Coal Industry Tax-related Criminal Risk Report (2021)

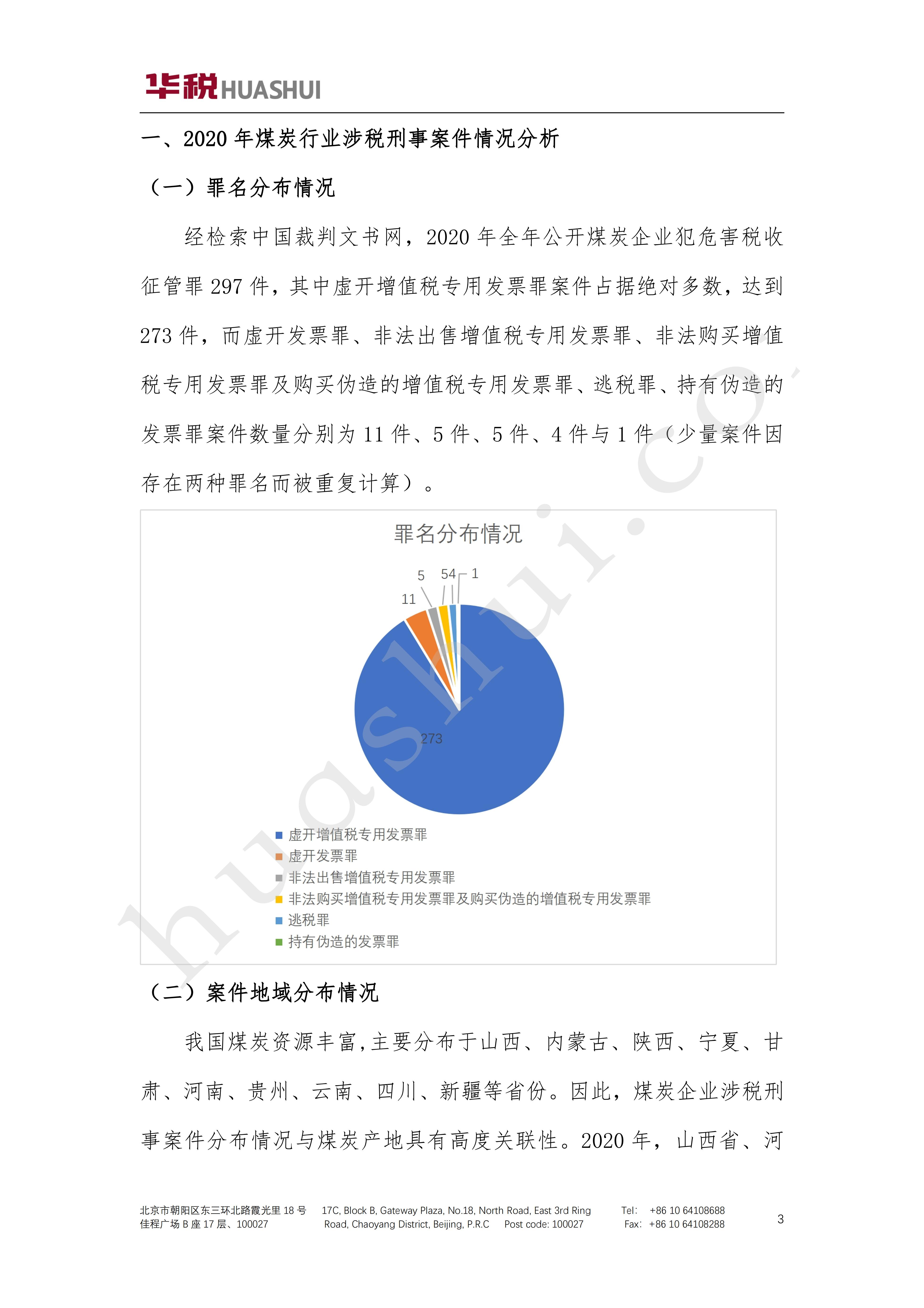

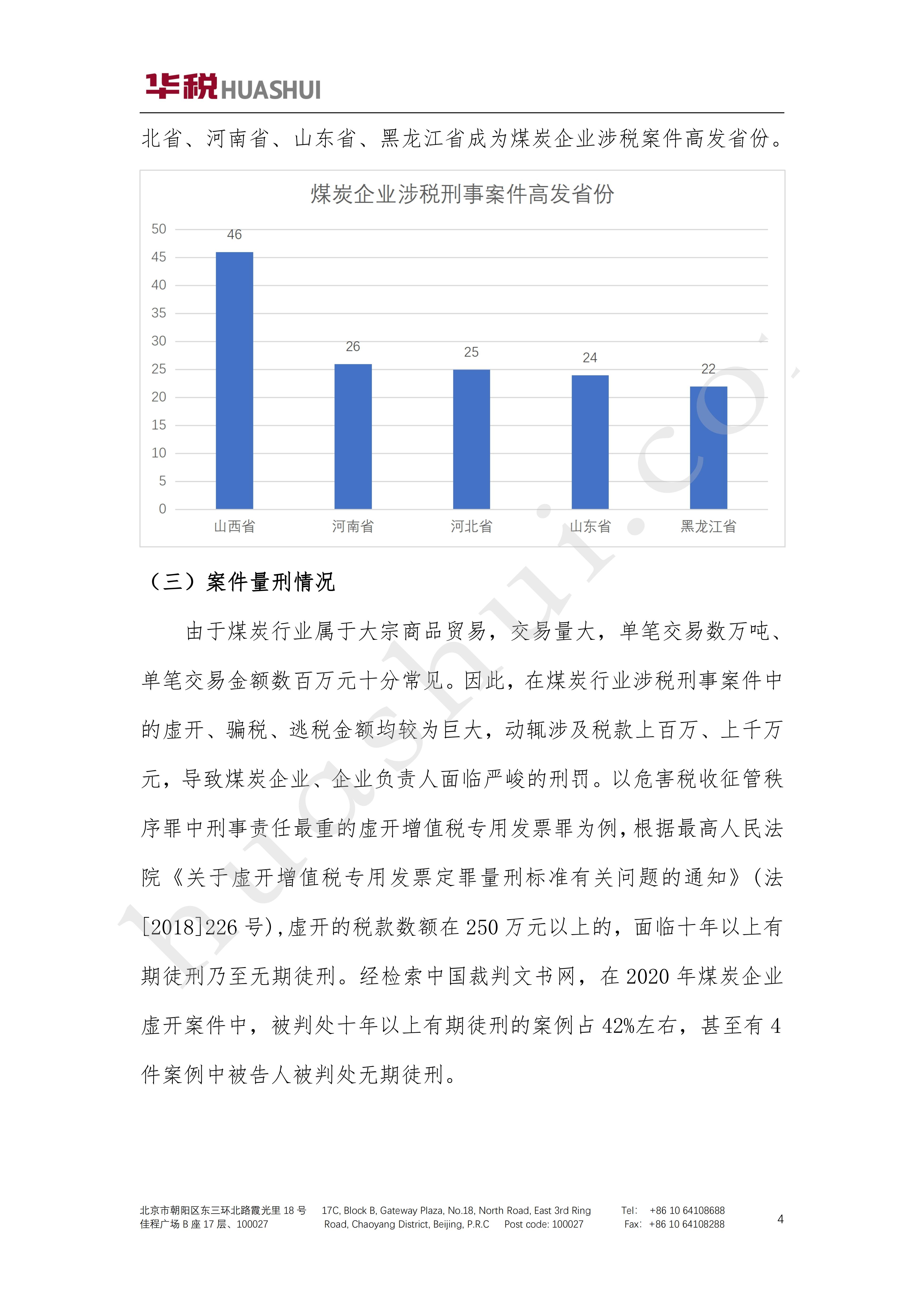

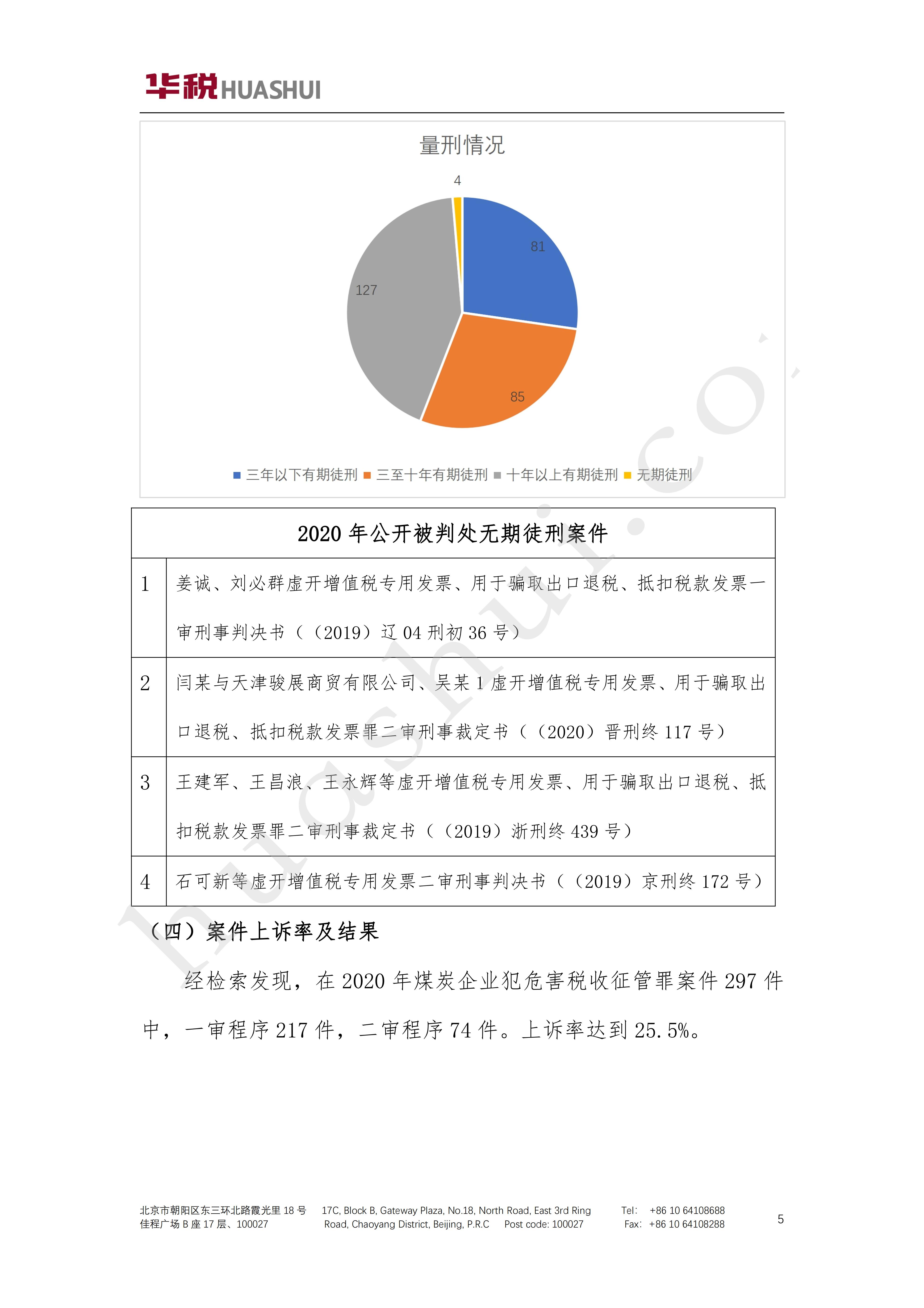

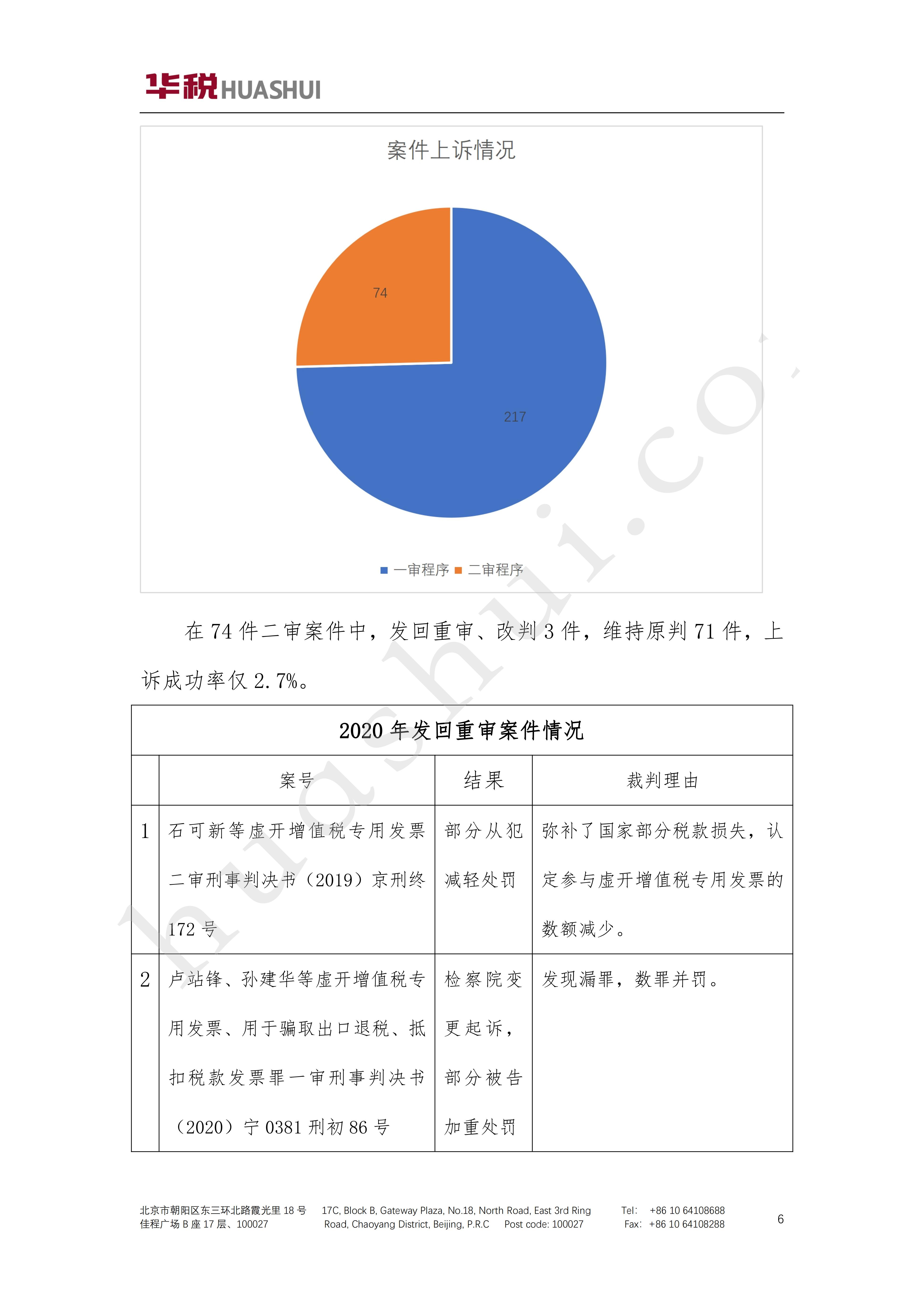

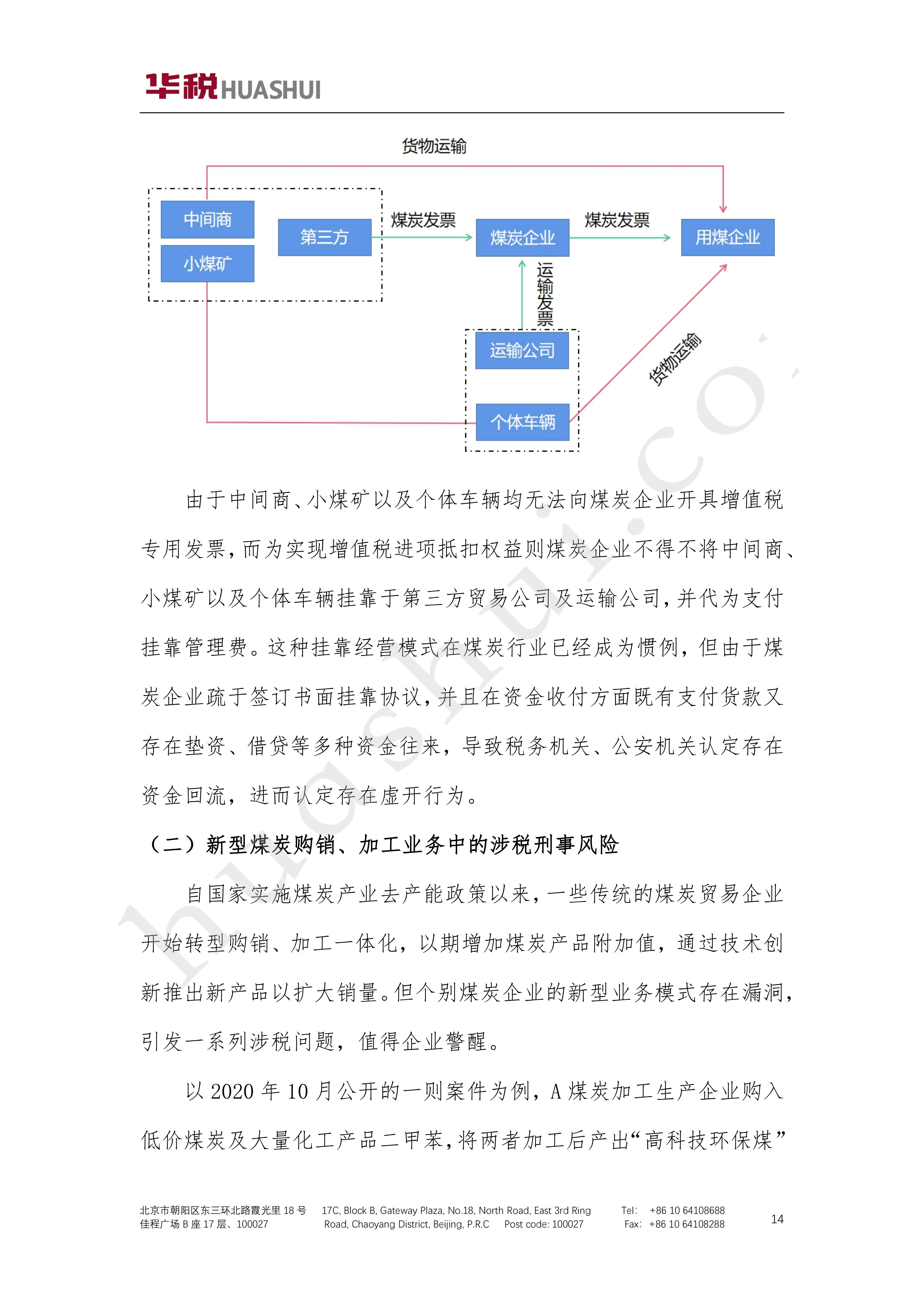

Coal is the backbone of China's traditional industry. Although the State has implemented a series of regulatory systems for the coal industry, such as the quota system, mining, production and operation licensing system (the operation licenses have now been abolished), irregularities in the operation process of coal enterprises still exist and give rise to the risk of criminal liability, which not only leads to the enterprises being caught in operational difficulties, but also puts a number of entrepreneurs behind bars. There is no lack of tax-related cases in these criminal cases. Tax-related criminal cases have become the "Sword of Damocles" hanging over the heads of enterprises and entrepreneurs due to the low threshold of criminalization and heavy criminal liability. However, in these tax-related criminal cases, not all the defendants have the subjective intention of false opening, tax fraud, tax evasion, but due to the business process of some non-compliance operation led to the objective criminal behavior. It is worthwhile for enterprises and entrepreneurs to be alerted to such cases. Compliance Report on Tax-Related Criminal Risks in Coal Industry (2021) is a thematic report based on Huatax's in-depth observation of the coal industry and profound summary of its experience in representing coal enterprises in tax-related criminal cases, aiming to reveal the current situation of tax-related criminal risks in the coal industry, their causes, and to put forward defense strategies and compliance recommendations, with a view to providing references for coal enterprises to avoid criminal risks.

