Can the tax authorities disqualify a venture capital enterprise from enjoying the 15% preferential tax rate for western development on the grounds of failure to file?

Editor's Note: According to the Interim Measures for the Administration of Venture Capital Enterprises, Venture Capital Enterprises that have not completed the filing procedures in accordance with the provisions of the Measures are not entitled to policy support. Meanwhile, the "Catalogue of Encouraged Industries in the Western Region" in China's preferential policies for the development of the western region includes "Venture Capital", which stipulates that qualified enterprises can enjoy the tax incentives of corporate income tax at a rate of 15%. Recently, a number of Venture Capital companies in a certain province have been requested by the tax bureau to conduct self-examination and pay back the tax, the reason is that they have enjoyed the preferential tax rate of 15% for the western development without filing, and some of them have even been requested to make retroactive adjustments for many years, which involves a huge amount of tax and is difficult to bear. When a venture capital enterprise has not completed the filing procedure, can it enjoy the tax incentives for encouraged industries in the western region? This article will analyze the issue with cases.

01 Case Sharing

H Investment Company (hereinafter referred to as "H Company") was established in 2013 in A city of a province in Southwest China, and the main business scope of the Company includes: venture capital investment (limited to investment in unlisted enterprises); investment activities with its own funds; and asset management services for investment of its own funds.In 2018, the Development and Reform Commission of A city issued the "Letter of Confirmation that the Relevant Main Businesses of H Confirmation on the Relevant Main Business of Investment Company Belonging to National Encouraged Industries" (hereinafter referred to as the "Confirmation"), confirming that the relevant main business engaged by H Investment Company from January 1, 2017 onwards is in line with the National Encouraged Industries of the Catalogue of Encouraged Industries in the Western Region. The relevant business scope of the encouraged industries to which Company H conforms is set out in the Annex to the Confirmation Letter as "Venture Capital Business". Subsequently, in accordance with the tax incentives under the Western Development Strategy for "Enterprises in the encouraged industries located in the western region are subject to a reduced enterprise income tax rate of 15%" (hereinafter referred to as the "Western Development Tax Incentives"), Company H has filed its enterprise income tax returns in accordance with the preferential rate and has continued to do so. Company H filed its enterprise income tax return according to the preferential tax rate and has continued to do so since then.

In April 2025, Company H received a Notice on Tax Matters issued by the competent tax authority, which considered that Company H did not meet the conditions for enjoying the preferential tax policies for the development of the western region, and required Company H to conduct a self-inspection for all the years in which it had previously enjoyed the preferential policies and to make up for the corresponding taxes and late payment fees. The reason stated in the Notice on Tax Matters was that, according to the relevant provisions of the Interim Measures for the Administration of Venture Capital Enterprises, the State implements filing management for venture capital enterprises, and venture capital enterprises that have completed the filing procedure and whose investment operations are in line with the relevant provisions can enjoy policy support; as Company H had not filed, it could not enjoy the relevant support policies for venture capital enterprises.

The key issues in this case are whether Company H meets the conditions for declaring its entitlement to the western development tax incentives and whether Company H's failure to file in accordance with the Interim Measures for the Administration of Venture Capital Enterprises will have the effect of disqualifying it from the western development tax incentives.

02 Conditions and Procedures for Venture Capital Companies to Enjoy Preferential Tax Policies for Western Development

(i) Conditions for Venture Capital Companies to Enjoy Preferential Tax Policies for Western Development

The Notice on Tax Policies Related to the In-Depth Implementation of the Western Development Strategy (Cai Shui [2011] No. 58) jointly issued by the Ministry of Finance, General Administration of Customs, and State Taxation Administration stipulates that "from January 1, 2011, to December 31, 2020, enterprises engaged in encouraged industries in western China shall be subject to a reduced corporate income tax rate of 15%." This preferential policy was extended to December 31, 2030, by the Announcement on Continuing the Corporate Income Tax Policy for Western Development (Announcement No. 23 of 2020) issued by the Ministry of Finance, State Taxation Administration, and National Development and Reform Commission.

According to Cai Shui [2011] No. 58, enterprises must meet three conditions to qualify for the preferential tax policy:

Location: Registered and operating in western China or equivalent policy areas.

