Real Estate Industry Tax Compliance Report (2023)

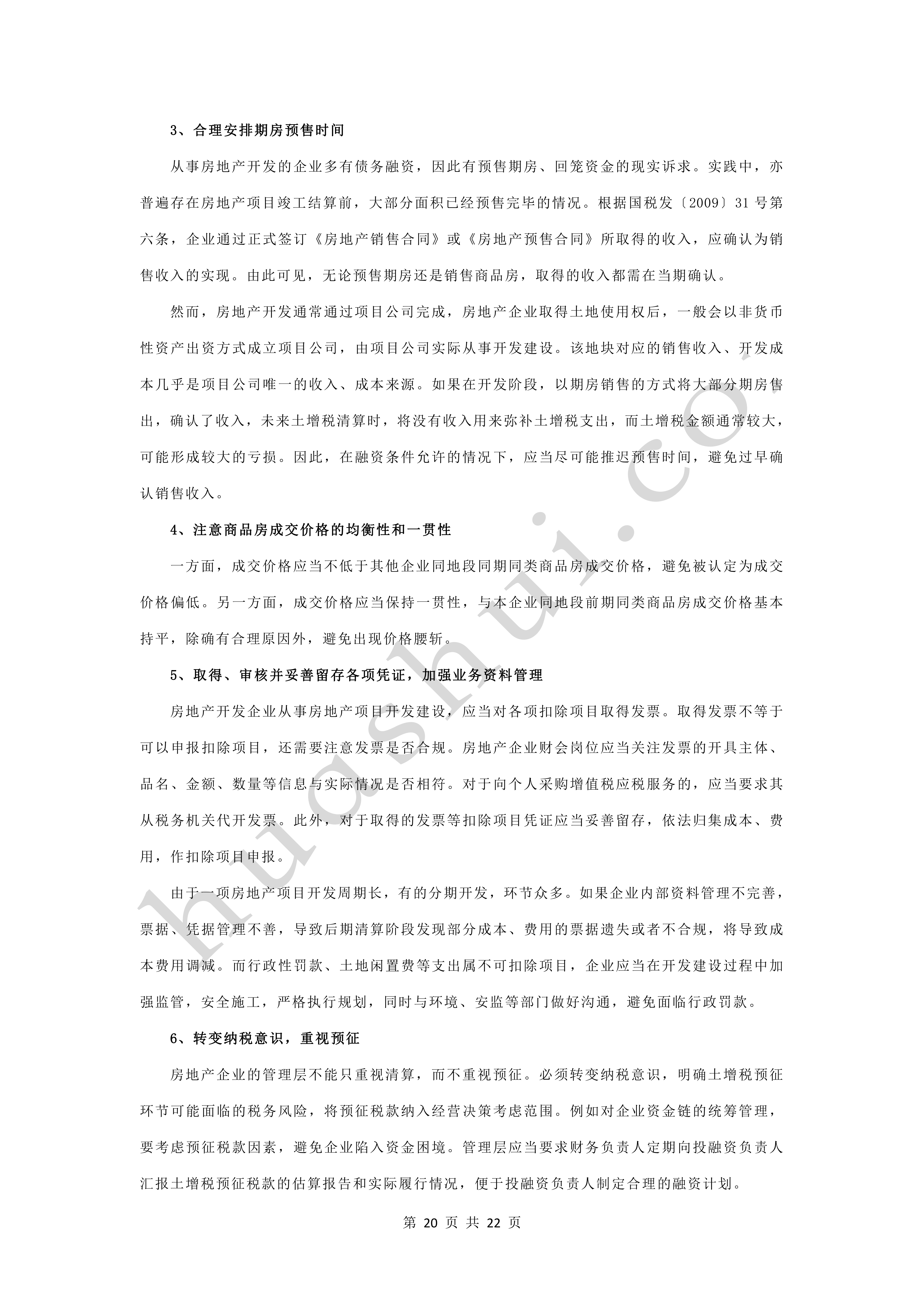

Since the beginning of 2018, tax authorities across the country have begun large-scale bidding and procurement of land value-added tax clearing and auditing services from third-party intermediaries. In Beijing, for example, before 2018, the government centralized the procurement of land VAT clearing and auditing services for 19 projects, and in the first three quarters from 2018 to 2022, the number was 667. The surge in the number of government procurement of land value-added tax clearing and auditing services reflects three aspects: first, in recent years, a large number of real estate projects across the country have reached the conditions for clearing and are required to make land value-added tax clearing, ushering in a batch of centralized clearing after the merger of state and land taxes; second, the land value-added tax tax burden cost of active clearing is abnormally high due to the mismanagement by many real estate enterprises of the fiscal management of their projects prior to the clearing of the land value-added tax liability. This has, to a certain extent, resulted in the low motivation of real estate enterprises to take the initiative to liquidate; and thirdly, due to the impact of the economic downtrend, the local governments objectively have the demand to accelerate the land value-added tax liquidation. Against this background, real estate enterprises faced severe land VAT risks.

The Land Value-Added Tax Compliance Report for Real Estate Industry (2023) is a legal research report compiled based on Hua Shui's in-depth observation of the real estate industry and profound summarization of its experience in representing land value-added tax cases in the real estate industry, aiming to reveal the current situation of land value-added tax cases in the real estate industry and the trend of investigation and handling, analyze the risk of land value-added tax in the real estate industry, and put forward professional strategies for tax-related dispute resolution and compliance recommendations, with a view to providing real estate enterprises with preventive measures against land value-added tax.

Click to download: Full Report of Real Estate Industry Tax Compliance Report (2023)