Natural person invoicing tax cases are frequent, both the invoicing party and the invoiced party need to be careful

Editor's Note: Since this year, tax cases related to invoicing by natural persons have occurred frequently, involving both enterprises of the invoiced party and natural persons of the invoicing party. For the invoicing party, the invoicing party should pay VAT and income tax according to the law, otherwise, it will face the risk of tax evasion or even tax evasion; for the invoiced enterprise which accepts the natural person to provide services, whether it can obtain the invoice issued on behalf of the invoicing party or whether the invoices are legally compliant, etc., will have different impacts on the invoicing party. This article will analyse and sort out the risks faced by the invoicing party and the invoiced party under different circumstances, so as to help enterprises improve tax compliance and safeguard their legitimate rights and interests.

I. Frequent tax cases involving invoicing by natural persons

Since the beginning of this year, many invoicing natural persons or enterprises receiving invoices from natural persons have received notices of tax matters or decisions on administrative penalties for tax matters in respect of invoices issued by them in previous years. The tax documents received by the invoicing party are generally to notify the natural person to declare and pay individual income tax, or to verify the authenticity of the business, or to decide on penalties for false invoicing. The tax documents received by an enterprise on the invoiced side involve three main situations: first, administrative penalties for its failure to fulfil its withholding and collection obligations; second, confirmation that the invoice obtained by it is a false invoice, requiring it to pay the value-added tax, enterprise income tax and late payment fees; and third, recognition of the invoice obtained by it as a false invoice, which is dealt with in accordance with the false invoicing or tax evasion.

There are the following reasons for the frequent occurrence of tax cases of invoicing by natural persons. Firstly, in certain industries where invoices at source have long been missing and credits are insufficient, such as the transport industry and the renewable resources industry, the enterprises lack the vouchers for VAT credits and pre-tax deduction of enterprise income tax, or some of the operating costs of the enterprises have not been invoiced, and in this regard, the enterprises may reduce their own tax liabilities by means of invoicing by natural persons. Secondly, due to the contradiction between the amount of invoices issued by natural persons and the huge supply volume in reality, the seller or the recipient enterprise may choose to split the business and issue invoices through a large number of natural persons, resulting in invoices that do not correspond to the real business. Finally, there are also cases where there is no real business, the natural person invoices for profit, and the enterprise obtains invoices through fictitious business in order to reduce its own tax burden.

II. Invoicing by natural persons exposed to the risk of reminder and false invoicing

(i) The invoicing party is subject to a reminder and is required to prove the authenticity of the business.

