How can companies be tax compliant against the backdrop of strict investigation of tax return violations?

Editor's Note: Giving tax incentives to investing enterprises and financial incentives is a common way for local governments to attract investment, and this kind of financial and tax support policy effectively alleviates the pressure of capital turnover of some enterprises, reduces the operating costs of enterprises, stimulates the vitality of enterprise development, and then boosts the development of the regional economy. With the clean-up of illegal tax concessions in recent years, tax exemptions, tax rebates and other local tax incentives tightened, based on the autonomy of the local government of the tax revenue belonging to the local retention part of the enterprise to pay full taxes and then the local government to give the mode of financial return has become a part of the mainstream of the regional investment tax policy. However, in practice, some enterprises in the process of applying the policy of false opening, tax evasion and other issues, facing the risk of administrative and criminal liability. Since this year, audit, tax and other departments in the form of meetings or documents to clearly investigate the local investment promotion in the form of tax-related violations, and around the remedial action, investment promotion tax-related issues tend to tighten the regulatory situation. This article takes the recent trend of investment tax regulation as an entry point, analyzes the legitimacy of the financial return policy, and puts forward suggestions for compliance management of investment enterprises for readers' reference.

I. Investment Promotion Tax Regulatory Situation in 2024

1. Many departments clearly investigate the tax-related problems in investment promotion.

(i) National Audit Work Conference: In-depth revelation of some local investment promotion in violation of the introduction of "small policies", the formation of "tax puddles" and other issues, and seriously investigate and deal with the irregular tax return chaos.

On January 11, 2024, the National Audit Work Conference was held in Beijing, which put forward six aspects of audit work, the second of which includes: audit around the deepening of key areas of reform. Focusing on promoting the acceleration of the construction of a unified national market, paying close attention to the implementation and progress of major reform tasks in key areas such as finance, finance, state-owned enterprises, foreign trade and foreign investment, and revealing in-depth problems such as the illegal introduction of "small policies" and the formation of "tax depressions" in the attraction of investments in some places, as well as seriously investigating tax irregularities. "It has also seriously investigated and dealt with irregular tax rebates.

In recent years, the audit report on the implementation of the central budget and other financial revenues and expenditures of the central government have mentioned the cleanup and standardization requirements of the financial rebate policy, and the report of the State Council on the rectification of problems identified in the audit of the implementation of the central budget and other financial revenues and expenditures of the year 2022, which was released at the end of 2023, pointed out that "the problem of insufficiently stringent management of the local finances. The relevant regions audited have rectified 51.627 billion yuan. ......55 areas to clean up and abolish the illegal introduction of tax rebate concessions, etc., to regulate the behavior of investment promotion".

(ii) The State Administration of Taxation: seriously investigate and deal with violations of investment promotion in tax-related issues

On January 18, 2024, the State Council Information Office held a press conference on tax services for high-quality development, and Rao Lixin, deputy director of the State Administration of Taxation, pointed out that "the tax department will conscientiously implement the requirements of the CPC Central Committee and the State Council on accelerating the construction of the deployment of the national unified market ...... to investigate and deal with tax-related issues in violation of the law". Investment promotion in tax-related issues, to help accelerate the construction of efficient and standardized, fair competition, fully open the national unified market".

(iii) The national tax work conference: strictly prohibit the tax department and tax cadres to participate in cooperation with illegal investment promotion

On January 25, 2024, the National Tax Work Conference clearly pointed out that "it is strictly prohibited for tax departments and tax cadres to participate in cooperating with investment promotion in violation of the law, and resolutely and seriously investigated and dealt with the problems found". In practice, some local governments have issued documents to make it clear that government departments will bear administrative or even criminal responsibility for tax rebates in violation of the law. In Guangdong Province, for example, on December 25, 2023, the People's Government of Guangdong Province issued the "Guangdong Province Tax Collection and Management Protection Measures", in which Article 40 makes it clear that "the tax authorities and relevant departments in violation of the provisions of the unauthorized expansion or narrowing of the scope of collection, unauthorized failure to levy, less levy, more levy, levy ahead of time, or reduce, exempt, slow levy of taxes and fees, unauthorized violation of the provisions of the concealment, transfer, misappropriation, misappropriation of taxes and fees or delay in the discharge of taxes and fees, and the return of taxes and fees in violation of the regulations resulting in the loss of fiscal revenues or the loss of the social insurance fund, the competent authorities shall impose penalties on the competent persons directly responsible and other persons directly responsible in accordance with the law; and the tax authorities and the relevant responsible persons of the relevant departments, units, and social organizations shall be investigated for criminal responsibility in accordance with the law, if the relevant responsible persons constitute a crime".

