Pharmaceutical Enterprises Tax-related Criminal Risk Report (2021)

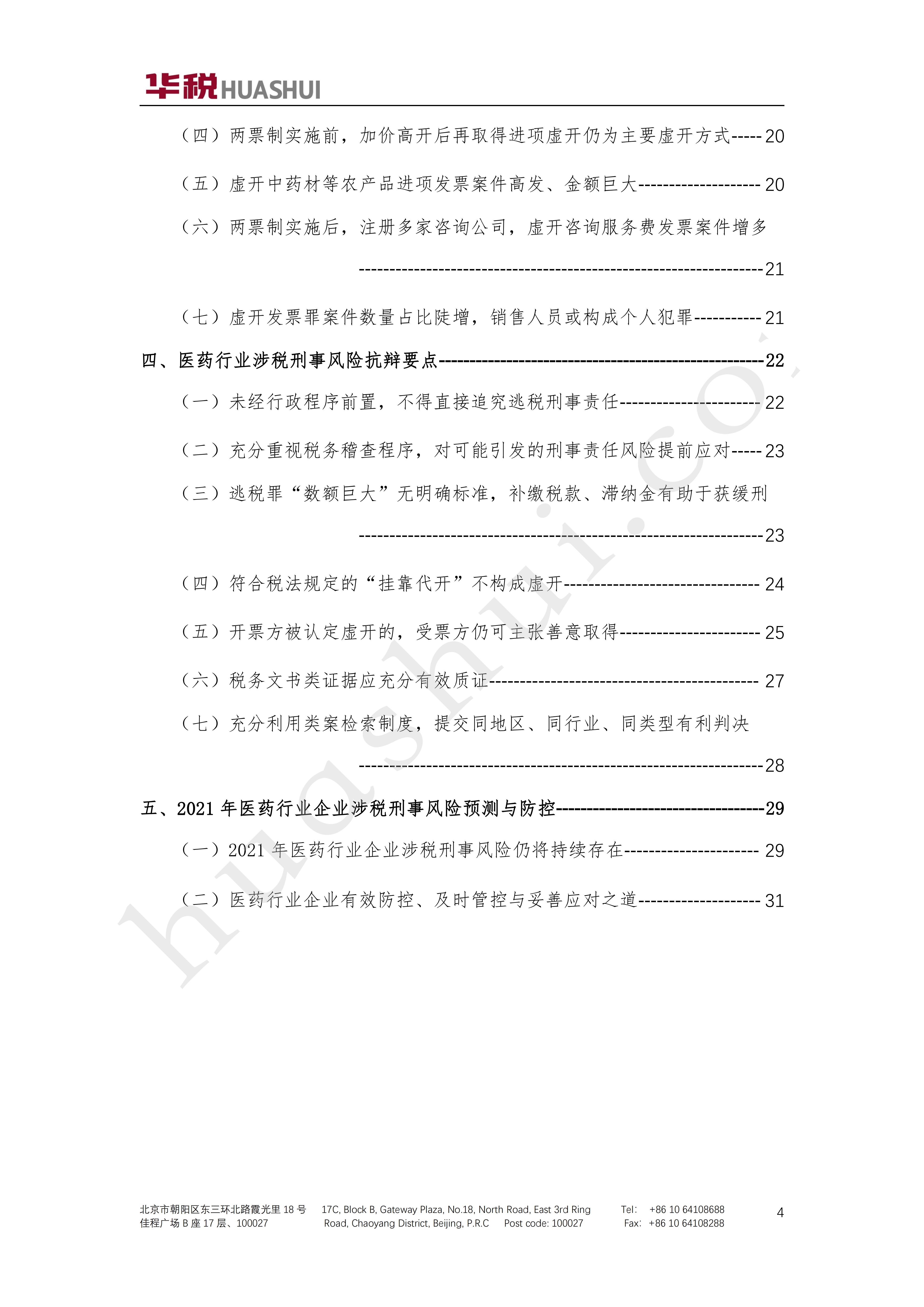

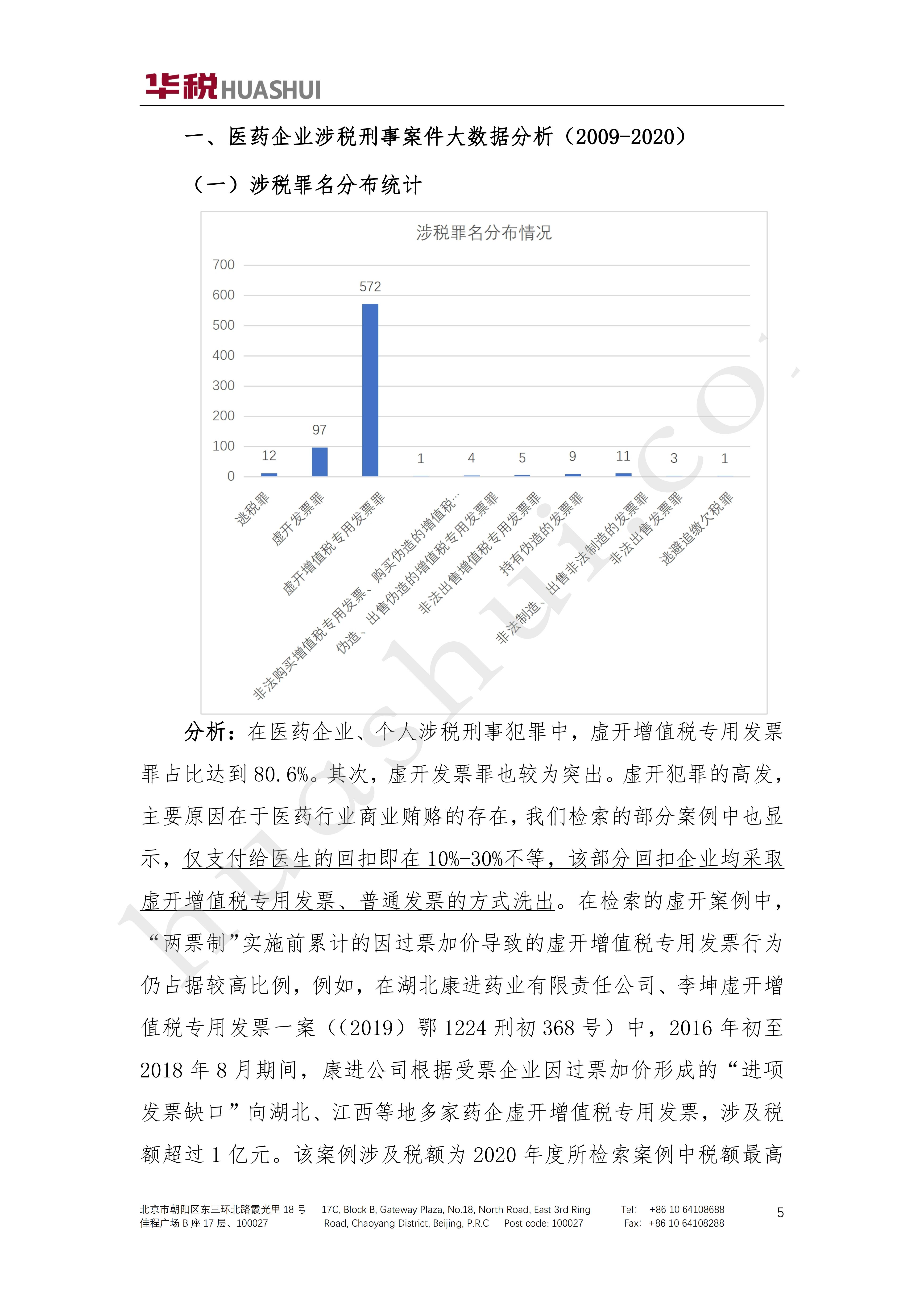

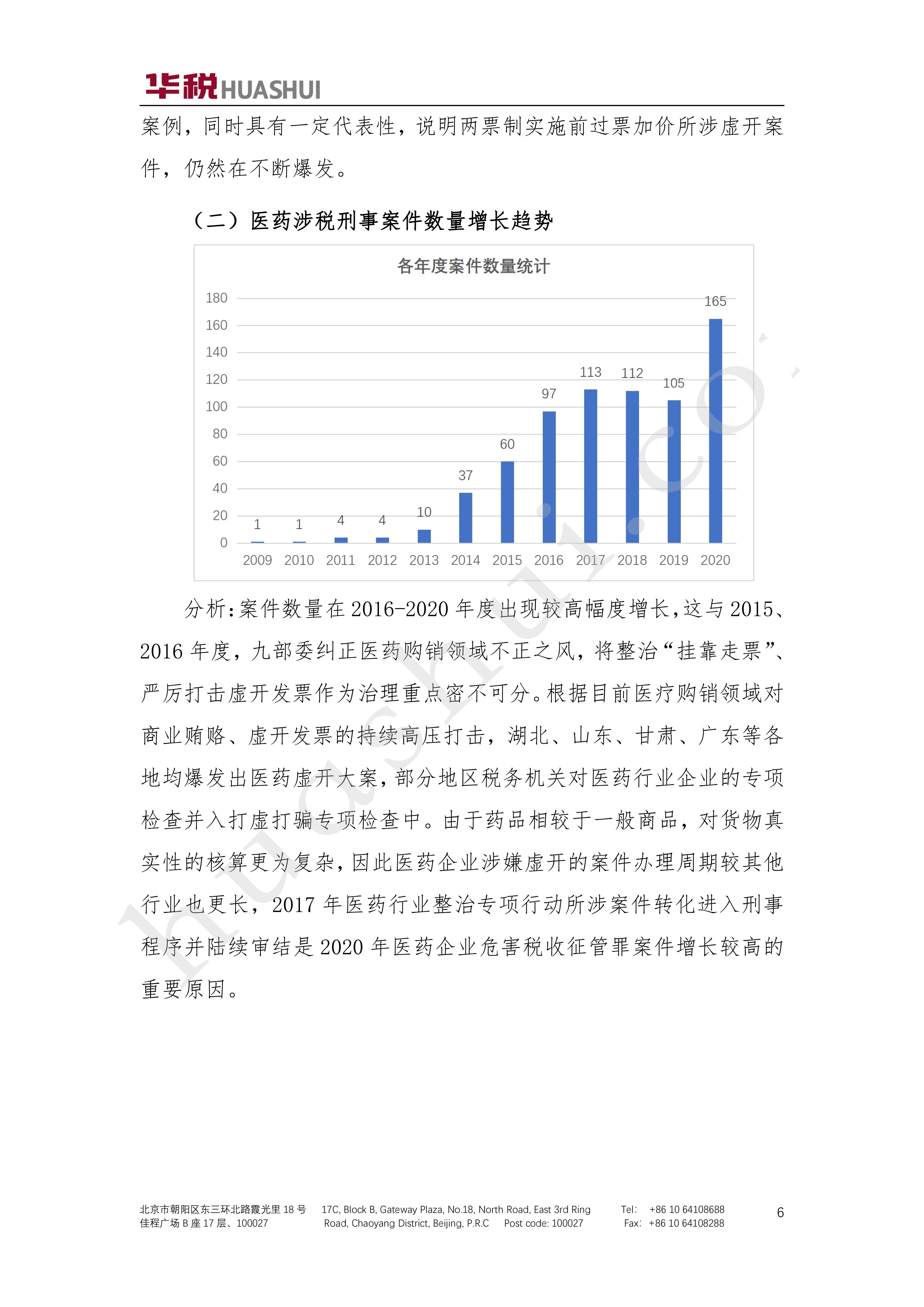

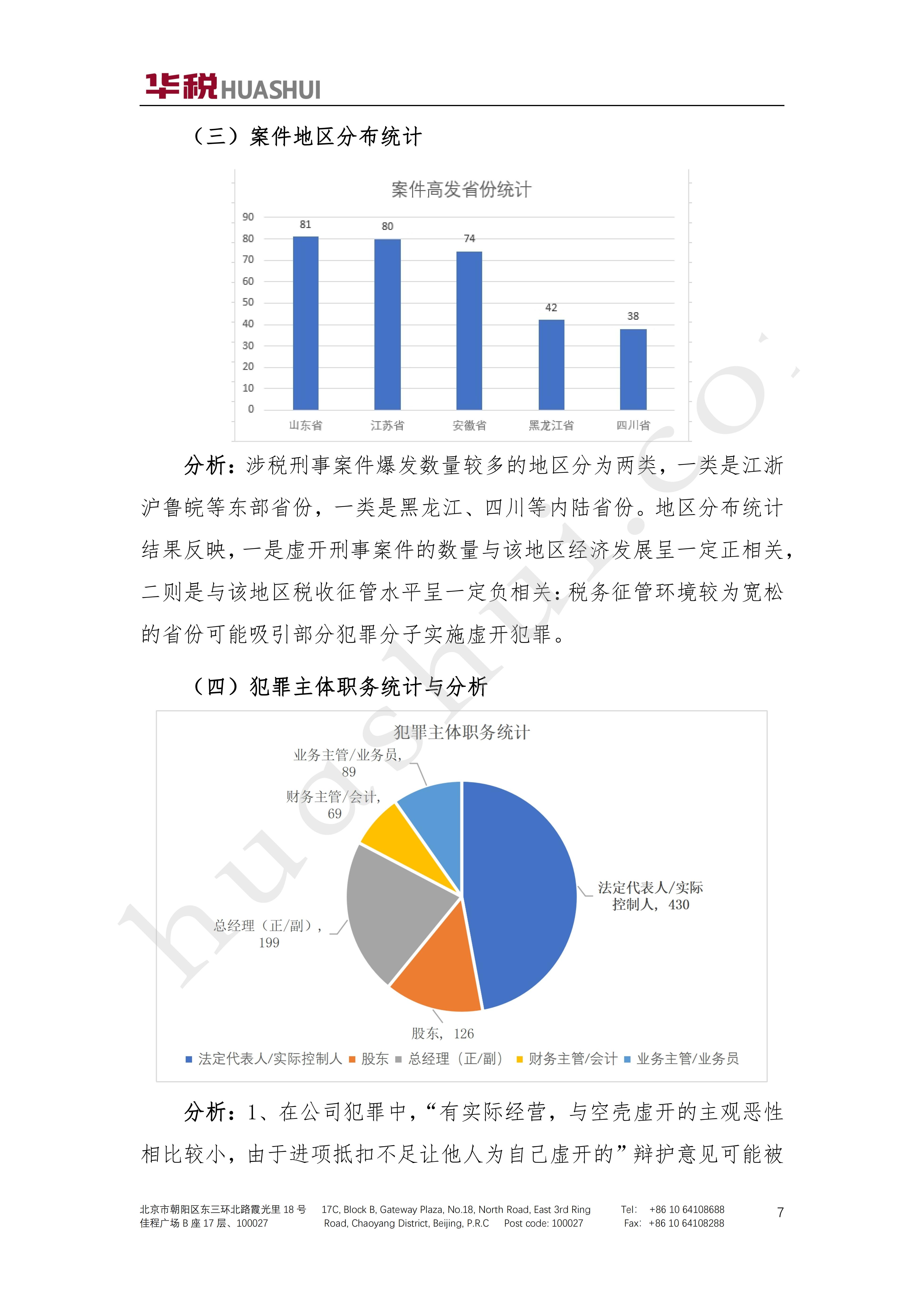

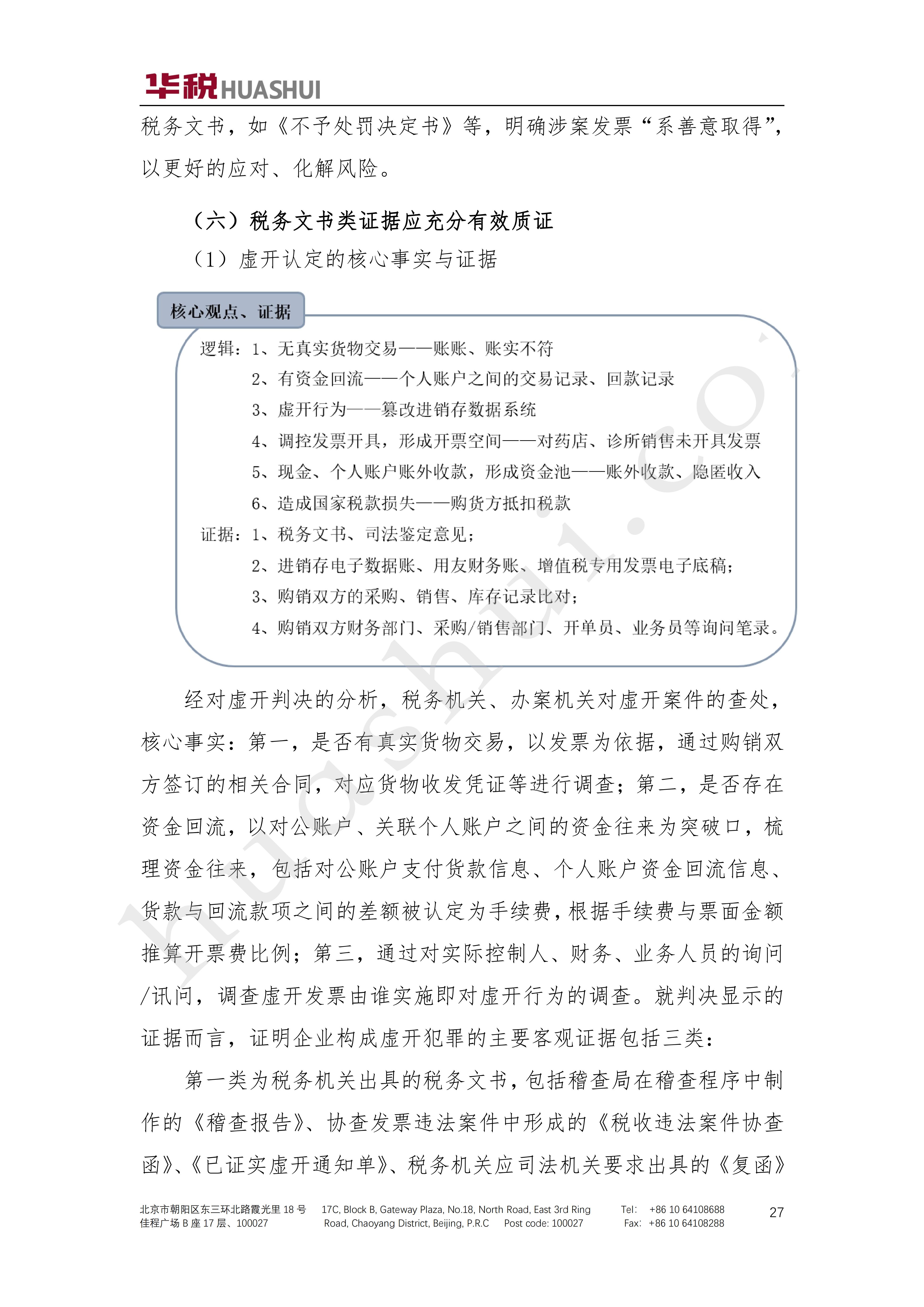

In this report, we firstly analyze the big data of more than 715 tax-related criminal cases of pharmaceutical enterprises retrieved through the referee network, Qixinbao, Enterprise Search and other platforms. On this basis, we analyze and summarize the legal application and defense strategies of major tax-related criminal offenses involved in tax evasion, false invoicing, and false VAT invoicing, as well as put forward management and control suggestions for the enterprises' compliant operation. Since the main sales market of drugs is hospitals, the co-existence of false invoicing and commercial bribery