Case analysis: accurate demarcation of tax fraud, smuggling and tax evasion according to the different causes of tax loss

Editor's Note: Tax evasion, smuggling and fraudulent export tax rebate behavior will cause the loss of national tax, but the constitutive elements of the three crimes are not consistent, resulting in the loss of national tax for different reasons. However, in judicial practice, these three crimes are often intertwined, difficult to distinguish, for example, the newly introduced “two high” “on the handling of criminal cases of endangering the tax collection and management of the interpretation of a number of issues in the application of the law,” the provisions of the “cycle of export” fraudulent tax behavior, at the same time Involving smuggling behavior. Does circular export behavior constitute tax fraud, and does import through smuggling after export necessarily constitute tax fraud? In this paper, we will analyze a typical case and try to return to the legal basis of tax fraud, identify the threshold and core of circular export tax fraud, and define the boundaries of tax fraud, smuggling, tax evasion and other series of behaviors.

I. Brief description of the case: smuggling back after goods are exported through customs clearance

(I) Introduction to the business model

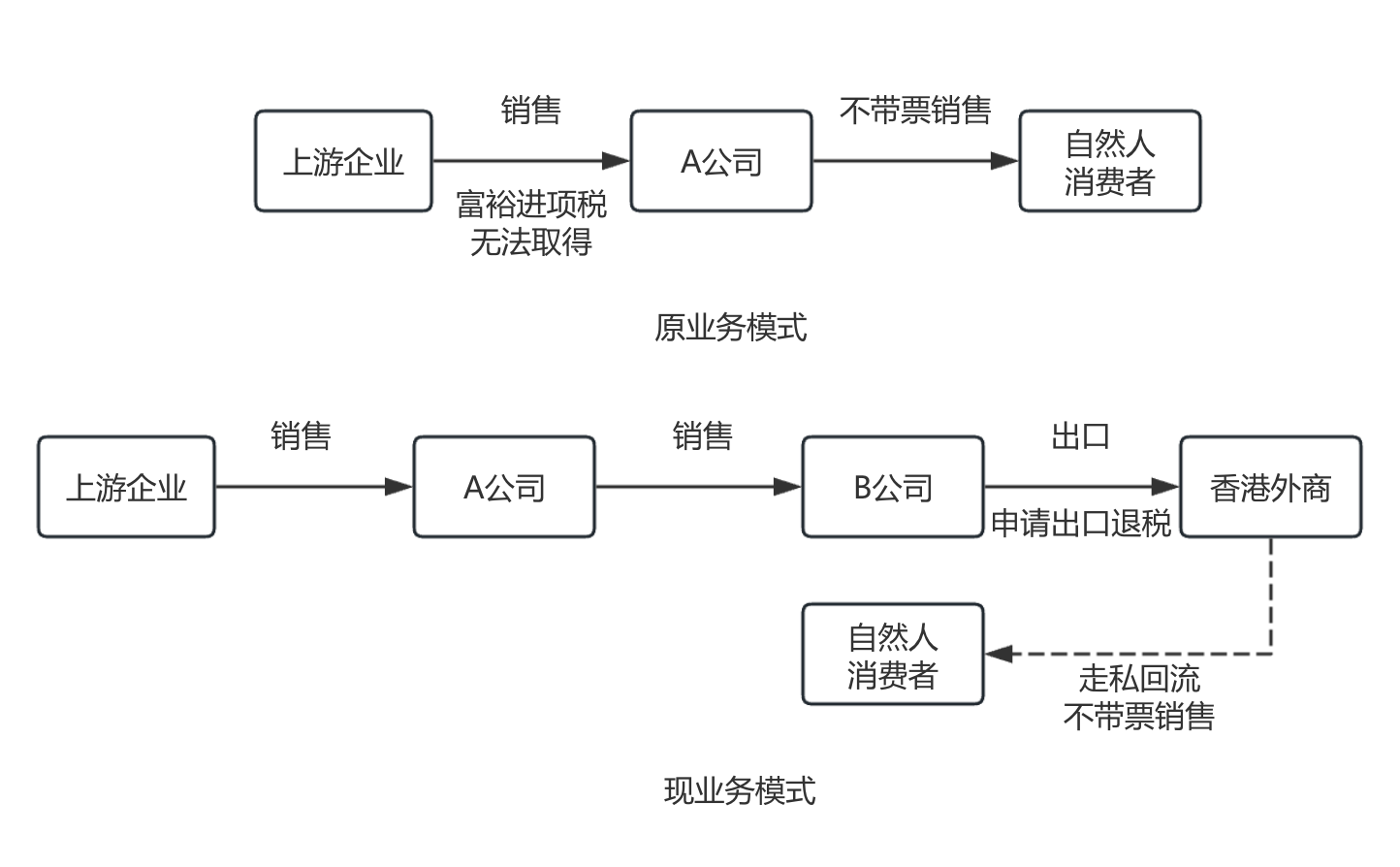

Company A is a cell phone sales enterprise, directly facing the majority of natural person consumers, there are a large number of non-invoiced income. According to the tax law, Company A should issue ordinary VAT invoices when selling cell phones to natural persons and collect VAT payments borne by natural persons for input deduction. If Company A hides its sales, it will have to bear the VAT input tax amount, while the huge amount of input credit will trigger the risk of tax audit.

In order to get its own input tax credit, Company A cooperated with Company B Import & Export and set up a false foreign merchant in Hong Kong, and then first exported the cell phone goods to Hong Kong through Company B, illegally obtained all kinds of export documents, and declared by Company B to obtain export tax rebate. Company A then returned the cellular phone goods from Hong Kong to the mainland territory through smuggling and sold them to the natural person consumers in the territory without tickets.

As can be seen from the comparison of the above business models, Company A's purpose was to sell to natural persons without invoices and still obtain input tax at its own burden. At the time when the business took place, China had not yet implemented the large-scale tax credit refund policy, so Company A adopted the above arrangement to capture the affluent input tax by obtaining the export tax refund.

(Ⅱ) Determination by the Judiciary

