Heavy tax burden and low profit in the steel industry, the industry is facing many tax problems in its operation

In recent years, the heavy tax burden in the manufacturing industry has become a common problem faced by many enterprises, and the iron and steel industry, as an important basic industry of the national economy, is also similarly faced with a high tax burden pressure. Since April 1, 2019, the central government has opened a tax reduction initiative, and the value-added tax of the manufacturing industry has been reduced from 16% to 13%. So what is the current tax burden situation of China's steel industry? What tax-related problems do steel enterprises face in the development process? This article will analyze these issues.

In recent years, the international political and economic situation is complex and severe, and the downward pressure on the domestic economy has increased. The country continues to implement a proactive fiscal policy and prudent monetary policy, maintaining the general tone of seeking progress while maintaining stability. Counter-cyclical regulation has been adopted, and a series of "stable growth" policies have been introduced and are being implemented with increasing vigour. The fundamentals of the long-term economic improvement has not changed; promote consumption, tax cuts and fee reductions, "make up for short boards" and other policy effects gradually appeared, is conducive to stimulate demand and reduce costs. Steel industry continues to promote in-depth structural reform of the supply side, vigorously energy saving and emission reduction, the operation of the overall stability, but also facing a significant decline in efficiency, tax pressure and environmental protection pressure to increase the difficulties.

I. the iron and steel industry tax burden, low profits, restricting the healthy development of the industry

At present, China has a total of 18 taxes, according to the nature of the tax can be broadly divided into goods and services tax, income tax, property and behavioral taxes three categories, which involves the enterprise tax burden is mainly corporate income tax, value-added tax, consumption tax, surtax 4. The manufacturing industry is the "big taxpayer" in China, and the overall tax burden is on the high side. With the intensification of global competition in the manufacturing industry, reducing the tax burden of China's manufacturing industry has become a strategic means of competition and an important macro-control policy.

As one of the important components of the manufacturing industry, the iron and steel industry is subject to a VAT rate of 13%, which leads to a heavy VAT burden in the iron and steel industry due to insufficient front-end VAT credit vouchers and poor VAT rates. In terms of corporate income tax, the applicable corporate income tax rate for steel enterprises is generally 25%. Incomplete cost vouchers in the procurement process of raw materials have resulted in the corresponding costs not being properly deducted, which in turn has led to an increase in the corporate income tax burden. In terms of consumption tax, the tax rate varies greatly, mainly concentrated in the petroleum, tobacco and alcohol, automobile manufacturing and other industries. In addition to the above three major taxes, iron and steel enterprises are also required to pay urban construction tax, education surcharge and stamp duty, but the amount is relatively small.

The iron and steel industry is an important part of the national economy and one of the industries that pay the most taxes to the state. According to the data released by the National Bureau of Statistics, the added value of China's ferrous metal smelting and rolling processing industry in 2020 increased by 6.7% compared with the previous year.In 2020, China's crude steel production was 106,476,000 tons, an increase of 7.0% compared with the previous year; steel production was 132,489,000 tons, an increase of 10% compared with the previous year. It is worth noting that among the many steel enterprises, there is no lack of some enterprises with good efficiency and outstanding profitability, and the comprehensive tax burden rate of these enterprises reaches 13.14%. The iron and steel industry, as a pillar industry of the country, plays an important role in economic construction, social development, financial taxation, national defense construction as well as stabilizing employment, etc., and makes important contributions to guaranteeing the sound and fast development of the national economy. In the process of development, the problems of heavy tax burden and low profitability constrain the healthy development of the industry, so there is a necessity of worthwhile research and further reform in the issue of fair and reasonable tax burden.

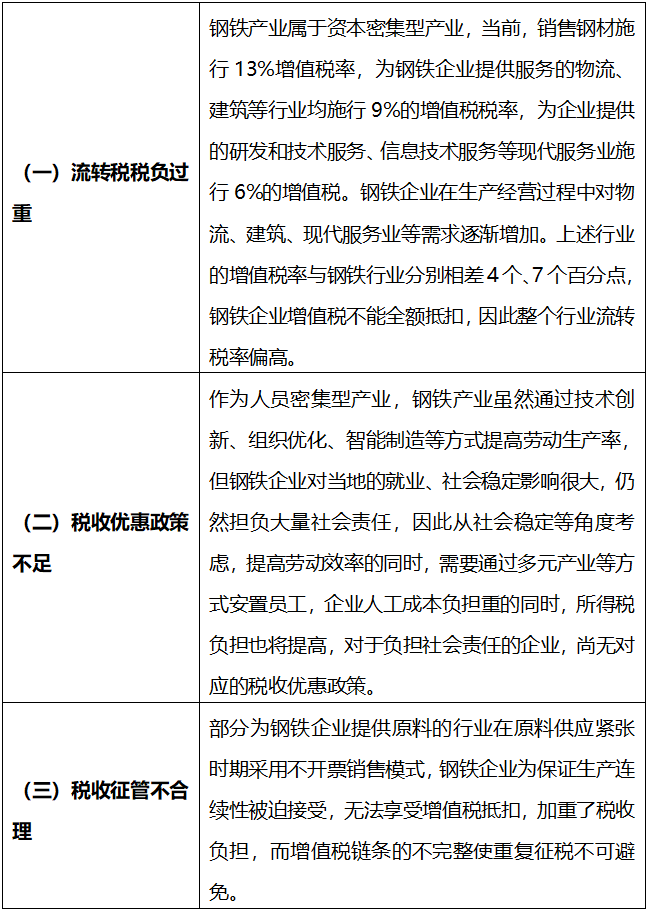

II. the main tax-related problems faced by the iron and steel industry

III. the steel industry faces two major tax-related risks

(I) Upstream trading enterprises false opening risk to the steel enterprise conduction

