, and HNWIs have become an area of continuous attention and focus of tax supervision and investigation. In practice, there are numerous cases in which HNWIs are recognized as tax evaders or have their taxes adjusted. This report is compiled by China Tax based on the analysis and research of tax administration policies for HNWIs, combined with the typical tax-related cases of HNWIs in which China Tax has participated in recent years, with the aim to base on the characteristics of tax administration of HNWIs, reveal the major tax risk points of HNWIs both inside and outside the country, and put forward the targeted and feasible compliance suggestions on the basis of which, in order to provide guidance and reference for HNWIs in terms of tax compliance.

Click to download: Full Report of High Net Worth Individual Tax Compliance Report (2023)