Business Scope: Main operations must align with the Western Region Encouraged Industry Catalog.Before the catalog’s official release in 2014, enterprises complying with the *Industrial Structure Adjustment Guidance Catalog (2005/2011)*, Foreign Investment Industry Guidance Catalog (2007), or Central and Western Region Advantageous Industry Catalog (2008) could apply the 15% tax rate upon tax authority confirmation. Post-2014, compliance with the Western Region Encouraged Industry Catalog (revised in 2020 and 2025) is required.

Revenue Threshold:Pre-2021: Main business income must account for ≥70% of total annual revenue.Post-2021: Main business income must account for ≥60% of total annual revenue.

According to these rules,H Company, registered and operating in a western tax incentive zone, primarily engages in venture capital. The local development and reform authority confirmed its eligibility under the "Financial Services" sector (Item 30, Clause 11 of the Industrial Structure Adjustment Guidance Catalog (2011)) in the Western Region Encouraged Industry Catalog. Since 2017, H Company’s venture capital income has consistently exceeded 70% of total revenue. Thus, H Company qualifies for the Western Development tax incentives.

(ii)Procedures for Venture Capital Companies to enjoy tax incentives for western development

Since the implementation of the Western Development Tax Preferential Policy, the procedures for declaring the enjoyment of the policy have changed several times and can be mainly divided into the following three stages:

2011-2015: first year of approval, subsequent years of filing

Article 2 of Announcement No. 12 of 2012 of the State Administration of Taxation stipulates that "Enterprises shall submit a written application with relevant information to the competent tax authorities prior to the annual remittance. The first year shall be reported to the competent tax authorities for examination and confirmation, and the second and subsequent years shall be managed by filing. The tax authorities of provinces, autonomous regions, municipalities directly under the central government and municipalities with separate plans may formulate specific audit and filing management methods in light of local actualities and report them to the State Administration of Taxation (Department of Income Tax) for record." According to this provision, enterprises enjoying the preferential tax policy for western development need to submit a written application with relevant information to the competent tax authorities before the annual remittance of the first enjoyment of the preferential policy, and after the competent tax authorities' examination and confirmation, they can enjoy the policy. Subsequent years are not subject to approval, but only to filing and review.

2015-2016: filing and retention of docket information for each year

In August 2015, the State Administration of Taxation ("SAT") issued the Announcement on the Publication of 22 Cancelled Tax Non-Administrative Permit Approval Matters (SAT Announcement No. 58 of 2015), which clarifies that the requirements for the approval of 22 tax non-administrative permit approval matters, such as tax incentives for the development of the western part of the country, have been cancelled, and that the tax authorities are not allowed to retain them or approve them in disguise in any form.

In November 2015, the State Administration of Taxation ("SAT") issued the Measures for Handling Matters of Enterprise Income Tax Preferential Policies (Announcement No. 76 of 2015). According to the provisions of the Announcement, the tax preferential policy for western development is a tax rate reduction policy, and enterprises should judge by themselves whether they meet the conditions of the tax preferential policy, and if they meet the conditions, the enterprises should submit the filing materials before the expiration of the annual remittance period and retain the backup information. The tax authorities will no longer fulfill the approval procedure, but conduct a formal review. If the filing materials submitted by the enterprise conform to the prescribed form, are complete, and the attached information is complete, the tax authorities shall accept the filing materials. The information to be retained by the enterprises under the preferential tax policies for western development as listed in the "Catalogue of Enterprise Income Tax Preferences for Filing and Management" attached to the announcement includes: the relevant supporting materials of the main business belonging to the specific projects in the "Catalogue of Encouraged Industries in the Western Regions", the description of the main business revenue in line with the catalog accounting for more than 70% of the total revenue of the enterprise, and other information stipulated by the provincial tax authorities.

2017-present: enterprises make their own judgment, declare their entitlement, and keep relevant information for inspection

In 2017, the procedures for enterprises to handle income tax preferences were further simplified.In April 2018, the State Administration of Taxation (SAT) issued the revised Measures for Handling Matters of Preferential Policies on Enterprise Income Tax (SAT Announcement No. 23 of 2018). The new Measures have completely abolished the filing system and changed the application of preferential policies to one in which enterprises discern on their own, directly declare for enjoyment, and retain backup information, with the applicable tax period being 2017 and subsequent years.

