Should Foreign Partners Pay Tax on Business Income or Enjoy Tax Treaty Treatment when a Domestic Partnership Distributes Profits?

Editor's Note: China's partnership tax payment method is "share first and tax later", therefore, when the investment and financing platform type partnership obtains profits by transferring equity and other capital operation methods and distributes them to individual partners, if the individual partners who obtain the profits are tax residents of China, they are usually required to pay an individual income tax at a rate ranging from 5% to 35% of the operating income. Individual Income Tax. If the individual partner is a non-resident outside China, it is controversial in practice as to whether he/she should be taxed as a resident individual or whether he/she should be subject to preferential treatment or preferential tax rate under a tax treaty. This article briefly analyses this difficult practical issue and puts forward tax-saving compliance suggestions.

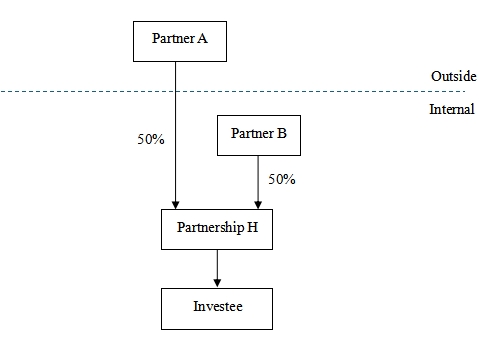

Case introduction:

Partner A, a non-resident individual partner, and Partner B, a resident individual partner, jointly set up a partnership H (a non-venture capital partnership) in China, and Partnership H makes foreign investments. For commercial reasons, Partnership H transfers its equity interest in the investee (in China) and receives an income of RMB 10 million, how should Partner A pay the tax?

I. How should Partner A pay tax if tax treaty treatment does not apply?

(i) Tax liability of Partner A

According to China's Individual Income Tax Law, non-resident individuals shall pay individual income tax on income derived from within China, and non-resident individual partner A shall be liable to pay tax on such income in China. However, China has not made any special provisions on the income of non-resident individual partners from partnership enterprises, therefore, without taking into account the treatment of the tax treaty, the tax paid by non-resident individual partner A on the income is calculated in the same way as that paid by resident individual partner B.

(ii) Nature of Partner A's income

In 2000, the Ministry of Finance and the State Administration of Taxation ("SAT") issued the "Provisions on Individual Income Tax for Investors in Wholly-owned Individual Enterprises and Partnership Enterprises" (Cai Shui [2000] No. 91), which clarified that the balance of income less costs, expenses and losses for each taxable year of a partnership shall be regarded as the investor's income tax. Provisions on Individual Income Tax for Investors of Wholly Individual-owned Enterprises and Partnership Enterprises (Cai Shui [2000] No. 91), which clarified that the balance of the income of a partnership enterprise in each taxable year after deducting the costs, expenses and losses is treated as the income from production and operation of the investor as an individual investor, and is subject to the individual income tax according to the excessively progressive tax rate of 5%-35%, of which the income refers to all income obtained by the enterprise from the engagement in the production and operation as well as the activities related to the production and operation. In 2001, the State Administration of Taxation (SAT) issued the Notice on the Implementation Calibre of the Provisions on Individual Income Tax for Investors of Sole Proprietorships and Partnerships (Guo Shui Han [ 2001] No. 84), which specifies that partnership income shall be subject to individual income tax at a rate of 5%-35%, and the balance of the income shall be treated as the investor's personal production and operation income. 2001] No. 84) made it clear that the dividend and bonus income repatriated by a partnership enterprise from its foreign investment is not included in its production and operation income, but is directly included in the dividend and bonus income of the individual partners, and is taxed at a rate of 20 per cent.