Based on the above business model and the subjective purpose of the person in charge of Company A, the judicial authorities considered that Company A constituted the crime of fraudulently obtaining export tax rebates. There are three core reasons: First, the person in charge of Company A confessed that he adopted the above arrangement in order to cheat the national export tax rebate; second, it was found that the Hong Kong foreign businessman was a fake enterprise, and the actual export settlement was completed through the underground money changers; and third, it was smuggled back to the mainland territory after exporting, which is in line with the characteristics of “circular export” to cheat export tax rebate.

(III) Raising of Problems

The “circular export” fraudulent export tax rebates is a common tax fraud, referring to the export of goods and then smuggled back to the flow, and then repeated exports, to a batch of goods to obtain multiple export tax rebates behavior. In the “Interpretation of the Supreme People's Court and the Supreme People's Procuratorate on Several Issues Concerning the Application of Law in Handling Criminal Cases of Endangering Tax Collection and Management” (Legal Interpretation [2024] No. 4, referred to as the “Two Higher Interpretations”), this means is stipulated as “after exporting the goods, transferring them back to the territory, or transferring the same kind of goods from abroad to the territory to circulate the import and export and to declare the export tax rebate “It is also clear that this behavior requires “repeated export”. Therefore, is it appropriate to qualify the above case as fraudulent export tax refund? How should the enterprises defend themselves in the face of similar situations? It is worth further thinking and research.

II. Jurisprudence analysis: Does the cited example constitute fraudulent export tax rebate?

(I) Company A and B exported the cellular phone to the false foreign merchant in Hong Kong,did not implement the tax fraudulent means.

First of all, company B apply for export tax rebates using invoices are not illegal invoices, and the domestic trade link has negative tax, company B as an import and export company, in its own name to declare exports, did not implement through false invoices, will not be negative tax goods into negative tax goods exported means of tax fraud. From the viewpoint of domestic trade, whether it is the purchase of goods by Company A, or the purchase and sale transactions between Company A and Company B are real, the invoices issued during the transaction are consistent with the transaction content, which belong to the legally compliant invoices, and the main bodies of the transaction chain are all paying the tax truthfully in accordance with the transaction price, and the declared exported goods belong to the goods which have been taxed negatively in the country, which not only do not take the means to cheat the tax but also meet the requirement of “tax rebate” for export. The essence of “real export of taxed goods” for tax refund should enjoy the rights and interests of export tax refund.