(iv) 2024 eight departments joint crackdown focus: fraudulent tax retention refunds, financial rebates and government subsidies by means of false openings

According to the official news disclosure of the Supreme People's Procuratorate on February 28, 2024, the joint crackdown mechanism of the eight departments will focus on six key areas, including "focusing on cracking down on the use of fraudulent export tax refunds, fraudulent tax rebates by means of fraudulent tax rebates, financial refunds and government subsidies".

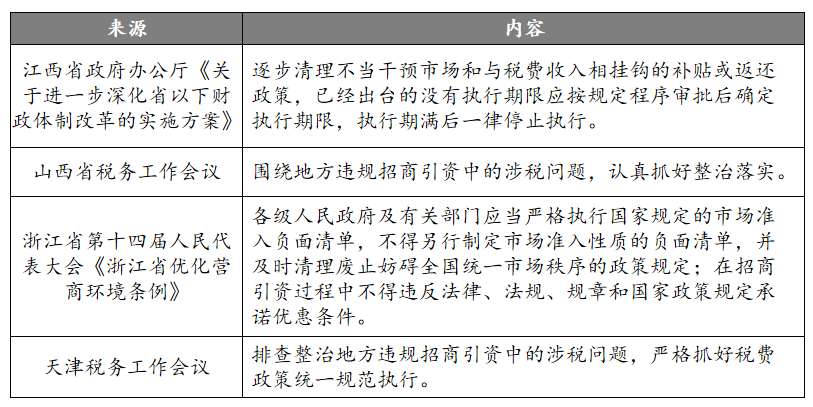

2. A number of provinces and cities have been deployed to rectify investment promotion in the illegal tax issues

This year, a number of provinces and cities in the form of documents or meetings clearly put forward to rectify local violations of investment promotion in tax-related issues, involving undue interference in the market and tax revenues linked to the subsidies or refunds to clean up, prohibit the commitment of illegal preferential conditions.

II. Exploring the legitimacy of local fiscal return policies

Giving supportive policies to investment enterprises in terms of finance and taxation is a common way for local investment promotion. With the "notice on cleaning up and standardizing tax and other preferential policies" (Guo Fa [2014] No. 62) on the cleanup of illegal tax preferential policies and the "Legislative Law", "Tax Collection and Management Law" on the formulation of tax preferential policies to make the authority of the tax preferential policies clear, with the tax directly related to the preferential policies, such as tax exemptions and reductions, tax refunds, approved levies, etc., tightened, the provisions of such tax concessions are facing the risk of invalidity due to the conflict with the supreme law; In recent years, some local governments have given preferential policies to enterprises in the form of financial rebates in the process of attracting investments, agreeing that the investing enterprises will first pay taxes in accordance with the law, and then the government will return a certain percentage of the taxes in the form of financial subsidies, financial support, financial incentives, etc., and some clauses are directly embodied in the "comprehensive tax burden rate". In the context of the current serious investigation and handling of tax-related issues in the context of illegal investment promotion, the question of what constitutes "illegal tax rebates" and the legality of financial rebate clauses deserves further discussion.

1. Fiscal rebate policies linked to tax revenues have greater risks of application

For a long time, due to the inherent source invoice dilemma of the industry, there usually exists a link in the business chain of resources recycling industry, logistics and transportation, and flexible labor industry that operates by relying on the local rebate policy, i.e., the enterprises set up trade chains in the parks that have the financial rebate, and make use of the financial rebate to reduce the tax burden of paying the full tax due to the unavailability of input invoices. However, in the process of applying the fiscal rebate policy, some unscrupulous elements make use of the fiscal rebate to open false invoices on a large scale in the absence of real transactions, resulting in the loss of national taxes. In addition, some localities compete for tax sources by violating the fiscal rebate, destroying the market environment of fair competition.

Since the Decision of the State Council on Deepening the Reform of the Budget Management System proposed to "clean up and standardize key expenditures and the increase in fiscal revenues and expenditures or gross domestic product, and generally do not take the linking method", the Circular of the State Council on Cleaning Up and Standardizing Preferential Policies on Taxation and Other Preferences pointed out that the illegal and irregular policies should be abolished. No. 62 pointed out that it is necessary to cancel the illegal and irregular formulation of fiscal expenditure preferential policies linked to the payment of taxes or non-tax revenues by enterprises, standardize the "financial incentives or subsidies and other forms of attracting enterprises from other regions to settle in the local area or to pay taxes and fees in the local area, and the implementation of the local level of fiscal revenues of the full retention of the local level or incremental rebate" behavior, to In 2015, the "Notice of the State Council on Matters Related to Preferential Policies on Taxation and Other Preferences" stipulated that "all regions and departments shall not generally link their expenditures with taxes or non-tax revenues paid by enterprises in the future when they formulate and introduce new preferential policies ...... . ", and then to the recent policy documents requiring strict investigation of tax rebates in violation of the law, it is not difficult to see from the above regulatory trends, in the context of building a unified national market and multi-sectoral joint efforts to fight against fraud, the fiscal rebate policy directly linked to the actual amount of tax paid by the investing enterprises has become the focus of the cleanup.