has led to the interconnection of false invoicing and bribery cases. In the cases we have searched, some of the judgments show that the cash kickbacks given by pharmaceutical representatives to doctors accounted for 10%-30%, and the motivation for false invoicing is not only to "more deductions of inputs" and "increase profits", but also to "increase profits", which is the main reason for false invoicing. In addition to "more deduction of inputs" and "increase in profits", the motivation for false driving is more based on the cash demand for commercial bribery. Since 2016, nine ministries to correct the medical purchase and marketing field and medical services in the unhealthy wind, will "crack down on false invoicing, tax evasion and other illegal behavior" as the focus of governance, since then in the corrective work, the fight against invoices related to illegal behavior has become the focus of the work in successive years. 2020 nine ministries to correct the unhealthy wind in the field of medical purchases and marketing In 2020, the nine ministries and commissions will take "cracking down on the illegal acts of pharmaceutical enterprises colluding with contract marketing organizations (CS0) to cash in fictitious fees to pay for illegal marketing expenses" as a key point of their work. Through the analysis of more than 700 cases, we found that more than 70% of tax-related criminal cases involve tax documents, and the "Letter of Concurrence on Tax Violation Cases", "Notification of Confirmed False Openings", "Audit Report", "Decision on Administrative Treatment of Taxes", and "Situation Statement on False Openings of Enterprises", etc. issued by the tax authorities have become the important evidences proving that the enterprises have constituted the