In the Government-led Iron and Steel Production Capacity Index Replacement, the Tax Cannot be Levied on the Basis of Deemed-transferred for Enterprises Reduced Production

Abstract:At present, the capacity indicator has become a necessary condition for steel enterprises to carry out construction projects, and China's capacity replacement activities are more active. Recently, the author received a steel production enterprise consulting, the local tax authorities believe that the enterprise in 2019 to retreat from the city relocation in the capacity replacement should be regarded as sales, requiring the enterprise to make up for the value-added tax, urban construction tax, education surcharges, local education surcharges and enterprise income tax totaling hundreds of millions of dollars. In the author's view, the steel production capacity indicator belongs to the administrative license qualification or intangible asset is controversial, whether the capacity replacement activity belongs to the scope of value-added tax and enterprise income tax also needs to be analyzed on a case-by-case basis. Taxation should be in line with the principle of substantive taxation and the principle of tax law, and the taxability of the act of production capacity removal should be judged on the basis of accurately grasping the legal nature of the iron and steel production capacity indexes and the nature of the production capacity replacement activities, and combining with the various elements of the tax entities stipulated in the tax law.

I.Case Introduction

1.Brief of the Case

Enterprise A is a company mainly engaged in black metal smelting and rolling processing industry, with two blast furnaces and an iron production capacity of 1.5 million tons; Two converters, equivalent to a steel production capacity of 1.25 million tons. In 2019, Company A, as a capacity reducing enterprise for the relocation project, used the above-mentioned equipment for capacity replacement. As a result, Enterprise B has achieved an iron production capacity target of 1.2 million tons and a steel production capacity target of 1 million tons, both of which are used for its construction projects.

It is understood that the relocation of a thermal power project involved in the case is a requirement of the local government department to carry out the "relocation of a thermal power project" work under the "Comprehensive Action Plan for Autumn and Winter Air Pollution Control" in a certain place, with the aim of responding to the unfavorable autumn and winter meteorological conditions for air pollution control and winning the battle to protect the blue sky. As a capacity reducing enterprise, Company A dismantled outdated production facilities under the guidance of government departments and replaced the corresponding capacity of the original production facilities with a capacity reduction ratio of 1.25:1. The new capacity index was given to Company B. Company A received compensation for the dismantling paid by the government department, and Company B, which obtained the capacity, did not directly pay any paid consideration to Company A.

In May 2019, the above-mentioned replacement plan was publicly announced in the "Capacity Replacement Plan Publicity" issued by the Industry and Information Technology Department of Enterprise A. The Announcement also disclosed that the withdrawal equipment of Enterprise A will be dismantled on July 1, 2020 and completed by July 30, 2020. The equipment and devices constructed by Enterprise B are planned to be put into operation on July 30, 2020. In July 2021, the production capacity replacement involved in the case received a reply from the Provincial Ministry of Industry and Information Technology.

In July 2024, Company A received a "Notice of Tax Matters" from its competent tax bureau, stating that its 2019 relocation and production capacity replacement should be considered as sales. Based on the quantity of 1.2 million tons of iron production capacity and 1 million tons of steel production capacity granted to Company B, the iron production capacity price index is 400 yuan/ton, and the steel production capacity price index is 400 yuan/ton, the calculated production capacity value is about 880 million yuan (including tax), and the price excluding tax is about 830 million yuan. The revenue will be confirmed according to the reply time of the provincial industry and information technology department in July 2021. After verifying the income, the tax authorities require Enterprise A to pay approximately 49 million yuan (830 million yuan * 6%) in value-added tax, 2.49 million yuan in urban construction tax, 1.49 million yuan in education surcharge, 1 million yuan in local education surcharge, and approximately 207 million yuan (830 million yuan * 25%) in enterprise income tax. This has sparked controversy among tax companies.

-

There are three deficiencies in the tax bureau's treatment of overcapacity reduction as equivalent to sales taxation

The author believes that there are three doubts and issues regarding the tax documents issued by the tax authorities.

Firstly, if the tax authorities consider that capacity replacement should be treated as sales, and the target of sales is the capacity indicators, then the tax authorities actually consider the capacity indicators as intangible assets of enterprise A. So, do production capacity indicators belong to intangible assets or administrative licensing qualifications? This issue is related to whether the object of taxation is established. If the object of taxation is incorrect, the taxation authority's taxation behavior loses its legitimacy.