However, when a partnership transfers its equity interest in an investment enterprise, there are differences in the implementation calibre of the individual partners among regions: one believes that the nature of the income obtained by the partners is the same as that obtained by the partnership, and that the transfer of equity interest by the partnership belongs to the act of transfer of property, and the income obtained by the individual partners should be taxed in accordance with the "Income from Transfer of Property". "One believes that the nature of the income obtained by partners is the same as the income obtained by the partnership, and the transfer of equity by the partnership is an act of property transfer, so the income obtained by individual partners should be taxed according to the "income from property transfer", and the individual income tax rate of 20% should be applied. With respect to the difference in implementation calibre, the Inspection Bureau of the State Administration of Taxation issued the "Guidance Opinions on the Inspection of Equity Transfer for the Year 2018" (Taxation General Inspection Letter [2018] No. 88) in 2018, which makes it clear that the income from the transfer of shares by a partnership shall be determined in accordance with the partnership's entire production and operation income and the distribution ratio agreed in the partnership agreement to determine the partnership investor's taxable income, and shall be taxed in accordance with the "Individual Businessman Production Operation Income", cf. "Income from production and operation of individual industrial and commercial households" is taxable. Although the above opinion targets the situation of "transfer of stocks by partnership enterprise", stocks and equity shares are similar, both belong to foreign investment and have property attributes, and in practice, the tax authorities may require the taxpayers to pay tax according to the "income from production and business operation" applying the 5-35% tax rate. tax rate.

In this case, according to the second viewpoint, the distribution of partnership H to the individual partner should be included in the production and operation income of the individual partner, and the non-resident individual partner A needs to be taxed at a rate of 5-35 per cent. Since the 35% tax rate applies to business income exceeding 500,000 RMB, in practice, the distribution made by individual partners of equity transfer usually far exceeds 500,000 RMB, so the individual partners are often taxed at the 35% tax rate.

II. How should Partner A pay tax if tax treaty treatment applies?

(i) Does Partner A qualify for tax treaty treatment?

In 2018, the State Administration of Taxation ("SAT") issued the Announcement of the State Administration of Taxation on Several Issues Concerning the Implementation of Tax Treaties (SAT Announcement No. 11 of 2018), which clarifies that if a partner of a partnership enterprise established in the territory is a resident of one of the parties to the tax treaty, the income for which he/she is liable to pay tax in China is entitled to enjoy the treatment under the treaty. The subjective qualifications of a partner to enjoy tax treaty treatment need to satisfy: 1) its resident country has entered into a tax treaty with China; and 2) it has obtained the income for which it has tax liabilities in China.

In this case, Partner A receives income from the distribution of Partnership H after the transfer of its equity interest, which satisfies the second condition, and should also satisfy the condition that its resident country has entered into a tax treaty with China. After fulfilling the above two conditions, Partner A has the subjective qualification to enjoy the tax treaty treatment. It should be noted that the subjective qualification only indicates that the "admission ticket" has been obtained, which does not mean that the income of Partner A can definitely enjoy the preferential treatment in the tax treaty, and the nature of the income needs to be confirmed.

(ii) Nature of Partner A's income

Since the taxation of non-resident partners involves the issue of taxing rights of both domestic and foreign parties, and the tax treaty provides for dividends, interest, property gains, business profits, etc., but not "business income", what kind of income is the distribution received by Partner A and how it should be taxed still needs to be further explored. Taking the tax agreement signed between China and Singapore as an example, the Agreement between the Government of the People's Republic of China and the Government of the Republic of Singapore for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income (hereinafter referred to as the "Sino-Singaporean Tax Agreement") and the Interpretation of the State Administration of Taxation (hereinafter referred to as the "Interpretation") specifically provide that real estate income shall be subject to the following provisions The Agreement (the "Agreement") and the SAT's Interpretation of the Agreement (the "Interpretation") specify that income from immovable property, business profits, shipping and air transport, affiliates, dividends, interest, royalties, property gains, independent personal services, independent personal services, director's fees, artists and sportspersons, superannuation, government services, students and trainees, as well as other incomes (amongst others, income from immovable property, shipping and air transport, affiliates, interest, royalties, directors' fees, artists and athletes, pensions, government service, students and interns are not relevant to the scenario discussed in this case and are therefore not addressed). From the definitions:

1. Business profits: profits arising from the business activities of an enterprise of one Contracting State in the other Contracting State.

