Real estate developers' decision to waive the preferential tax policy for ordinary residential properties during land appreciation tax settlement has sparked controversy. What is the rationale behind

Editor's Note: Since the implementation of the "Interim Regulations on Land Appreciation Tax," the preferential tax policy for ordinary residential properties has always been in effect: taxpayers who construct and sell ordinary standard residential properties, with the appreciation amount not exceeding 20% of the deductible project amount, are exempt from land appreciation tax. For real estate development enterprises, controlling the selling price and appreciation rate of ordinary residential properties can enjoy tax exemption incentives, provided that different types of real estate are accounted for separately as required. In practice, some real estate enterprises have found that abandoning the preferential tax policy for ordinary residential properties in the same project is more conducive to reducing tax liability, but subsequent disputes have arisen with tax authorities during the review of land appreciation tax settlement. This article will discuss this issue and provide suggestions for the readers.

01

Case Introduction: Controversy Arises over Real Estate Developer's Decision to Waive Preferential Tax Policy for Ordinary Residential Properties during Land Appreciation Tax Settlement

Recently, we received a consultation from a real estate developer, Company A, located in Tianjin. The company encountered a dispute with the tax authorities due to its decision to waive the preferential tax policy for ordinary residential properties during the land appreciation tax settlement. The specific situation is as follows:

I. Basic Project Information

Company A developed the City Garden project, and the project approval documents and land transfer contract indicated that the property types of the project included residential and commercial properties. After signing the land transfer contract, the company completed the project registration and filing. During the construction phase, both types of properties were built simultaneously, and the construction contract did not distinguish between the costs of different property types. The company completed sales in 2022. According to the local land appreciation tax policies, the residential part of the project meets the local standards for ordinary residential properties.

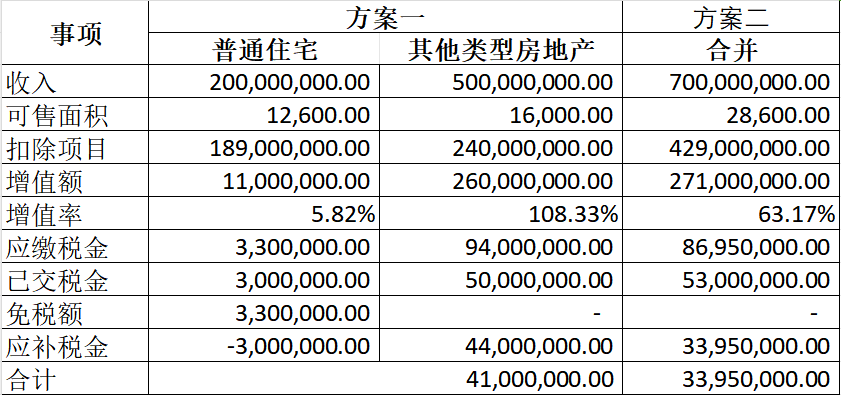

Before the official settlement, the financial personnel calculated and found that if the preferential tax policy for ordinary residential properties were to be enjoyed, the tax supplement would be 41 million yuan. However, if the policy was not enjoyed and the income and deductible items were calculated uniformly, the tax supplement for the project would be 33.95 million yuan (specific calculations are shown in the table below). Subsequently, the company submitted a settlement report based on the overall project settlement and declared in the report that it would waive the preferential tax policy for ordinary residential properties. During the tax authorities' review, they raised objections to the overall project settlement, arguing that the appreciation amount and payable land appreciation tax of ordinary residential properties and other types of real estate should be calculated separately according to local policy requirements, and the tax return form should be filled out accordingly.