Secondly, does Company A engage in sales activities and obtain consideration as a result? In practice, the trading of production capacity indicators carried out by enterprises in a fair competition market mechanism conforms to the characteristics of business behavior. However, in the government led capacity replacement, the capacity indicators of enterprise A are eliminated and no consideration is obtained from enterprise B, making it difficult to establish a sales behavior. Moreover, the capacity indicators do not have practical circulation and appreciation, resulting in the tax bureau's taxation behavior losing its tax basis and coexisting with the defect of tax basis.

Again, what is the taxable income obtained by Company A? In the case of capacity replacement, Company A did not obtain any additional economic benefits due to the elimination of capacity indicators, except for the demolition compensation paid by government departments. This issue is related to whether there is a tax base for the collection and payment of corporate income tax. The answer to the above question needs to be analyzed in conjunction with relevant policies on steel production capacity indicators. The author has summarized the evolution of relevant policies as follows.

II. The replacement of steel production capacity presents a dual track feature of government led and market trading

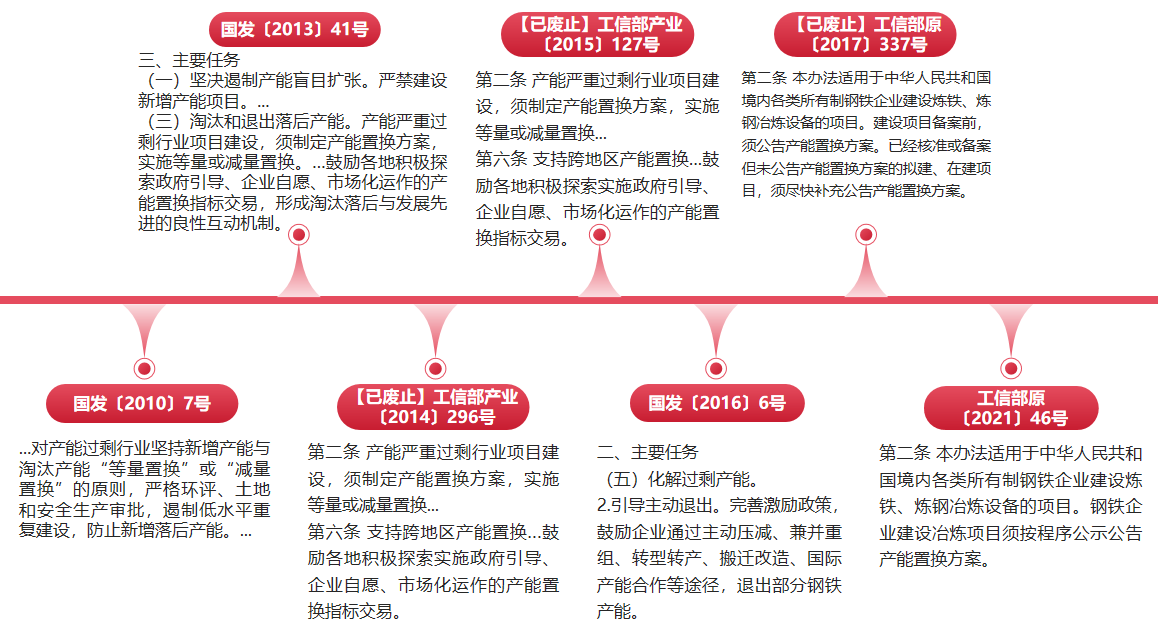

The steel production capacity index is one of the means for administrative agencies to macroscopically regulate steel production activities. The steel production industry, as an important basic industry of China's national economy, has long faced the problem of overcapacity, which has led to many negative impacts such as business difficulties, decreased fiscal revenue, and accumulated financial risks. At first, resolving overcapacity was mainly achieved by setting targets and tasks for phasing out outdated production capacity, and requiring each province to decompose and implement them in enterprises. However, relying solely on administrative orders such as shutdowns, mergers, and transfers to resolve excess capacity can easily lead to problems such as low efficiency, difficulties in employee placement, and intensified social conflicts. On February 6, 2010, the State Council first proposed in the "Notice of the State Council on Further Strengthening the Work of Eliminating Outdated Capacity" (Guofa [2010] No. 7) that industries with overcapacity should adhere to the principle of "equal replacement" or "reduction replacement" of newly added capacity and eliminated capacity. In 2013, outside the clear scope of reduction in various regions, the Ministry of Industry and Information Technology compiled and announced a batch of enterprises to eliminate backward and excess production capacity. In the "Notice on Doing a Good Job in Capacity Replacement in Some Industries with Severe Overcapacity" (MIIT Industry [2014] No. 296, now abolished) issued on July 10, 2014, it was clarified that only enterprises listed in MIIT's announcement to eliminate backward and excess production capacity can be used for capacity replacement. Based on the above documents, all new, renovated, and expanded projects of steel enterprises must implement capacity replacement within the announced capacity range, and the newly built capacity must be less than or equal to the exiting capacity, in order to achieve the policy effect of orderly exiting excess capacity and optimizing capacity structure while controlling the total capacity. In 2016, the State owned Assets Supervision and Administration Commission of the State Council and provincial governments submitted the implementation plan for capacity reduction to the State Council for record, and formed a list of smelting equipment in the steel industry. The "Implementation Measures for Capacity Replacement in the Steel Industry" (formerly Ministry of Industry and Information Technology [2017] No. 337) clearly stated that only the equipment on the list and legally compliant smelting equipment built in 2016 and after can be used for capacity replacement.

