How can enterprises cope with the tax-related risks when they are required to return the financial incentives and file a criminal case for false opening?

Editor's Note: As goods or services are mostly provided by a large number of individuals, there is a widespread shortage of source invoices for flexible labor, platforms such as network freight transport, and enterprises in the bulk commerce industry such as resources recycling industry, many local governments have given various industrial support funds and financial incentives in order to support the development of these industries, which in turn reduces the tax costs that are fully borne by enterprises due to the impossibility of obtaining invoices, and maintains the enterprises and the industries Continuous operation. This year, the audit, tax, development and reform commission and other departments issued a letter requiring strict investigation of illegal tax rebates, especially with the August 1 “fair competition review regulations” landing, around the financial incentives to clean up the policy and tighten the supervision, there have been many enterprises were required to return the financial incentives, and even local judicial authorities that enterprises will be the financial incentives as a false open profit-making tool, the enterprise purchase and sale of business to the crime of false open for investigation! The relevant enterprises, persons in charge, financial and business personnel are facing serious criminal liability risks. In this context, the relevant enterprises, personnel should be how to prevent tax-related administrative and criminal risks, this article will be further analyzed.

I. A number of places require enterprises to return financial awards and subsidies and to open a criminal case, the relevant enterprises and personnel legal risk is huge

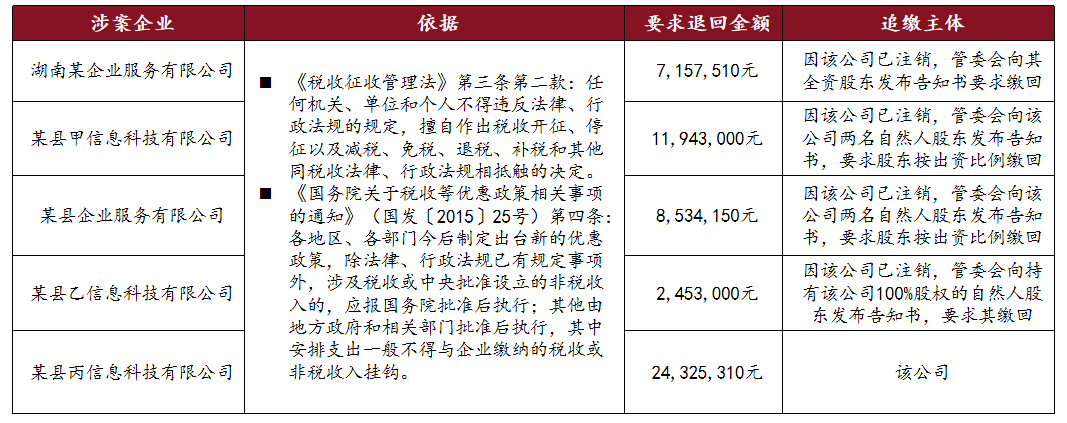

This year, according to public information, there have been Jiangsu, Hunan, Shandong and other places to require enterprises to return financial awards, financial incentives or industrial support funds, requiring enterprises to return for different reasons, part of the “to standardize the behavior of financial revenue and expenditure”, part of the local government did not enter into a tax reduction, exemption and refund policy authority, the arrangement of its expenditures shall not be linked to the tax revenue of enterprises. Some of the instruments do not even state the reason or basis, but only require the enterprises to return the funds within a specified period. As some enterprises have been written off, the local government directly informs the shareholders and requires them to pay back the financial incentives in proportion to their capital contribution, and the relevant shareholders face a huge financial burden.

After searching the official website of the local tax bureau, it was found that a number of enterprises were required to return the fiscal award subsidies before the local inspection bureau had announced to the enterprises to deliver the Notice of Tax Inspection to check their tax-related situation, what's more, some enterprises and their responsible persons have been criminally prosecuted for the crime of allegedly falsely issuing VAT invoices, and due to the huge business volume of the enterprises of the bulk trade category or the platform category, if the crime of falsely issuing special invoices is established, the related If the charge of false invoicing is established, the relevant person in charge will face a sentence of more than ten years to life imprisonment.