ⅡDispute Focus

After detailed communication, it was learned that the tax-enterprise dispute lies in the following: Company A believes that the "Interim Regulations on Land Appreciation Tax" stipulates that a tax exemption policy is available for ordinary residential properties with an appreciation rate below 20%. However, to enjoy this exemption, the conditions for separate accounting must be met. In this project, the residential and commercial costs were not separately accounted for, and the company is willing to waive the preferential tax policy for ordinary residential properties. Therefore, there is no need to distinguish between ordinary residential properties and other types of real estate, and the two types of properties should be consolidated for settlement. The tax authority, however, maintains that according to Article 6 of the "Tianjin Land Appreciation Tax Settlement Management Measures," project settlement requires the calculation of appreciation amounts and payable land appreciation tax by type. Otherwise, the tax system declaration form cannot be filled out. If the enterprise wishes to waive the tax exemption, after calculating the appreciation amount and the additional land appreciation tax payable, the ordinary residential property portion can be handled by paying an additional RMB 300,000.00. Company A cannot accept this.

From the perspective of tax administration, whether ordinary residential properties and other types of real estate must be settled separately involves the policy provisions for settlement by type within the same project. From the taxpayer's perspective, whether the taxpayer can waive the preferential tax policy for ordinary residential properties, and if the exemption is waived, whether all properties should be settled uniformly without enjoying the exemption or whether they should be settled separately and then the exemption waived, involves the exercise of taxpayer rights. To distinguish the right and wrong of the above case, we will analyze these issues one by one.

02

Must ordinary residential properties and other types of real estate in the same project be cleared separately?

In the case, the tax authority requires separate clearing of different types of properties within the same project (commonly known as the "three-way classification" or "two-way classification"). So, what is the policy basis for this type of separate clearing? How do we view this policy? Is the implementation result consistent with its intended purpose? Let's take a look:

I. Evolution of the Policy on Separate Clearing of Different Types of Properties

Among the policies regarding land value-added tax, the earliest documents that mentioned three types of projects were the "Detailed Rules for the Implementation of the Interim Regulations on Land Value-added Tax" and the "Circular on Specific Issues Regarding Land Value-added Tax". These served as the "roots" of separate clearing by types. Subsequent policies on separate clearing were evolved based on these two policies.

Firstly, Article 8 of the original "Interim Regulations on Land Value-added Tax" states: "Land value-added tax shall be exempted in the following circumstances: (1) Where the taxpayer constructs and sells ordinary standard residential properties, and the appreciation amount does not exceed 20% of the deducted item amount." This was the first mention of ordinary standard residential properties, offering incentives to developers for constructing such properties.

Secondly, Article 11 of the "Detailed Rules" stipulates: "The ordinary standard residential properties referred to in Article 8(1) of the Regulations refer to residential properties constructed according to the general civil residential standards of the locality. High-end apartments, villas, resorts, etc., do not belong to ordinary standard residential properties. The specific dividing line between ordinary standard residential properties and other residential properties shall be stipulated by the people's governments of provinces, autonomous regions, and municipalities directly under the Central Government." The detailed rules categorize residential properties into two types based on whether they can enjoy preferential policies: ordinary and non-ordinary. These two documents, as the top-level system for land value-added tax, did not mention or require separate clearing of different types.

Thirdly, Article 13 of the "Circular on Specific Issues Regarding Land Value-added Tax" (Cai Shui Zi [1995] No. 48) stipulates: "Where taxpayers construct both ordinary standard residential properties and engage in other real estate development, they shall separately calculate the appreciation amount. If they do not separately calculate the appreciation amount or cannot accurately calculate it, the exemption provisions in Article 8(1) of the Regulations shall not apply to their ordinary standard residential properties." This provision introduced a third type of property: other types of real estate. This marks the emergence of all three types of properties for the "three-way classification." However, the purpose of this provision was to prevent real estate companies from abusing preferential policies. To enjoy the benefits, ordinary standard residential properties and other types of real estate must be accounted for separately; otherwise, ordinary standard residential properties will not enjoy the benefits. Note that this policy still did not require separate clearing by types, but only stated that separate accounting is necessary to enjoy the benefits.