2. Dividends: Distributions of profits made by a company (a company is any body corporate or an entity treated as such for tax purposes). Dividend payments include not only distributions of profits decided at the annual shareholders' meeting, but also other distributions of earnings in money or with a monetary value, such as bonus shares, dividends, liquidation proceeds, and disguised distributions of profits. Dividends also include interest adjusted to dividends by the Contracting States in accordance with the provisions on the prevention of weakening of capital.

3. Proceeds of property: generally, proceeds arising from changes in the legal tenure of property, including proceeds arising from the sale or exchange of property, but also proceeds arising from partial transfers, expropriations, sale of rights and so on.

4. Independent personal services: income derived by an individual resident in one of the Contracting Parties as a result of professional services or other independent activities. The term "professional services" includes, inter alia, independent scientific, literary, artistic, educational or teaching activities, as well as the independent activities of physicians, lawyers, engineers, architects, dentists and accountants. Individuals claiming the provisions of the independent personal services clause of a tax treaty shall be judged to be independent on the basis of the following conditions: (1) proof of occupation, including a registration document and a document proving his identity or a statement of his current occupation in a certificate of residence issued by the tax authorities of the Contracting State of which he is a resident; (2) a labour contract with the company concerned indicating that his relationship with the company is a labour service relationship and not a labour service relationship. (b) The labour contract with the company in question indicates that the relationship with the company is a labour service relationship and not an employer-employee relationship.

5. Non-independent personal labour: salaries, wages and other similar remuneration received by a resident of one of the Contracting Parties in respect of employment.

If Partner A is a resident of Singapore, for 1, Partner A is an individual partner rather than an offshore enterprise, so the relevant provisions on business profits do not apply; for 4 and 5, independent personal labour emphasises the labour service relationship between an individual and a company, and non-independent personal labour emphasises the employment relationship, whereas Partner A is in an investor/investee relationship with the enterprise, so the relevant provisions on independent personal labour and non-independent personal labour also do not apply. The relevant provisions of independent personal labour and non-independent personal labour are therefore not applicable. However, there are two views as to whether the income obtained by Partner A is subject to the provisions on property gains or dividend income. One view is that the income obtained by Partner A belongs to property gain, reasoning that: general partnership is a platform for partners to hold shares, and the transfer of property by partnership is essentially a transfer of property by partners, and the nature of the income obtained by Partner A should be consistent with the nature of the income obtained by the partnership. Another viewpoint is that the nature of the income obtained by Partner A belongs to dividend income under the tax treaty, on the grounds that the transfer of equity by the partnership is the production and operation of the partnership itself, and the partners obtain the distribution of the profits of the partnership after deducting the production costs, expenses and losses.

The author argues that Partner A can apply the dividend income provisions. The distribution of profits of the partnership has not been excluded from the provisions relating to dividends. The definition of dividend in our foreign tax treaties is generally expressed as income derived from shares or rights to share profits in a non-credit relationship, as well as income derived from other corporate rights that are taxed as if they were income from shares under the laws of the contracting state in which the company distributing the profits is a resident. The above definition does not exclude the distribution of profits of a partnership from the definition of dividend. For the purposes of the Sino-Singaporean tax treaty, a partnership is an entity treated as a body corporate for tax purposes because, except for the fact that it is not subject to corporate income tax as a general body corporate, a partnership is treated the same as a corporation for all other tax purposes. Therefore, it is more reasonable to apply the dividend provision to Partner A's income from Partnership H.

If dividend income applies, according to Article 10 of the Sino-Singapore Tax Treaty, if the beneficial owner of the dividend is a resident of the other Contracting State, the tax levied: (i) shall not exceed five per cent of the total amount of the dividend where the beneficial owner is a company (other than a partnership) that directly owns at least twenty-five per cent of the capital of the company paying the dividend; (ii) shall not exceed, in any other case, ten per cent of the total amount of the dividend. ten per cent. In this case, since Partner A is an individual partner, he falls into the "other cases" category and is able to obtain the tax treaty treatment of being taxed at no more than 10 per cent.