As far as the current cases requesting the return of fiscal rewards are concerned, the enterprises involved are mostly platform-type enterprises such as human resources, network freight transport, etc. or bulk commerce and trade enterprises such as resources recycling industry, etc. As mentioned above, due to the shortage of invoices at source, the business model of these industries generally relies on the fiscal reimbursement and fiscal reimbursement to alleviate the pressure of paying full taxes. However, in the context of the current clean-up of irregular tax rebates, some places have filed criminal cases for false invoicing in order to recover the fiscal rebates, and some judicial authorities have fallen into the prejudice that false VAT invoicing exists if there is a fiscal rebate, and believe that the enterprises have used the fiscal rebates as the capital to make profits by falsely issuing VAT invoices externally, and they have taken coercive measures against the personnel of the enterprises involved in the cases and have frozen and seized the properties of the enterprises, which have led to the stagnation of the operation of the enterprises. We believe that whether the business of the enterprise constitutes false opening and whether it can enjoy financial refund should be viewed separately, if the business of the enterprise is real and the business process is compliant, then it should not be characterized as false opening, and then talk about the legitimacy of the financial refund policy, if the financial refund policy violates the laws and regulations, the local government requires the enterprise to pay it back with a certain legal basis; if the enterprise enters into a cooperation agreement with the local government or the minutes of the government meeting, documents and so on are in compliance with the regulations, then the enterprise will be required to pay back the financial refund policy. If the cooperation agreement or government meeting minutes, documents, etc. concluded between the enterprise and the local government are in line with the regulations, the enterprise should obtain the agreed financial return, and the local government has no right to ask the enterprise to return.

II. The business model relying on financial refund shall not be recognized as false opening, and the recognition of false opening shall return to the real business

The determination of the crime of false VAT invoicing is premised on the judgment of the existence of real business. For enterprises relying on financial rebates, the invoices issued to the downstream should not be generalized as false VAT invoices, but should be based on facts and evidence to clarify the transaction mode and verify the authenticity of the goods or services, and then respond to the subjective and objective constituent elements of false invoicing.

Taking flexible labor platform as an example, the current business model of flexible labor platform is mainly for the flexible laborers to register as labor and service providers on the platform and provide labor and services for the labor enterprises on the platform, and the platform enterprises issue invoices in their own names for the labor enterprises and rely on the financial incentives given by the local government to alleviate the problem of their own lack of inputs. In practice, flexible labor platforms are often challenged by the authenticity of their business, leading to the risk of false invoicing. For example, some labor-using enterprises accept the labor services provided by individuals, but because there is no invoice in the accounts, in order to reduce the tax burden at a later stage through the platform to create a new business chain to obtain invoices; some individuals, based on the consideration of lowering the personal tax, through the platform of flexible labor use to transform wages and salaries into “operating income” and enjoy the approved levy policy, and the platform of flexible labor use to issue invoices for the labor-using enterprises. The flexible labor platform issues invoices for the labor-using enterprises. In practice, some judicial organs recognize this as false invoicing “without real business”. However, we are of the view that if an individual provides real labor services to a labor-using enterprise after establishing a labor relationship with the flexible labor platform, it is not improper for the flexible labor platform to issue invoices to the labor-using enterprise. As to the question of whether there is false invoicing, the judicial authorities should focus on verifying whether the individual has truly provided services to the employer, rather than determining across-the-board that the flexible labor platform is false invoicing under the “no real labor service” rule. In addition, due to the flexible labor platform downstream of the invoiced party many enterprises, if one of the suspected false invoicing implicated in the flexible labor platform, the judicial authorities should not expand the platform all business recognized false invoicing, but should return to the authenticity of the business, one by one to verify the existence of real business for the real business is not characterized as false invoicing.

Another example is the resources recycling industry, most of the recycling enterprises are set up in areas with financial rebates, and because of the characteristics of the industry, such as “long business chain, a pound list to the end, not involved in the transportation of goods”, many recycling enterprises are questioned to be not real goods transactions, and the purpose of their participation in the transaction is to falsely issue VAT invoices to the downstream, and the financial rebates are the reason why the recycling enterprises falsely issue VAT invoices, and the financial rebates are the reason why the recycling enterprises falsely issue VAT invoices. The purpose of their participation in the transaction is to issue VAT special invoices to the downstream, and the financial return is the “capital” of the recycling enterprises' false invoicing, plus the fact that in the criminal cases, the actual confessor's deviation from the business model and the statement that he did not know about the existence of the recycling link have become the important evidences for the case-handling authorities to characterize the false invoicing of the recycling enterprises. We believe that the recycling enterprise whether there are real goods transactions should be considered in conjunction with the trade pattern of bulk commodities, with instructions for delivery and other concepts of delivery for the transfer of the right to goods in accordance with the provisions of the civil law, but also in line with the needs of rational economic man. Therefore, in judging the authenticity of the purchase and sale of waste materials transactions this key issue, should not only one-sided examination of the recycling enterprise is personally involved in the delivery of goods and other issues, but should restore the complete transaction chain, trace the source of the transaction whether the actual supplier to the waste enterprise transfer of possession of the goods, if the whole transaction chain on the source of the supplier and the end of the waste enterprise supply and receipt of goods failed to find out, then it can not be directly “If the source supplier and the end-use enterprise fail to check the supply and receipt of goods in the whole transaction chain, then it cannot directly deny the authenticity of the purchase and sale transactions of the goods in the intermediate recycling link in a broad-brush manner, and then determine that the recycling enterprise has no real transactions under the false opening.