Subsequently, provisions for separate clearing by types appeared in land value-added tax policies. According to Article 1 of the "Circular of the State Administration of Taxation on Issues Related to the Management of Land Value-added Tax Clearance for Real Estate Development Enterprises" (Guo Shui Fa [2006] No. 187) and Article 17 of the "Circular of the State Administration of Taxation on Printing and Distributing the 'Management Procedures for Land Value-added Tax Clearance'" (Guo Shui Fa [2009] No. 91), different types of real estate should separately calculate the appreciation amount, appreciation rate, and pay land value-added tax. However, the attached "Land Value-added Tax Return" in Guo Shui Fa [2009] No. 91 still did not distinguish types (the income and deductions in the return had only one column, not two or three).

Finally, in the "Circular of the State Administration of Taxation on Printing and Distributing Related Forms and Documents for the 'National County-level Taxation Service Standards (1.0 Version)'" (Tax Zong Fa [2014] No. 109), the land value-added tax return appeared with three columns for ordinary residential properties, non-ordinary residential properties, and other types of real estate, requiring separate entries for various types of income, costs, etc. Later documents, such as Tax Zong Fa [2015] No. 114 and Announcement No. 9 of the State Administration of Taxation in 2021, continued with this format.

In summary, the higher-level law for land value-added tax does not require separate clearing based on different types, but subsequent policy regulations and tax return forms both mandate separate clearing. How should we view these subsequent policies?

ⅡAnalysis of the Policy on Categorized Settlement of Land Appreciation Tax

(I) Categorized Settlement Lacks Legal Basis and Contradicts the Provision of "Settlement Unit" in the Higher-level Law

The practice of categorized settlement within the same project essentially involves further segmentation of the original settlement unit, which further breaks down the settlement unit into ordinary residential properties, non-ordinary residential properties, and others. Is there a legal basis for the refinement of the settlement unit? According to Article 8 of the "Implementation Details": "Land appreciation tax shall be calculated based on the most basic accounting project or accounting object of the taxpayer's real estate cost accounting." In other words, the settlement unit is determined based on the taxpayer's accounting object. Clearly, the mandatory requirement for categorized settlement stipulated in the documents of Guo Shui Fa [2006] No. 187 and Guo Shui Fa [2009] No. 91 is inconsistent with the provisions regarding the settlement unit in the "Implementation Details."

**(II) Categorized Settlement's Refinement of Settlement Unit Is Unreasonable**

From the perspective of the evolution of the categorized settlement policy, while it seemingly satisfies the requirement of separate accounting for ordinary residential properties by having three types of properties accounted for separately in the tax return, this policy also brings another consequence: When the appreciation rates of different types of real estate vary significantly, under the progressive tax rate system, separately calculating the appreciation rate and taxable amount for each type of real estate increases the overall tax burden of the project. This is because, without distinguishing between types, the offset effect between properties with high and low appreciation reduces the overall appreciation rate of the project, resulting in a lower tax rate and ultimately reducing the overall tax burden. However, subsequent policies that require further segmentation of the settlement unit and separate settlement for each type of real estate eliminate the function of overall settlement in smoothing out the peaks and valleys, thus increasing the burden on taxpayers, which is obviously unreasonable for taxpayers.

**(III) The Purpose and Result of Categorized Settlement Diverge**

As analyzed above, categorized settlement further refines the settlement unit, resulting in the inability of different types of real estate to offset each other's appreciation. This is increasingly at odds with the purpose of categorized settlement. From the evolution of the policy, the purpose of categorized settlement is to prevent the abuse of tax exemption policies, ensuring that only qualified ordinary residential properties enjoy the benefits, thereby encouraging real estate developers to build and sell ordinary residential properties with high demand. Its purpose is not to narrow down the settlement unit and restrict the offset of appreciation among different types of real estate.