In practice, due to the large volume of ferrous scrap acquisition and the dispersed source of goods, in order to obtain compliant procurement cost vouchers, iron and steel enterprises in the procurement of scrap steel through the recycling enterprise: goods directly transported to the iron and steel enterprises by the retailer, through the "supply sheet", "weighing sheet" marked "supply unit for a certain recycling enterprise" to prove that the recycling enterprise and the production enterprise there is a real transaction of goods, and the recycling enterprise is not involved in the physical flow of goods. There is a real transaction of goods between the enterprise and the production enterprise, and the recycling enterprise is not involved in the physical flow of goods. At the payment level, when a retailer makes a delivery, the payment is usually settled instantly by the recycling company's on-site staff, and the producer settles the payment with the recycling company based on the total amount of goods delivered over a period of time. Under this model, steel enterprises can obtain 13% VAT invoices for input tax credits.

In practice, some recycling enterprises are unable to obtain compliant invoices for VAT input tax deduction, and can only "settle for the second best" by using purchase invoices and purchase vouchers as bookkeeping documents to calculate and pay enterprise income tax. At the same time, some recycling enterprises obtain special VAT invoices issued by upstream companies through business re-engineering in the course of business operation. Due to the fact that recycling enterprises advance and recover the payment for the goods through the associated personal accounts in this business model, there will be a "return of funds", coupled with the fact that the goods are transported to the iron and steel enterprises directly by the individual retailers, the recycling enterprises are neither involved in the transportation of goods nor the transportation of the goods, and the recycling enterprises do not participate in the transportation of goods. Enterprises are not involved in the transportation of goods, nor the variety of goods, the number of implementation of supervision, most of the case-handling authorities will be separated from the ticket or the return of funds to pursue the recovery of the criminal responsibility of the enterprise fraudulent invoicing, and in such cases, the iron and steel enterprises as the recipient of the invoice, it is very easy to be upstream recycling enterprises involved, thus facing a great criminal risk of fraudulent invoicing.

(II) Increased risk of tax adjustment for deduction before EIT

As can be seen from Article 2 of the Measures for the Administration of Pre-tax Deduction Vouchers for Enterprise Income Tax (State Administration of Taxation Announcement No. 28 of 2018), when calculating the taxable income for enterprise income tax, all types of vouchers proving that expenditures related to the obtaining of income and reasonable expenditures have actually occurred and are deducted before tax are pre-tax deduction vouchers, and the concept of "pre-tax deduction vouchers The concept of "pre-tax deduction voucher" indirectly clarifies that "invoice is not the only pre-tax deduction voucher". As can be seen from Article 8 of the Administrative Measures, pre-tax deduction vouchers can be categorized into internal vouchers and external vouchers according to their sources. The ninth, tenth and eleventh articles of the Administrative Measures have systematically sorted out what kind of vouchers issued by different objects can be used as pre-tax deduction vouchers. Needless to say, some internal vouchers and external vouchers can be used as pre-tax deduction vouchers under what circumstances.

The raw materials of steel enterprises are mostly iron ore, scrap iron, etc., and the purchase of coal as energy is also a major cost. In business practice, due to lax tax administration in some industries, coupled with some retailers, small mines selling raw materials there is no invoicing and sales problems, resulting in iron and steel enterprises in the purchase of the corresponding vouchers can not be used for pre-tax deduction of enterprise income tax.

According to China's tax law, under normal circumstances, iron and steel enterprises from the tax registration has been dealt with in the purchase of raw materials, should obtain invoices (including tax authorities on behalf of invoices) as a deduction; iron and steel enterprises from the hands of individuals who do not need to apply for tax registration of small sporadic business to acquire raw materials, tax authorities on behalf of invoices, acquisition vouchers and internal vouchers can be used as a basis for deduction, the "Management Measures" in the "Small Sporadic Operations". The "small sporadic business judgment standard is that individuals engaged in taxable items business sales do not exceed the starting point of value-added tax-related policies", to the current small and micro-enterprises monthly sales of no more than 100,000 yuan exempted from value-added tax as the standard calculation, then the steel enterprises from the hands of the retailer, the small mines to purchase raw materials can be self-issued The amount of acquisition vouchers shall not exceed 1.2 million/year. If the sales of the retailer exceeds the above requirement, the relevant expenses of the iron and steel enterprises shall still be deducted by invoices (including invoices issued by the tax authorities in accordance with the regulations) as pre-tax deduction vouchers. Such requirement is out of line with the actual procurement status of steel enterprises, especially for the higher unit price varieties such as scrap steel and scrap metal, where the annual sales volume of a single retailer is close to tens of millions or even tens of millions. In this regard, part of the tax authorities due to the inability to verify the authenticity of the purchase and sale transactions between the retailer and the steel enterprises and choose to "one size fits all" to stop on behalf of the opening, while the steel enterprises are subject to the limitations of the scale of operation of the seller can not obtain the full amount of the acquisition of certificates to account for the cost of the steel enterprises have to be forced to make their own acquisition of certificates or through the recycling of business enterprises for purchases to maintain the enterprise. Enterprises to purchase to maintain business operations, this situation makes the steel enterprises face a greater risk of tax adjustments.