Similarly, in the purchase and sale transactions in the coal industry, there are also trading enterprises from small coal mine purchases can not obtain invoices and apply the local financial rebates to reduce the cost of the tax burden of the purchase and sale of the business, the trade chain for the “small coal mine - trading company 1 - trading company 2 - coal The trade chain is “small coal mine-trading company 1-trading company 2-coal-using enterprise”, under which the trading company also faces the problem of business authenticity being questioned. As mentioned above, for this kind of bulk commodity trading, the judicial authorities should consider the industry's specificity and operation practice, investigate the situation of supplying at the source and receiving at the end, restore the transfer of goods in the whole business chain, and avoid one-sidedly denying the authenticity and reasonableness of the intermediate trade links.

III. Based on the real business to obtain financial rebates, financial incentives should not require enterprises to return across the board

As mentioned above, the enterprise based on real transactions external invoicing, income, there is no false open problem, if the agreement with the government to meet the agreed conditions of the award, the government should fulfill the agreement, to give the enterprise financial incentives.

For the legitimacy of the financial subsidy policy, there is no relevant regulations to clarify what is “illegal”, “Fair Competition Review Regulations” provides that there is no law, administrative regulations or without the approval of the State Council, the financial subsidy policy shall not include the content of the impact of the production and operation costs, including, but not limited to, giving specific operators tax incentives The Regulations on Fair Competition Review stipulate that without the basis of laws and regulations or without the approval of the State Council, the fiscal incentive policy shall not contain contents that affect the production and operation costs, including but not limited to granting tax incentives to specific operators, and the implementation of selective and differentiated fiscal incentives or subsidies. We believe that the judgment of the legitimacy of the financial return policy should return to the nature of the financial return, and tax revenue linked to the financial return policy because of the violation of the “Tax Collection and Management Law” and other provisions, there is a greater risk of application, and for other financial incentives and subsidies and other policies, such incentives and subsidies belong to the financial expenditure, subject to the constraints of the “Budget Law”, China's “Budget Law” only stipulates that the local expenditures should be balanced with the revenues, and the local budget does not include deficits, and the local budget does not include deficits. The local budget does not include deficits, and the final approval of the local budget belongs to the National People's Congress at the same level. Therefore, the localities enjoy the autonomy to control the expenditures of their own finances, and such autonomy of expenditures will be limited only when the laws and administrative regulations have established the mandatory expenditures responsibilities for the localities. The Supreme People's Court also held this type of view in the retrial ruling ((2017) Supreme Law Xing Shen 7679) in the case of Weifang Xunchi Real Estate Development Co. v. Anqiu Municipal People's Government Administrative Agreement, “The issue of the local retention of business tax and income tax to be returned after Xunchi's payment of the above expenses belongs to the local government's fiscal revenue, and Anqiu Municipal Government enjoys the autonomy to Discretionary power, on the basis of the contract terms and does not violate the mandatory provisions of the laws and administrative regulations, should also be valid agreement”.

Therefore, the local government of the tax revenue attributable to the local retention of the part of the local government enjoys the right of independent disposal, by the local budget expenditure or adjustment procedures of the expenditure procedures are legal. Such as the budget approval, the local government to support the eligible enterprises, the issuance of financial incentives, if the issuance of these incentives is not linked to the amount of taxes actually paid by the enterprise, it is not a violation of the relevant provisions, the local government does not have the right to require the enterprise to return.

Summary

Under the background of the current strict investigation of local investment promotion irregularities related to tax issues, relying on the financial rebate operation of the enterprise there is a greater risk of tax-related issues, based on the financial rebate to carry out business outside the invoice business model there is the possibility of recovery of financial returns or even the characterization of the false openings. Having real business is the basis for issuing invoices and the prerequisite for obtaining financial rebates. We suggest that relevant enterprises should actively seek professional support and legal remedies when facing the risk of requesting the return of financial rewards and subsidies, administrative and criminal cases of false invoicing, and respond to the challenge of false VAT invoicing from the root of the substance of the transaction and the specificity of the industry, so as to minimize the risk of their own economic losses and criminal liabilities.