According to this new regulation, enterprises enjoying income tax incentives for the development of the western region no longer need to file with the tax authorities, but can directly declare for enjoyment, and at the same time, they should retain the backup information in accordance with the "Administrative Catalog of Enterprise Income Tax Preferences (2017 Edition)" attached to the announcement, including (1) relevant supporting materials for the main business belonging to specific projects in the Catalogue of Encouraged Industries in the Western Region; (2) a description of the percentage of the main business revenue in line with the catalogue; and ) a statement that the revenue from the main business in compliance with the catalog accounts for more than 70% of the total revenue of the enterprise.

03 Western Development Tax Incentive is not a tax incentive tied to the VC filing system

(i) The filing of Venture Capital Enterprises is not a mandatory matter and does not fall within the scope of administrative licensing

The legal nature of the Interim Measures for the Administration of Venture Capital Enterprises belongs to departmental regulations, and its Article 3 stipulates The State implements record management for VC enterprises. Venture capital enterprises are required to file with the Development and Reform Commission or the Securities and Futures Commission in accordance with the procedures. Venture capital enterprises that have not completed the filing procedures are not subject to the supervision of the management department of the Venture Capital Enterprises, and are not entitled to policy support. According to the provisions of the Administrative License Law, departmental regulations do not have the authority to set administrative licenses. Therefore, the filing of VC enterprises is a voluntary act rather than a restriction on market access, and enterprises that have not filed can still carry out normal venture capital activities, i.e., the filing of VC enterprises does not constitute a restriction or authorization of the enterprises' venture capital activities, and will not affect the enterprises' ability to carry out the venture capital business and obtain income.

As far as this case is concerned, the fact that Company H uses venture capital business as its main business, regardless of whether it has filed a case or not, will not affect the determination that its main business belongs to the encouraged industries in the western region, nor will it affect the proportion of its venture capital business to its total revenue. Therefore, even if it is not filed, Company H can still enjoy the enterprise income tax incentives for the encouraged industries in the western region.

(ii) The scope of policy support provided for venture capital enterprises does not include tax incentives for the development of the western region.

The Administrative Measures stipulate that VC enterprises that have completed the filing procedure may enjoy policy support, including: 1) obtaining support from the government's guidance fund; 2) enjoying tax incentives; and 3) providing a variety of investment exit channels. It also stipulates that the specific measures for tax incentives shall be formulated by the finance and taxation department of the State Council in conjunction with relevant departments.

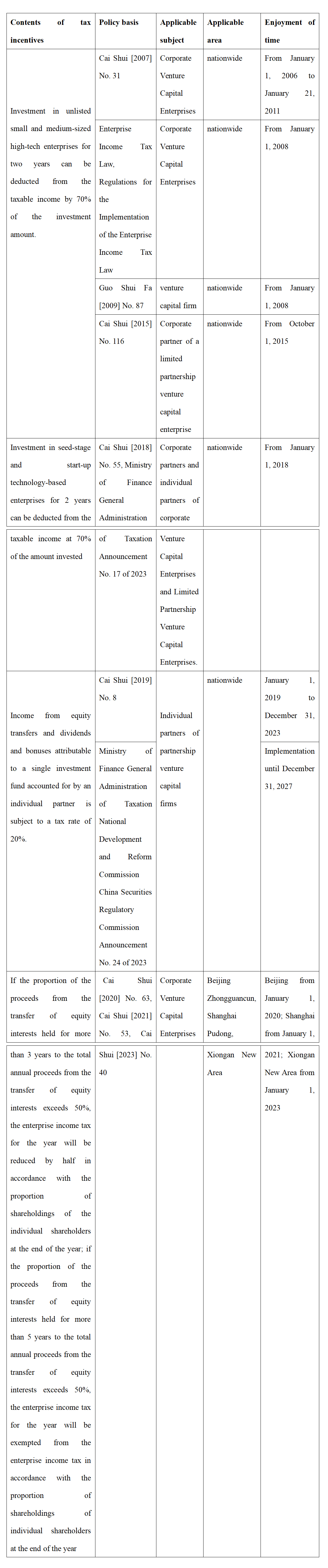

Since the enactment of the Administrative Measures, the Ministry of Finance and the State Administration of Taxation (SAT) have successively formulated targeted tax incentives for Venture Capital Enterprises (VCEs) that meet the requirements of filing and management, investment operation and other requirements, which mainly include the following types of tax incentives:

According to the above regulations, the only preferential enterprise income tax policy that VC enterprises can enjoy after completing the filing procedure is "offsetting taxable income by 70% of the investment amount", and only the income tax offset policy and the 20% tax rate applicable to specific partners are the tax preferential policies linked to the filing system of VC enterprises. In fact, we can confirm this conclusion from the many documents of the State Council and the National Development and Reform Commission and the filing work.