criminal offenses related to taxes. As tax-related criminal cases are mostly transferred to public security organs after audit by tax authorities, the cross-cutting features of execution and punishment are more significant. According to the provisions of the Criminal Procedure Law, the evidence collected by administrative organs in administrative procedures conforms to the procedural norms and has the requirements of objectivity, authenticity and legality, and can be transformed to be applied as evidence in criminal proceedings. Whether it is the calculation of the proportion of tax evasion amount occupying the taxable amount for the tax evasion crime, or the determination of the key facts such as the amount of invoices issued for the crime of false invoicing and the amount of tax loss caused, the judicial authorities rely on the investigations of the tax authorities in the inspection procedures, or send a letter to the tax authorities for clarification. Therefore, enterprises should pay full attention to the tax audit procedure, especially the counterparty has been characterized as false invoicing invoice concurrence case, more should pay full attention to the impact of the tax audit, review procedures on criminal risk, the risk response port forward, as early as possible to hire tax lawyers to intervene. In addition, through the big data analysis of tax-related criminal cases of pharmaceutical enterprises, we also pay attention to the fact that although there is a positive correlation between the amount of false invoicing/tax evasion and the final sentence, there is a big difference in the final judgment of the same sentencing circumstances and the same amount of tax involved in judicial practice in different places. The complexity of tax-related criminal cases superimposed on the special background of the pharmaceutical industry highlights the importance of the tax risk management and control in the pharmaceutical industry, especially due to the fact that the tax audit and review procedures have already been characterized as the criminal risk. The importance of management and control, especially due to the merger of national and local taxes, the enhancement of the ability of big data tax administration, and the departmental collaboration mechanism of multiple investigations in one case, the external risk of tax-related criminal risks of enterprises has been increased, and the invoice management compliance is still the keyword for pharmaceutical enterprises to avoid the responsibility of criminal risks in the year of 2021.

Click to download: Full Report of Pharmaceutical Enterprises Tax-related Criminal Risk Report (2021)