Secondly, Company A and B have forged export documents, such as foreign companies are shell companies and there are false foreign exchange, etc. However, there is no fictitious export documents in this business. However, there is no fictitious export facts in this business, on the contrary, the export of goods is real, and the declared information of exported goods is consistent with the actual exported goods, which are products enjoying the tax rebate policy, and therefore are not tax fraud. Although the Two Higher Explanations provide for the tax fraud means of “forged export documents”, the core of the means must be for “false export of goods”. In this case, although the perpetrator has fictitious foreign business and foreign exchange behavior, but only to make up the declaration of export tax rebates for the form of elements, it is not false information on the goods, declared the export of goods and the real export of goods elements are matched, and in line with the scope of export tax rebates of goods, and did not fictitious export of goods facts. In other words, if this batch of goods sold to overseas residents, can be based solely on the foreign business is a shell enterprise that business constitutes a tax fraud crime?

Thirdly, this case is not a circular export. The most controversial point in this case is whether it is in line with the “circular export” tax fraud, that is, Article 7 (6) of the “Two High Explanations”, which states that “after the goods are exported, they are transferred to the territory or the same kind of goods outside the territory are transferred to the territory for circulating import and export and declared for export tax rebate”. Before analyzing the case, it is necessary to discuss the jurisprudence that the behavior stipulated in this paragraph constitutes a crime. First of all, the core of determining whether the behavior constitutes the crime of tax fraud lies in whether the amount of tax-negative goods has been overstated, resulting in the amount of tax rebate is greater than the actual amount of tax paid. In the case of complying with the import and export declaration procedures, the simple circular export will not jeopardize the tax collection and management and will not cause the loss of national tax, regardless of the purpose of the circular export, which belongs to the autonomy of the taxpayers, and the public power should not be excessively involved. Therefore, although the Two Higher Explanations do not attach more behavioral elements and results in this paragraph, the judicial interpretation cannot break through the basic jurisprudence of the corresponding crime, and the crime still needs to comply with the threshold of the crime of tax fraud, therefore, in addition to meeting the behavioral elements of “circular export” stipulated in this article, at least there must also be an underreporting, non-reporting of import tariffs, import value-added tax or other behaviors that cause the loss of national tax, resulting in the amount of tax refund declared at the time of re-export declaration being greater than the actual negative tax amount, in order to comply with the constituent elements of the tax crime of tax fraud. Secondly, it is also necessary to consider how the tax losses caused by under-reporting or non-reporting of customs duties and import VAT can be realized. In terms of the law, the import and export cycle must be realized, i.e., the export is reimported and then declared for export in order to constitute the crime of tax fraud in the cycle export mode; in other words, the result of the tax loss is only realized through the declaration of the export tax rebate again, so that the tax loss is realized through the way of the tax refund, which is the crime of obtaining the tax rebate by cheating the export tax rebate. In this case, although Company A had illegal acts such as importing goods without customs declaration, its purpose was to sell the goods without invoices and it did not declare export again, and the tax loss caused in the illegal importation was not realized in the form of tax rebate, therefore, it did not constitute the tax cheating of circular export type.

In conclusion, Company A and B exported the cellular phone to Hong Kong, and the export link as a whole, although flawed, did not implement the means of tax fraud and did not cause the loss of tax refund in the form of tax refund.

(Ⅱ) The cell phone export link does not cause the loss of the export tax refund, and does not have the result of tax fraud

The result of tax loss in the crime of fraudulent export tax rebate must be realized through the way of tax refund, therefore, judging whether it constitutes the crime of fraudulent export tax rebate only needs to observe the facts associated with tax refund in this case. As mentioned above, the essence of export tax refund is to refund the value-added tax borne by the goods in the territory, therefore, as long as the exported goods belong to the goods which have already been negatively taxed, there is no loss of tax in export tax refund, and it does not have the result of tax fraud. From the above analysis, we can see that, whether it is A, B's domestic trade links or B declared export links, the parties in the trade chain are truthfully negative tax, and the declared information on goods is consistent with the real information on goods, which satisfies the substantive conditions for tax refund of “the real export of taxed goods”, and the refund of paid taxes does not result in loss of the national export tax rebate, and does not have the result of tax fraud. There is no result of tax fraud.

(III) The loss of tax occurred in the link of smuggling back of cellular phone, which is the evasion of import tariff and value-added tax.

According to Article 53 of the Customs Law of the People's Republic of China, “Customs shall collect customs duties on goods authorized to be imported or exported and on articles entering or leaving the country in accordance with the law.” According to Article 1 of the Provisional Regulations of the People's Republic of China on Value-added Tax (VAT), “Units and individuals selling goods or processing, repairing and fitting services (hereinafter referred to as services), selling services, intangible assets, immovable property, and importing goods within the territory of the People's Republic of China are taxpayers of value-added tax (VAT), and shall pay VAT in accordance with these Regulations. ” Therefore, imported goods are subject to customs duties and import VAT. Although there was no loss of export tax rebates due to the illegally imported goods did not apply for tax rebates again, the failure to pay customs duties and VAT at the import stage violated the above regulations, and the loss of tax occurred at the cell phone smuggling stage, which was actually the loss of import customs duties and VAT.