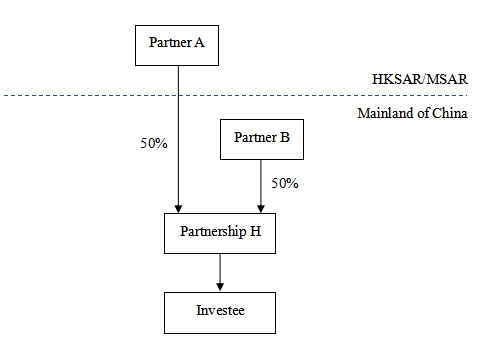

III.If A is a Hong Kong or Macau resident, how should partner A pay tax?

The definition of dividend is more clearly defined in the tax arrangements between the Mainland of China and HKSAR and MSAR. Both the Arrangement between the Mainland and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income and the Arrangement between the Mainland and the Macao Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income define dividend income as income derived from the right to share in the profits from shareholdings or non-debtor relationships and income which is similarly taxable as shareholding income under the law of the party of which the company distributing the profits is a resident income derived from the rights of other companies of which the company is a resident. At the same time, Protocol IV to the Arrangement between the Mainland of China and the Macao Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income defines an interest in a partnership or trust as "an interest similar to shares". Therefore, if Partner A is a resident of Hong Kong or Macao, the distribution of profits received by Partner A from the partnership should be an "interest similar to shares" and the relevant provisions on dividends can be applied.

According to the Arrangement between the Mainland of China and the Macao Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income, if the payee is the beneficial owner of the dividend, the amount of tax levied shall not exceed 10 per cent of the total amount of the dividend. The Arrangement between the Mainland of China and the Hong Kong Special Administrative Region for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income provides that where the beneficial owner of the dividend is a resident of the other party, the tax levied shall not exceed; (i) 5 per cent of the total amount of the dividend, if the beneficiary owner is a company that directly owns at least 25 per cent of the capital of the company that pays the dividend; and (ii) 10 per cent of the total amount of the dividend in other cases. In summary, Partner A can apply the second provision and seek to have the tax levied not exceed 10 per cent.

IV. How do non-resident partners enjoy tax treaty treatment?

From the early 1990s to the present, the enjoyment of tax treaty treatment by non-residents has gone through four stages, namely, full approval, partial approval, filing and docket. In 2019, the State Administration of Taxation (SAT) issued the Measures for the Administration of the Enjoyment of Tax Treaty Treatment by Non-Resident Taxpayers (Announcement of the State Administration of Taxation No. 35 of 2019), which confirms that the enjoyment of tax treaty treatment by non-residents in China has officially changed from a "filing system" to a "docket system". The "filing system" has been formally changed to a "docket system" - since 1 January 2020, non-resident taxpayers enjoying tax treaty treatment will be subject to the following criteria From 1 January 2020, non-resident taxpayers enjoying tax treaty treatment will be processed in accordance with the method of "self-judgment, declaration of enjoyment, and retention of relevant information for inspection". The information to be retained includes tax resident identification, relevant contracts and other materials that can prove that non-resident taxpayers can enjoy tax treaty treatment. In particular, when benefiting from dividend, interest and royalty agreements, non-resident taxpayers should also retain relevant information proving the identity of the "beneficial owner".

From "filing" to "preparation", China's non-resident enterprises have experienced a major change in the way of enjoying the agreement treatment, and it is more convenient for non-resident taxpayers to enjoy the agreement treatment, but at the same time, the tax bureau will also further increase the follow-up management, so non-resident taxpayers Therefore, non-resident taxpayers should keep relevant information in time to provide the basis for enjoying the tax treaty treatment, and consult the professional team to effectively prevent and control the tax risk of enjoying the preferential treatment under the agreement if necessary.