At the same time, in order to guide the orderly exit of backward production capacity, raise funds to solve the funding problems of employee placement and debt disposal in overcapacity reducing enterprises, and resolve social risks, the "Guiding Opinions of the State Council on Resolving the Contradiction of Serious Overcapacity" (Guofa [2013] No. 41) encourages the implementation of government guided, enterprise voluntary, and market-oriented capacity replacement index trading. Based on this, some regions are actively exploring capacity indicator trading mechanisms to resolve overcapacity through market-oriented means. For example, on October 26, 2016, the People's Government of Hebei Province issued the "Management Measures for Trading of Steel Production Capacity Use Rights in Hebei Province (Trial)" (Ji Zheng Ban Zi [2016] No. 172, Attachment 3), which refined the relevant norms for trading steel production capacity indicators. Nowadays, the practice of obtaining steel production capacity indicators through market-oriented channels such as auctions is becoming more mature. For example, Fujian Sangang Minguang Co., Ltd. once disclosed in the "Announcement on the Successful Participation in the Bidding of Steel Production Capacity Indicators" that it participated in the bidding of steel production capacity indicators belonging to Shandong Iron and Steel Group Laiwu Iron and Steel Xinjiang Co., Ltd., which was publicly listed and transferred on the Shandong Property Rights Trading Center, and successfully bid for a total price of RMB 1.814 billion.

In summary, the dual track approach of government led capacity replacement and market-oriented capacity replacement in China is parallel. The government led capacity replacement aims to achieve public policy goals such as resolving overcapacity conflicts and optimizing capacity structure, which is fundamentally different from trading capacity indicators under a fair competition market mechanism based on profit objectives. In the market-oriented operation of capacity replacement, the transferee acquires capacity indicators through market-oriented means, and the capacity indicators are transferred from the overcapacity reducing enterprise to the new capacity building enterprise. In the government led capacity allocation, the capacity indicators of overcapacity reducing enterprises are eliminated, and new capacity indicators are given to newly established capacity reducing enterprises. Non overcapacity reducing enterprises do not receive consideration from newly established capacity reducing enterprises due to the elimination of their capacity indicators. Therefore, from this perspective, looking back at the introduced case, it can be seen that the case was a government led capacity replacement, and the steel production capacity index involved is a qualification. There is no legal basis for treating overcapacity reducing enterprises as sales and levying taxes, which will be analyzed in detail later.

III. The steel production capacity index that has not entered market-oriented operation is essentially a qualification rather than an asset

At present, there are different opinions among various sectors on whether the steel production capacity indicator is a qualification or an asset. Some argue that steel production capacity indicators are a qualification and are subject to restrictions in terms of transfer, evaluation, and enforcement; Another viewpoint is that steel production capacity indicators are an asset because they have property attributes. The essence of the above disagreement lies in whether the steel production capacity indicator is an administrative license.

According to Article 2 of the Administrative Licensing Law, "Administrative licensing referred to in this Law refers to the act of allowing citizens, legal persons, or other organizations to engage in specific activities based on their applications and after examination in accordance with the law." It can be seen that administrative licensing has the following characteristics: in essence, administrative licensing has the power and does not have retroactive effect; In terms of procedures, eligible entities can apply and obtain administrative licenses through the approval process.