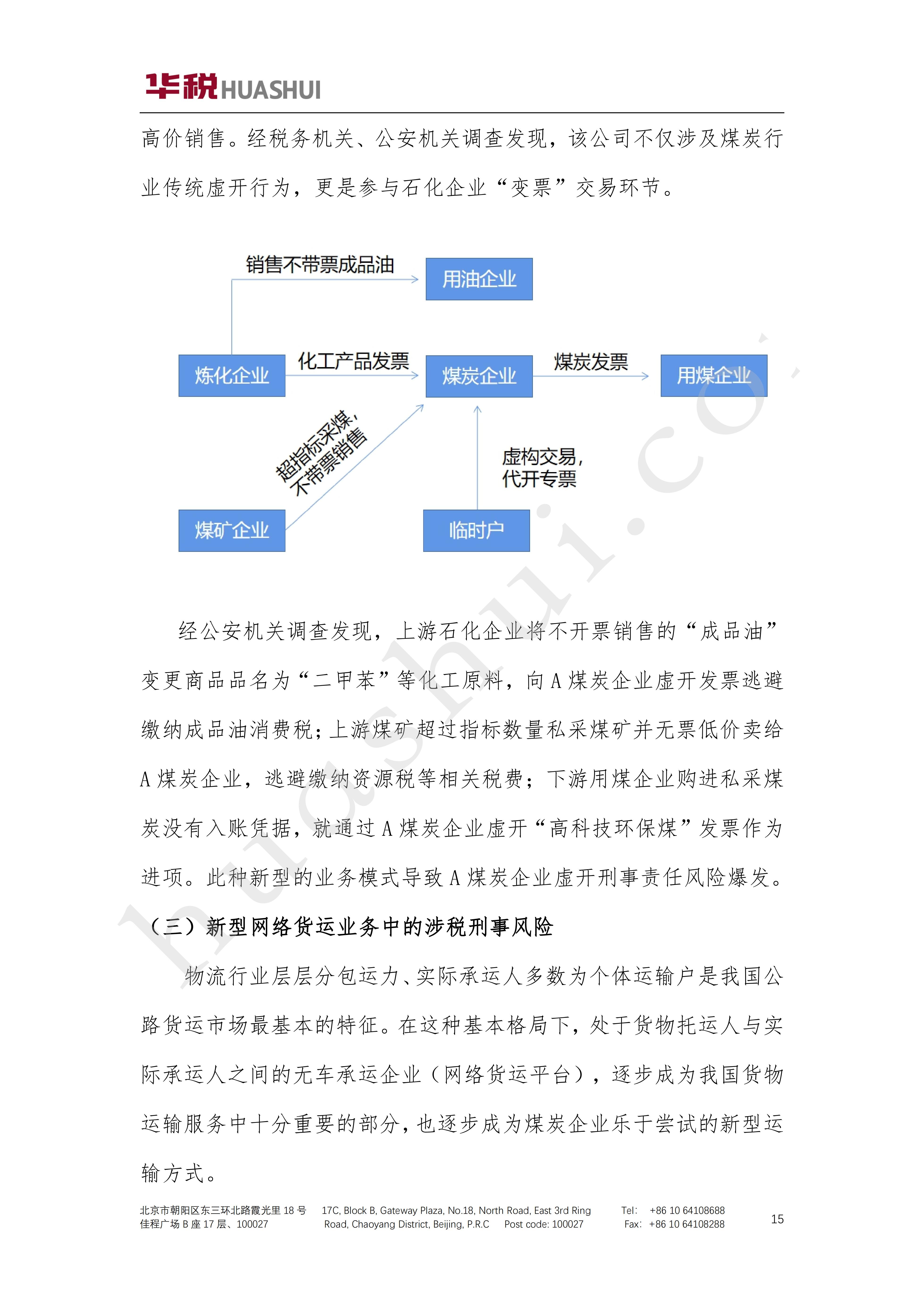

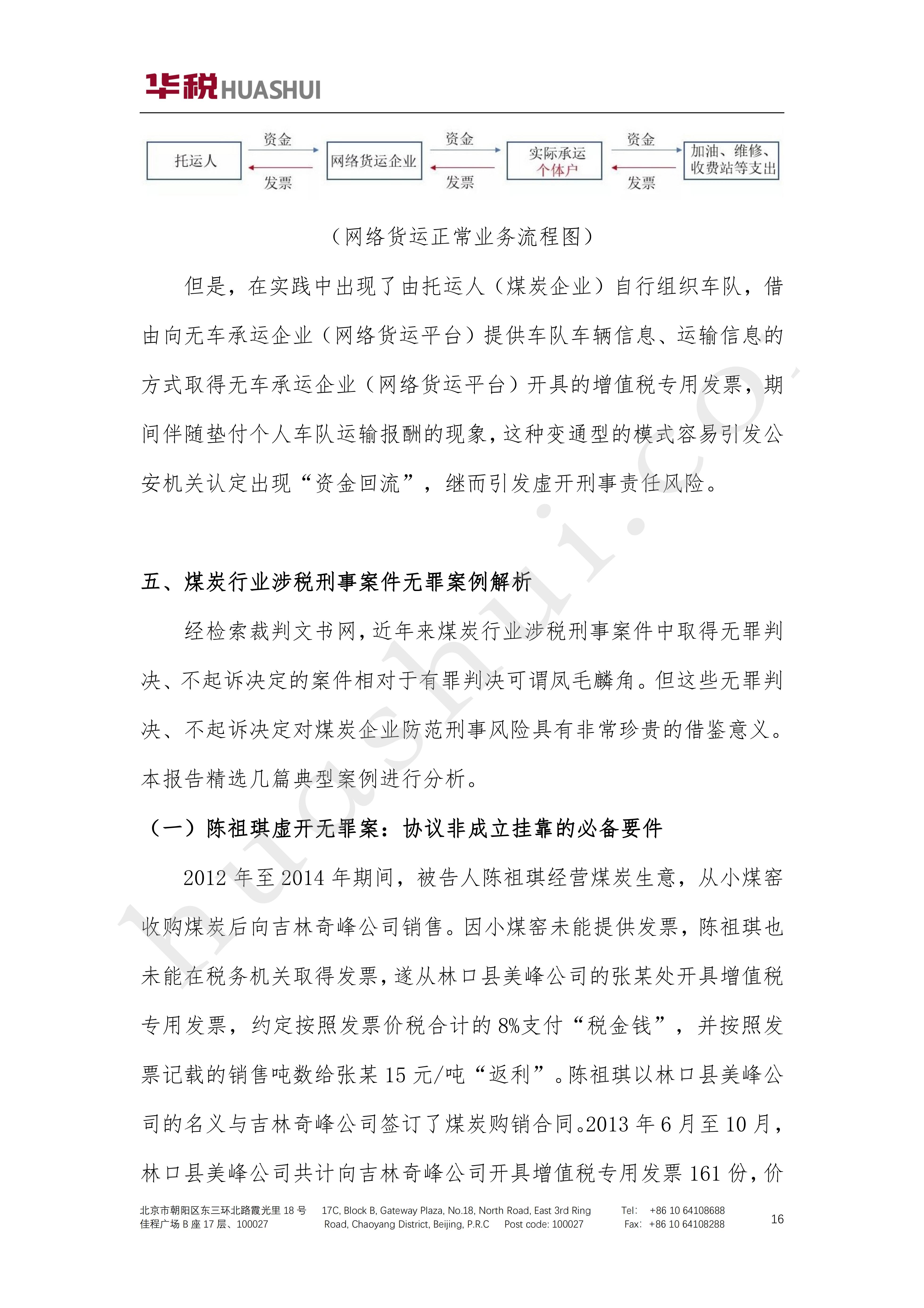

Click to download: Full Report of Coal Industry Tax-related Criminal Risk Report (2021)