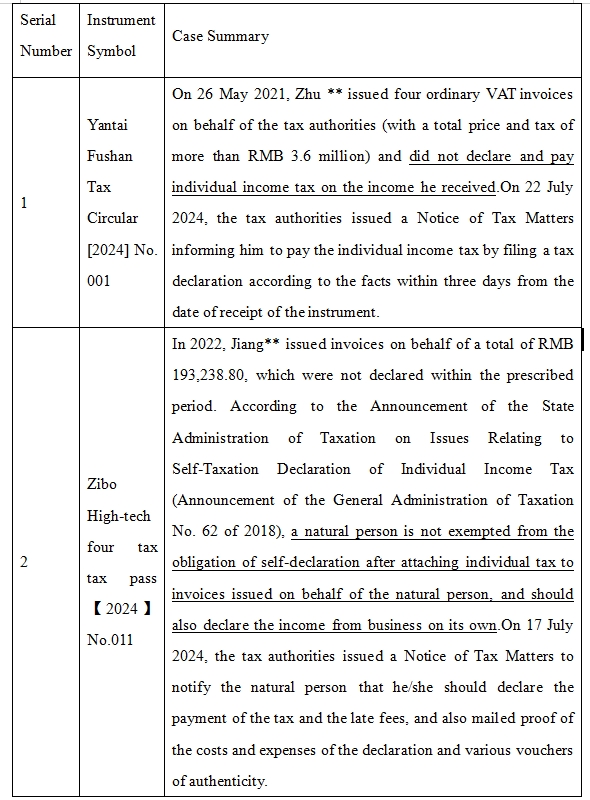

As can be seen from the following two typical cases, a natural person who obtains business income should declare and pay individual income tax, which is generally attached by the tax authorities when making invoices, but the natural person should still declare and pay. When the tax authority serves a notice of tax matters to the natural person to remind him to report and pay the individual income tax, if the taxpayer neither declares and pays the tax nor puts forward a statement or defence, the taxpayer may be regarded as a tax evader who "refuses to declare after being notified by the tax authority to declare", and will be subject to an administrative penalty of fifty to fifty times of the unpaid tax, and may even face the risk of the crime of tax evasion. The risk of tax evasion. It should be noted that in the second case, the notice of tax matters states that the natural person should provide proof of the costs and expenses to be declared as well as the authenticity of the vouchers. In addition to being used for pre-tax deduction of individual income tax to correctly calculate the taxable income, the above documents are more important to prove the authenticity of the business provided by the natural person. If the natural person fails to provide the documents proving the authenticity of the business, the tax authorities may initiate tax inspection on the natural person accordingly, and the natural person may subsequently be involved in the administrative or even criminal risk of fraudulent invoicing.

(ii) Being recognised as a false invoice, administrative and criminal risks co-exist

Article 21 of the Measures of the People's Republic of China for the Administration of Invoices specifies two types of fraudulent invoicing: (i) issuing invoices for others and for oneself that do not correspond to the actual business operations; and (ii) having others issue invoices for oneself that do not correspond to the actual business operations. Thus, there are also administrative and criminal risks for a natural person to issue invoices for others that are inconsistent with the actual operation of the business. At the administrative level, a natural person may be subject to administrative penalties for false invoicing; at the criminal level, in the absence of real business, a natural person may be suspected of invoice-type offences and face the risk of criminal liability for issuing invoices on behalf of others.