-

Based on the autonomy of local governments in financial expenditures, the procedures for financial rebates approved by the budget are legal.

Local governments' financial returns and subsidies to enterprises belong to local financial expenditures and are subject to the Budget Law. China's Budget Law only stipulates that local expenditures should be balanced with revenues, that local budgets do not include deficits, and that the final approval of local budgets belongs to the National People's Congress at the same level. Therefore, the local for its own financial resources of expenditure enjoys the dominant autonomy, only in the law and administrative regulations for the local establishment of mandatory expenditure responsibility, this expenditure autonomy will be limited. The supreme people's court in weifang xunchi real estate development co., ltd v. Anqiu city people's government administrative agreement of the case of the retrial ruling also holds such views, "business tax, income tax local retention in xunchi company to return after payment of the problem, the above costs belong to the local government financial income, anqiu city government enjoys the right of autonomy, on the basis of which the contract terms and conditions do not violate the mandatory provisions of laws and administrative regulations. The mandatory provisions of laws and administrative regulations shall also be effective agreement".

Therefore, the local government based on the tax revenue attributable to the local retention enjoys the right of independent disposal, by the local budget expenditure or adjustment procedures of the expenditure procedures are legal. If, after budgetary approval, the local government grants government subsidies to enterprises that meet certain standards, or to enterprises in specific industries to be supported, this does not ipso facto constitute a violation of the law as it is generally not linked to the amount of tax actually paid by the enterprise.

III. Under the trend of strict investigation of tax rebate violations, how to do a good job of tax compliance management of enterprises

1. Pay attention to the effectiveness and stability of the financial rebate policy

Enterprises should choose industrial parks with high government credibility and policy stability to settle in, and carry out special tax planning for investment and financing projects. Enterprises need to review the cooperation agreements signed with local governments or platform enterprises, focus on verifying the legitimacy of fiscal and tax incentives, analyzing and assessing the feasibility of fiscal and tax policies and payment risks. Enterprises may also hire tax professionals to participate in investment and financing negotiations and decision-making meetings, and issue professional fiscal and tax opinions and recommendations.

2. Investment enterprises that have already moved in need to "look back" and check the risks of the application of investment promotion policies.

Enterprises that have already obtained the financial rebate policy should regularly "look back", review the legality of the signed investment promotion agreement, pay attention to the latest regulatory developments, analyze the risk of fulfillment, and adjust the business model in a timely manner; at the same time, in the process of applying the investment promotion agreement, the investment enterprise should review whether it fulfills the obligations agreed upon, such as whether the financial rebate is used for the agreed upon purpose, and whether the financial rebate is used for the agreed upon purpose. At the same time, in the process of applying the investment promotion agreement, the investing enterprise should examine whether it has fulfilled the obligations agreed in the agreement, such as whether the financial rebates are used in the agreed fields or projects, so as to avoid the legal risk of improper use of financial rebates.

3. Grasp the authenticity of its own business

Real business is the basis for issuing invoices and the prerequisite for obtaining financial rebates. Enterprises should complete the business process and pay attention to the retention of written agreements. At the same time, we need to pay special attention to the seller whether there is the phenomenon of opening on behalf of the seller, dependence, etc., and timely investigation of whether there is inconsistency in the three streams of the situation, if there is a directive delivery, advances on behalf of the payment of the behavior of the other party must be retained in the description of the document, the relevant agreements, etc., in order to prove the authenticity of their own business. In the design of contract terms, it is necessary to make a clear agreement on the type of invoicing, project, tax rate, invoicing time, the main body to bear the tax, out-of-the-price costs, breach of contract, and other tax-related terms, as well as a clear agreement on the mode of delivery of the goods and the risk of liability for the goods after delivery. After the transaction is completed, it is necessary to save the relevant contracts, invoices, transportation documents, remittance statements and other information related to the transaction. In case of tax audit or public security investigation, you should actively seek professional support and legal remedies, provide information proving the authenticity of the business, and safeguard your legitimate rights and interests.