(Ⅳ) Summary: the case should constitute the crime of smuggling of ordinary goods in essence

In summary, the perpetrator of this case, despite the behavior of fictitious foreign merchants and foreign exchange, did not tamper with the goods, the declaration information is true, the goods are really exported and actually negative tax, to meet the substantive conditions of fraudulent export tax rebates, did not cause the loss of refund of export rebates, and should not constitute the crime of fraudulent export tax refunds. According to the above analysis, the actual loss of tax occurred in the import link, i.e., through smuggling without customs declaration to avoid payment of import tariff and value-added tax, jeopardizing the national order of import and export management of goods and the tax in the import link, which should constitute the crime of smuggling of ordinary goods.

Ⅲ. clarify the links of tax loss in import and export business, and accurately distinguish this crime from other crimes

Through the above case analysis, it is not difficult to see that, although smuggling, fraudulent export tax rebates will cause the loss of national tax, but the perpetrator of the tax benefit infringement of the means, the way is different, the loss of tax benefits occur in different links. Accordingly, this paper summarizes the three types of situations in which the loss of national tax occurs in the export link:

(Ⅰ) goods have been burdened with taxes, cheating the tax they have paid should be recognized as tax evasion

The difference between the crime of cheating export tax rebates and tax evasion lies in the different nature of the tax loss caused. According to the second paragraph of Article 204 of the Criminal Law, “If a taxpayer, after paying tax, adopts the deception method stipulated in the preceding paragraph to cheat the tax paid, he shall be convicted and punished in accordance with the provisions of Article 210 of this Law; if the tax cheated exceeds the part of tax paid, he shall be punished in accordance with the provisions of the preceding paragraph.” Can again confirm the previous thesis about the crime of fraudulent export tax rebates, fraudulent export tax rebates are not actually burdened with the tax, resulting in tax refunds higher than the actual burden of the tax, and fraudulent payment of their own tax should belong to the category of tax evasion.

(Ⅱ) The goods are normally exported and then returned through smuggling, and the tax loss occurs in the smuggling link, which should be dealt with according to the smuggling crime

The key to the breakthrough of this case lies in the correct definition of the tax loss occurred in the link. Fraudulent export tax rebate crime harm to the legal interests of the state export tax rebates, the tax loss is bound to be generated through the tax rebate link. For example, criminals do not report imported goods or false invoicing in the domestic trade, etc., need to declare export tax rebates again, resulting in the loss of export tax refunds, before constituting a circular export category of tax fraud. If the goods are normally exported and then returned to the country through smuggling, the tax loss occurs in the import link, and the tax loss is essentially the import tariff and value-added tax, which should be dealt with in accordance with the smuggling crime.

(Ⅲ) The goods are not taxed and the enterprise is not burdened with input tax before fraudulently obtaining export tax rebate constitutes the crime of fraudulently obtaining export tax rebate

As mentioned above, the essence of export tax rebate is to refund the real export goods in the domestic VAT, consumption tax and other turnover taxes, and the core of the crime of fraudulent export tax rebate is to make the goods not taxed or less taxed by illegal means such as false opening, resulting in obtaining the amount of export tax rebate is higher than the amount of the actual tax, resulting in the loss of national tax. Therefore, whether the goods are tax-paid or not is the key to judging the crime or non-crime. Goods in the case of not tax-paid, the enterprise in the case of not burdened input tax fraud export tax rebates, constitute the crime of fraudulent export tax refunds.

With the increasing efforts of the state to combat export tax fraud, a large number of cases of fraudulent export tax rebates have erupted around the world. The author observes that some courts have deviated from the understanding of the basis of adjudication, confusing the boundaries between the crime of tax cheating and smuggling-type crimes, false opening-type crimes, and tax evasion, which is not conducive to safeguarding the rights and interests of taxpayers and realizing the fair application of the criminal law. Enterprises should ensure the authenticity of transactions in their daily operation, truthfully declare and pay taxes, and bear tax liabilities. When facing tax fraud challenges from tax authorities, they should actively hire tax lawyers to defend themselves, and use the power of professionals to safeguard the fair application of the law and strive for the optimal results.