In this case, the steel production capacity indicators meet the legal characteristics of administrative licensing in both substance and procedure. Firstly, the determination of steel production capacity indicators is weighted. Capacity, as a technical parameter, only reflects the production capacity of fixed assets under specific production cycles and technical conditions. By implementing the replacement capacity determination procedure, the production capacity is converted into steel production capacity indicators, granting steel enterprises the qualification to participate in capacity replacement. Secondly, the first achievement of the steel production capacity indicator is effective for the future and does not have retroactive effect. The determination of steel production capacity indicators has two legal effects: one is the confirmation of the existing production capacity of steel enterprises; Secondly, from the date when the production capacity is confirmed as a production capacity indicator, the qualification to participate in production capacity replacement is obtained, and this qualification does not have retroactive effect. Thirdly, the acquisition of steel production capacity indicators requires approval procedures. Firstly, the production capacity converted into a production capacity indicator must meet specific conditions. According to the Implementation Measures for Capacity Replacement in the Iron and Steel Industry (formerly Ministry of Industry and Information Technology [2021] No. 46), the smelting equipment used for capacity replacement must be included in the list of smelting equipment in the steel industry that was submitted to the State owned Assets Supervision and Administration Commission of the State Council and provincial governments for the State Council's implementation plan for capacity reduction in 2016, or be legal and compliant smelting equipment built in 2016 or later. The production capacity included in the task of reducing steel production capacity, the exit capacity supported by incentive funds, the production capacity of "strip steel", outdated production capacity, the production capacity of zombie enterprises that have not been restructured or liquidated, and the production capacity of non steel industry smelting equipment such as casting and ferroalloys shall not be used for replacement according to regulations. At the same time, the determination of production capacity indicators is not based on the actual production capacity of the equipment, but on the conversion according to the "Capacity Accounting Table" of the Ministry of Industry and Information Technology. All of the above reflect that administrative agencies have fulfilled their function of reviewing and approving when determining production capacity indicators.

Therefore, only steel production capacity indicators that have undergone market-oriented operations meet the characteristics of intangible assets that can be owned or controlled by enterprises, expected to bring economic benefits to enterprises, and whose value can be reliably measured. The steel production capacity indicators that have not been operated in a market-oriented manner are essentially administrative licenses, and their determination as enterprise assets has no legal basis.

IV. Government led capacity replacement is different from asset disposal and does not fall within the scope of value-added tax

Asset disposal refers to the act of transferring, changing, and canceling the ownership and use rights of some or all of the assets occupied and used by the asset occupying unit, as well as changing the nature or purpose of the assets. However, government led capacity replacement is significantly different from asset disposal.

Firstly, as an administrative license, the participation of production capacity indicators in fair competition and market-oriented transactions has no legal basis. Article 9 of the Administrative Licensing Law stipulates that "administrative licenses obtained in accordance with the law shall not be transferred except for those that can be transferred in accordance with legal conditions and procedures as stipulated by laws and regulations." Current laws and regulations do not provide clear provisions for trading capacity indicators under a fair competition market mechanism, and there is no legal or regulatory basis for enterprises to transfer capacity indicators.

Secondly, in government led capacity replacement, capacity indicators cannot be recognized as intangible assets of enterprises. According to the relevant provisions of the Enterprise Accounting Standards, intangible assets refer to identifiable non monetary assets that an enterprise owns or controls without physical form, that is, the enterprise should have ownership of intangible assets, or although there is no ownership, the asset can be controlled by the enterprise. One of the conditions for the recognition of intangible assets that meets the definition of intangible assets. The government led capacity replacement serves policy purposes such as resolving overcapacity and optimizing industrial structure, and the transfer, change, and verification of capacity indicators are not based on the will of enterprises. In government led capacity replacement, enterprises do not have exclusive rights to possess, benefit from, or dispose of capacity indicators, and do not have control over capacity indicators. Therefore, the production capacity indicators in this case do not meet the definition of intangible assets, nor do they meet the recognition criteria for intangible assets. Recognizing them as intangible assets may violate accounting standards.