In addition, we believe that the separate accounting required to prevent the abuse of tax exemptions for ordinary residential properties should encourage real estate developers to accurately account for the costs of ordinary residential properties using direct costing methods, rather than the current practice in most places of having three separate columns for accounting for the three types of properties, and resorting to a simplistic calculation of cost allocation based on building area when costs cannot be separately identified. Currently, the purpose and result of the categorized settlement policy to prevent abuse of exemptions have deviated, and the policy should shift from focusing only on "form" rather than "substance" of separate accounting to paying attention to whether taxpayers have truly implemented separate accounting. At the same time, the categorized settlement policy should be abandoned, and no new "settlement units" should be added within the settlement unit.

In summary, categorized settlement is not stipulated in the "Interim Regulations on Land Appreciation Tax" and the "Implementation Details." The documentary basis for requiring categorized settlement in policy and on the tax return form is Guo Shui Fa [2006] No. 187 and Shui Zong Fa [2014] No. 109. From the perspective of implementation results, the "three-way segmentation" eliminates the function of overall settlement in smoothing out peaks and valleys, may increase the burden on taxpayers, and is inconsistent with its implementation purpose.

03

Can taxpayers waive the preferential policy for ordinary residential properties?

As is widely known, the preferential policy for ordinary residential properties under the land appreciation tax is merely one type of tax incentives in the overall tax preferential system. Similar incentives exist in other tax categories. So, can taxpayers freely dispose of these tax incentives?

I. Tax Reduction and Exemption Are the Rights of Taxpayers

First and foremost, Article 8 of the Tax Collection and Administration Law stipulates that "taxpayers shall have the right to apply for tax reduction, exemption, and refund in accordance with the law." Tax reduction and exemption are rights of taxpayers, and taxpayers can decide whether to waive them.

Secondly, Article 36 of the Detailed Rules for the Implementation of the Provisional Regulations on Value-Added Tax stipulates that "Where taxpayers selling goods or taxable services are entitled to exemption from tax, they may waive the exemption and pay value-added tax in accordance with the provisions of these Regulations. After waiving the exemption, they shall not apply for exemption again within 36 months." Similarly, Article 48 of Annex 1 to the Notice of the Ministry of Finance and the State Administration of Taxation on the Comprehensive Pilot Reform of Replacing Business Tax with Value-Added Tax (CS [2016] No. 36) stipulates that "Where taxpayers' taxable activities are subject to the provisions of tax exemption and reduction, they may waive the exemption and reduction and pay value-added tax in accordance with the provisions of these Measures. After waiving the exemption and reduction, they shall not apply for exemption or reduction again within 36 months." It is evident that taxpayers can waive the tax reduction and exemption specified in the value-added tax policies, and of course, they should bear the adverse consequences.

II. Regulations and Consequences of Waiving Tax Incentives in Other Tax Categories

Meanwhile, China's tax law system contains numerous tax incentives. Policies requiring separate accounting, similar to the preferential policy for ordinary residential properties, include: Article 3 of the Provisional Regulations on Value-Added Tax, which stipulates that "Taxpayers who concurrently engage in projects with different tax rates shall separately account for the sales revenue of projects with different tax rates; if the sales revenue is not separately accounted for, the higher tax rate shall apply." Article 102 of the Implementing Regulations of the Enterprise Income Tax Law stipulates that "Where an enterprise concurrently engages in projects that are subject to different enterprise income tax treatments, the income of the preferential projects shall be calculated separately, and the period expenses of the enterprise shall be reasonably apportioned; if not separately calculated, the enterprise shall not enjoy the enterprise income tax incentives." Article 4 of the Resource Tax Law stipulates that "Where taxpayers engage in mining or production of taxable products of different categories, they shall separately account for the sales revenue or sales quantity of taxable products of different categories; if they fail to separately account for or cannot accurately provide the sales revenue or sales quantity of taxable products of different categories, the higher tax rate shall apply." These policies, whether aimed at preventing the mixing of high-tax and low-tax projects or the confusion of taxable and tax-exempt projects, all require taxpayers to account for them separately. If they fail to do so, they shall not enjoy tax incentives.