III. Multiple risks that should concern the offeree in obtaining invoices issued on behalf of natural persons

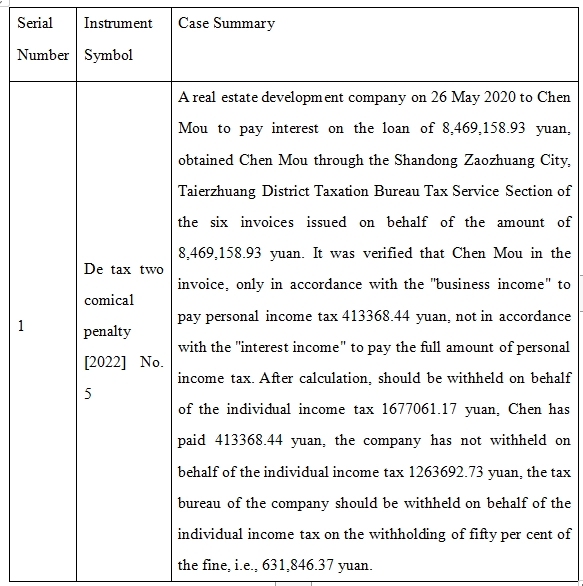

(i) Administrative penalties for failure to fulfil withholding obligations

As mentioned earlier, in some cases, the party to whom the invoice is issued shall withhold and pay the personal income tax on behalf of the natural person when it pays the price, and if the party to whom the invoice is issued fails to fulfil the obligation of withholding and paying, it may face - firstly, the personal income tax has not been withheld and not been paid, and the obligation to pay the tax is still on the taxpayer, i.e., the natural person, so that the tax authority will, first of all, recover from the natural person the withholding and unpaid The tax authorities will firstly recover the withholding tax from the natural person, and at the same time impose a fine of 50 per cent to three times of the withholding tax on the payer; secondly, if the personal income tax has not been withheld and paid, the natural person has already borne the tax, therefore the tax authorities will recover the tax from the payer, and at the same time impose a fine of 50 per cent to five times of the withholding tax, and in serious cases, the party to whom the invoice has been issued may also be subjected to tax evasion or even face the risk of assuming criminal liabilities. In particular, according to the policy of "reverse invoicing" in the renewable resources industry, the recycling enterprises need to fulfil the obligation to act on behalf of the seller after reverse invoicing - the recycling enterprises should act on behalf of the seller in respect of the value-added tax (VAT), personal income tax, etc., and if they fail to pay the tax on behalf of the seller according to the stipulated period, the competent tax authorities will suspend the tax on behalf of the seller. If the tax is not paid within the specified period, the competent tax authority will suspend the qualification of "reverse invoicing" and recover the unpaid or underpaid tax and late payment fees according to the regulations.

(ii) Relevant costs not deductible before enterprise income tax

If the invoice obtained by the invoicee is a fraudulent invoice, and the invoicee has made VAT input deduction and EIT deduction, then the tax authority may require the invoicee to carry out input tax reversal and pay EIT, as well as to impose late payment fees. If the invoicee can prove the authenticity of its business, then it can seek to deduct the true business costs before EIT. For example, in November 2021, Lianfeixiang's subsidiary Hebei Shanshi New Material Technology Company Limited (hereinafter referred to as "Hebei Shanshi") received a notice from the tax department requesting to verify the business transactions and tax status of CNPC New RiDa Petrochemical (Dalian) Co. (hereinafter referred to as "Sunrise") and its business transactions and tax payment. Subsequently, Hebei Shanshi actively cooperated with the tax inspection, but due to the inability to contact New RiDa and the huge amount of VAT owed by New RiDa for invoices issued to other companies at a later stage, the tax department considered all invoices issued by New RiDa as false invoicing regardless of whether the tax was paid or not. 7 June 2022, the Second Inspection Bureau of Langfang Taxation Bureau of the State Administration of Taxation made a processing decision letter to determine that 292 VAT invoices obtained by Lianfeixiang Technology were false invoices and were not allowed to be issued. Special invoices obtained by Lianfei Technology were falsely issued and were not subject to tax deduction, but it was determined that its business was genuine and was allowed to deduct the above purchase costs before tax.

According to the Enterprise Income Tax Law and its implementing regulations, reasonable cost of sales and cost of goods sold actually incurred by an enterprise in the course of production and operation in relation to the acquisition of income are allowed to be deducted before enterprise income tax. Accordingly, enterprises are allowed to deduct expenses that meet the criteria of authenticity, reasonableness and relevance before EIT in accordance with the law. However, in practice, as the invoice obtained by the recipient enterprise is recognised as false invoicing, the tax authority will not allow the deduction before EIT. For the bulk trade business, if the cost deduction is denied and the EIT is adjusted due to the fact that the invoice obtained by the invoice recipient is recognised as a false invoice, the survival of the enterprise will face a big challenge. According to the Measures for the Administration of Pre-tax Deduction Vouchers for Enterprise Income Tax, false invoices obtained by enterprises cannot be used as pre-tax deduction vouchers, and invoices that have been replenished or exchanged can be used as pre-tax deduction vouchers or provide supporting information that the invoicing party is unable to replenish or exchange the invoices, the business contract, and payment vouchers, etc., to prove the authenticity of the expenditures. In practice, due to the lag in updating information, it may be difficult for the recipient enterprise to provide supporting information proving that the invoicing party is unable to reissue or replace the invoice, thus facing the risk of not being able to make pre-tax deduction for enterprise income tax.