Thirdly, government led capacity replacement is not a business activity, and overcapacity reducing enterprises do not gain economic benefits from capacity replacement and do not have value-added tax obligations. According to the Implementation Measures for the Pilot Program of Replacing Business Tax with Value added Tax, the taxable object of value-added tax is the value-added amount generated during business activities, and non business activities do not fall within the scope of value-added tax taxation. The implementation basis of government led capacity replacement is public policy, aimed at achieving policy objectives. It is a non-profit and occasional non business behavior that does not fall within the scope of value-added tax. Taking a step back, even if it is believed that the government led capacity replacement has the characteristics of business behavior, the overcapacity enterprises have not obtained taxable sales due to capacity replacement. In this case, Company A did not receive any consideration for capacity replacement, and the economic benefits related to the steel production capacity involved did not flow into the company. The imposition of value-added tax on government led capacity replacement is not only inconsistent with its economic essence, but also lacks a tax basis.

V. There is no factual basis for calculating and levying corporate income tax as the production capacity reducing enterprise in this case did not obtain taxable income

According to the relevant provisions of the Enterprise Income Tax Law, the taxable object of enterprise income tax is the taxable income, and its calculation is based on the principle of accrual basis.

In this case, the tax authority determined the value of the production capacity indicator based on the price index of the product, essentially using the virtual income of enterprise B as the basis for calculating the value of the production capacity indicator. However, in fact, whether the above-mentioned income can be realized requires comprehensive consideration of various economic factors that may exist in enterprise B within the service life of the production capacity indicator, and the verification method of the tax authority is contrary to the principle of accrual basis. In fact, enterprises that have reduced production capacity have only carried out activities such as withdrawing production capacity and dismantling equipment, and have not obtained any economic benefits from the elimination of production capacity indicators. There has been no taxable income, and there is no basis for calculating corporate income tax.

VI. This case does not meet the applicable conditions for approved expropriation

Even if it is considered that the involved capacity replacement has incurred tax obligations, the application of assessed collection should still comply with the legal provisions. Article 35 of the Tax Collection and Administration Law stipulates that there are six situations in which tax authorities have the right to determine the amount of tax payable, namely: (1) those that may not set up accounting books in accordance with laws and administrative regulations; (2) According to the provisions of laws and administrative regulations, account books should be established but have not been established; (3) Destroying accounting books without authorization or refusing to provide tax information; (4) Although accounting books are set up, the accounts are chaotic or the cost information, income vouchers, and expense vouchers are incomplete, making it difficult to audit the accounts; (5) Those who have tax obligations but fail to file tax declarations within the prescribed time limit, and are ordered by the tax authorities to file within a specified time limit, but still fail to file within the deadline; (6) The taxpayer's declared tax basis is significantly low and without justifiable reasons.

As mentioned earlier, the steel production capacity indicators in this case are subject to administrative licensing and were obtained by the enterprise through administrative approval procedures in accordance with the law. They cannot be included in the balance sheet and do not fall under the category of failure to set up accounting books, intentional damage to accounting books, or incomplete accounting books. At the same time, the capacity replacement implemented by Enterprise A to implement public policies did not generate any consideration, sales revenue, or taxable income due to the capacity replacement, and does not belong to a situation where the tax basis is significantly lower. Therefore, the tax authorities have no legal basis for determining the value of production capacity indicators and levying value-added tax based on the unit value of products without being ordered to declare within a specified time limit.

Conclusion: On August 20, 2024, the Ministry of Industry and Information Technology announced the "Notice on Suspending the Work of Steel Capacity Replacement" (Original Letter from the Ministry of Industry and Information Technology [2024] No. 327), which clearly stated that the "Measures" would be revised, and the public announcement of new steel capacity replacement plans would be suspended from August 23, 2024. This will be the third revision of the 'Regulations'. Capacity replacement has been effective in resolving the contradiction of overcapacity in the steel industry. Clear enforcement measures are not only of great significance for the high-quality development of China's economy, but also affect the trust and interests of steel industry operators. This article insists that tax collection related to the replacement of steel production capacity indicators should adhere to the principle of substantive taxation. Government led production capacity replacement is not for profit, and if enterprises have not obtained any economic benefits from production capacity replacement, they do not have any tax obligations for value-added tax and corporate income tax. Steel enterprises participating in capacity replacement should accurately grasp the economic attributes of capacity replacement activities and, if necessary, rely on the power of professional tax lawyers to assess and control tax risks.