In other words, taxpayers have the right to choose whether to waive tax incentives. If they choose not to account for them separately, i.e., waive the incentives, they must bear the consequences of applying the higher tax rate or paying the full tax. However, none of the aforementioned tax incentives require taxpayers to separately account for non-incentive items.

04

Is the result of giving up unified liquidation of all non-tax-free assets, or giving up tax exemption after separate liquidation?

Land value-added tax is a local tax, and policies related to land value-added tax are mostly local policy documents in addition to the national policies mentioned above, which also leads to inconsistent liquidation policies across regions. For example, provinces have different methods of classifying project types, such as Beijing and Guangdong, which use a "two-point method", while Tianjin and Guangxi use a "three-point method". In terms of the results of waiving the exemption for general residential housing, Article 6 of the Announcement of the Tianjin Local Taxation Bureau on Issuing the Measures for the Administration of Liquidation of Land Value-Added Tax in Tianjin (Tianjin Local Taxation Bureau Announcement No. 24, 2016) stipulates that "when a real estate development project includes both ordinary residential housing and non-ordinary residential housing or other types of real estate, the land value-added tax shall be liquidated separately". However, Article 53 of the Measures for the Administration of Liquidation of Land Value-Added Tax in Anhui Province (Announcement No. 21, 2018) stipulates that "when a taxpayer applies for exemption from land value-added tax for ordinary standard residential housing in a liquidation report, the value-added amount, value-added rate, and land value-added tax payable shall be calculated separately for the same development project or the same phased project that includes both ordinary standard residential housing and non-ordinary standard residential housing or other types of real estate. If the taxpayer requests exemption from land value-added tax for ordinary standard residential housing in the liquidation report, the value-added amount, value-added rate, and land value-added tax payable shall be calculated separately for the entire development project. If the taxpayer requests to waive the right to apply for exemption from land value-added tax for ordinary standard residential housing in the liquidation report, the value-added amount, value-added rate, and land value-added tax payable shall be calculated for the entire development project." That is, Tianjin policy requires taxpayers to liquidate separately regardless of whether they waive the exemption for general residential housing, while Anhui allows housing enterprises to liquidate uniformly for the entire project after waiving the exemption.

In the case, the tax authority in charge of company A believes that the taxpayer should calculate the supplementary tax for different types of real estate before waiving the tax exemption, according to Article 6 of the Tianjin Land Value-added Tax Liquidation Management Measures. The basis for this provision is Article 17 of the Notice of the State Administration of Taxation on Issuing the "Regulations on the Administration of Land Value-added Tax Liquidation" (Guo Shui Fa [2009] No. 91), which is in violation of higher-level laws and unreasonable, as discussed above. Therefore, the author believes that it is unreasonable for the tax authority to deny company A's practice on the grounds of violating local regulations and being unable to fill out the declaration system.

Conclusion

Starting from the controversy arising from real estate developers' decision to waive the preferential tax policy for ordinary residential properties during land appreciation tax settlement, this article analyzes how this issue relates to the segmented settlement policy based on property types. We then review the evolution and implementation results of the segmented settlement policy, and from the perspective of taxpayers' right to tax reduction and exemption as well as the application of preferential policies for other taxes, we argue that taxpayers may not necessarily need to separately account for properties if they choose not to enjoy the preferential policy. Furthermore, we cite examples from some provinces and cities that stipulate that if real estate developers choose to waive the tax exemption for ordinary residential properties during land appreciation tax settlement, they can conduct the settlement on an overall project basis. Finally, we draw the conclusion that the practices of the competent tax authorities in these cases are unreasonable. However, given that many provinces still adhere to this approach in practice, the debate on segmented settlement is unlikely to end today.

Based on the above analysis, it can be seen that the land appreciation tax policy is complex and has local characteristics. It is recommended that taxpayers familiarize themselves with local policies, plan ahead for important matters such as settlement units and allocation methods, actively communicate with tax authorities and argue for their legitimate rights and interests in case of disputes arising from subsequent settlement. If necessary, taxpayers may seek assistance from third-party professional institutions.