(iii) Treatment as tax evasion or false accounting

According to the existing cases, there are cases in which the recipient of the invoice is found to have committed tax evasion or false invoicing after obtaining a falsely issued invoice on behalf of the company, and the handling of such cases in practice is inconsistent. For example, in the administrative penalty case of an electronic equipment company, an outsourced individual provided semiconductor equipment installation and maintenance services for the company, and some of the personnel did not provide invoices according to the actual situation. Therefore, the company made use of the information of its own employees and employees of its affiliated enterprises, and issued 43 VAT invoices with the same amount as the actual amount of VAT invoices in the amount of 8.83 million yuan, which was regarded by the tax authorities as "over-listing expenses on the books of accounts and underpaying tax payable". The tax authorities considered it as a tax evasion behaviour of "over-listing expenses in the books of accounts and under-paying tax payable". In the administrative penalty case of a construction labour service company, the company allowed several natural persons to write ordinary invoices to offset costs because they provided construction and installation services for the company without providing invoices, which was determined by the tax authorities to be an act of obtaining 37 ordinary VAT invoices that did not correspond to the actual business, with the price and tax amounting to approximately RMB 44.68 million, which was then qualified as false invoicing.

Different results of the determination will bring different impacts for the invoiced party. If the invoiced party is found to be tax evasion, if the invoiced party can actively cooperate with the inspection and pay the tax and late payment fees, it can avoid the subsequent development of the offence of tax evasion, just as the result of the previous case: given that a certain electronic equipment limited company can cooperate with the inspection of the tax authorities during the inspection process, and take the initiative to mitigate the harmful consequences of the tax violation, and make prepayment of the enterprise income tax of RMB 57,325.66 yuan, the tax authorities shall be mitigated punishment. The tax authorities imposed a lenient penalty. And if the invoiced party is found to have made false invoices, there is a possibility that the enterprise will be referred to the public security authorities to be found to have committed invoice-type offences. In our opinion, according to the provisions of the Circular of the State Administration of Taxation on the Handling of Issues Concerning Taxpayers Obtaining Fraudulently Issued Value-added Tax Special Invoice (Guo Shui Fa 〔1997〕 No. 134, hereinafter referred to as Document No. 134), for the real purpose of obtaining the vouchers of tax deduction and pre-tax levy and paying less tax, the fraudulent invoicing is a means rather than a purpose, and this kind of behaviour shall be handled in accordance with the qualitative treatment of tax evasion.

IV. How the billing party and the party to be billed should respond

In summary, recent cases of invoicing on behalf of natural persons have occurred frequently, and both the invoiced party and the natural person are facing different degrees of administrative and criminal risks. In this regard, we suggest that ex ante prevention should be combined with ex post response.

For the invoicing party, on the one hand, it is prudent to take precautions beforehand, i.e. to pay attention to the accuracy and truthfulness of the type of income and the place of invoicing to avoid being recognised as false invoicing, and at the same time, it should declare and pay the personal income tax in a timely manner, and if it is not possible to ascertain the cost of the business, it should communicate with the tax authorities in a timely manner to strive for the approval of the collection of income tax; on the other hand, it should respond positively to the situation after it is involved in a crime, i.e. for the case of not declaring and paying the income tax. On the other hand, after being involved in the case, the natural person should actively respond to the case, i.e., for the non-declaration and payment of income tax, if the natural person has objections to the type of income, the taxable income and the amount to be paid, the natural person should make a statement and defence within the prescribed period to avoid being identified as the tax evasion of "refusing to declare after notification of the declaration", which involves the risk of criminal offence. If the natural person can prove that the business has really happened, he should also timely apply for statement and defence to the tax authorities to avoid criminal risks.

For enterprises on the invoiced side, the State has introduced a series of policies to help enterprises legally comply with source invoices in industries with many upstream self-employed persons, such as the pilot invoicing on behalf of network freight transport platforms, and the policy of "reverse invoicing" in the renewable resources industry. Even so, the recipient enterprise should retain complete business information to ensure that the "four streams of consistency" to confirm the authenticity of the business, even if the VAT is recovered after the case, but also to strive to rely on other vouchers for pre-tax deduction of enterprise income tax, and more importantly, to avoid being recognised as a fraudulent invoicing and thus face the risk of criminal liability. More importantly, it will avoid the risk of being recognised as false invoicing and facing criminal liability.