For example, the State Council's Opinions on Promoting the Continuous and Healthy Development of Venture Capital (Guo Fa [2016] No. 53) states that the preferential tax policy for VC enterprises is to "further improve the preferential tax policy for investment tax credits for venture capital enterprises".

As another example, the annual notice on the annual inspection work of filed venture capital enterprises issued by the NDRC every year takes the income tax credit preferential policy as one of the important contents of the annual inspection of filing, and also indicates that the only preferential policy linked to the filing system is the income tax credit policy. The author presents the 2018 NDRC document involved in the introduction of the case as an example.On July 14, 2018, the General Office of the National Development and Reform Commission (NDRC) issued the Notice on the Annual Inspection of Recorded Venture Capital Enterprises in 2018 The first article thereof stipulates that "the management departments of the provincial-level (including sub-provincial-level) Venture Capital Enterprises for the Record shall complete the annual inspection of the Venture Capital Enterprises for the Record and their management consultant organizations before August 15, and issue certifying documents for the qualified Venture Capital Enterprises for the Annual Inspection, so as to ensure that they are able to enjoy the timely deduction of their taxable income, exemption of the state-owned Venture Capital Enterprises or the state-owned Venture Capital Guiding Fund state-owned stock transfer obligations and other preferential policies."

04 Problems of Tax Authorities Denying the Eligibility of Venture Capital Enterprises for Tax Benefits on the Ground of Failure to File a Case

Summarizing the above analysis, the author believes that the Venture Capital Enterprises did not handle the filing in the Development and Reform Commission, and the enterprise income tax preference it cannot enjoy is the income tax credit preference. Venture capital enterprises that meet the applicable conditions of the tax incentives for the development of western China and handle the incentives in accordance with statutory procedures can enjoy the incentives without the need for filing as a prerequisite. In the case introduced, the tax authority denied the enjoyment of the western development tax incentives by Company H on the ground that Company H had not filed a record, which was obviously improper and there were the following enforcement errors.

First, the Interim Measures for the Administration of Venture Capital have been unduly broadly interpreted. Based on the provisions of Article 3 of the Administrative Measures, the tax authorities considered that VC enterprises that had not completed the filing procedure did not enjoy policy support, and therefore Company H could not enjoy the Western Development Enterprise Income Tax Preferences. However, the tax incentives stipulated in the Administrative Measures do not include the tax incentives for the development of the western region, and the tax authorities directly considered that the VC enterprises enjoying the tax incentives have to meet the filing requirements, which in fact enlarged the scope of application of the Administrative Measures, and violated the basic principle of administration in accordance with the law.

If we follow the understanding of the tax authorities, then in fact there will be an inappropriate restriction on the application of the Western Development Tax Preferential Policies. For example, one of the conditions to be met by VC enterprises applying for filing is "paid-in capital of not less than RMB 30 million", and VC enterprises failing to meet this condition will not be able to complete the filing. However, the Catalogue of Encouraged Industries in the Western Region only stipulates that "Venture Capital" belongs to the scope of encouraged industries, and it does not put forward requirements on the scale and capital of enterprises. Requiring VC enterprises to file before they can enjoy the tax incentives for the development of western region not only increases the burden of enterprises in the procedure, but also deprives the VC enterprises that do not meet the filing conditions of the eligibility to enjoy the tax incentives for the development of western region. Obviously, the tax authorities cannot arbitrarily make such unfounded clues, which are obviously beyond the rule-making intention of the main body of the Administrative Measures.

Secondly, violation of the principle of protection of reliance interests.Company H has made annual enterprise income tax returns to the tax authorities and enjoyed the preferential tax rate of 15% in accordance with the law since obtaining the Confirmation Letter issued by the NDRC in 2018. During this period, the objective status of the enterprise's failure to file for Venture Capital Enterprises continued to exist and was not questioned, and the tax authorities never objected to the applicability of the tax preference in any form or requested the enterprise to supplement the materials or make risk reminders in the course of tax inspection and declaration acceptance in the past years. Based on its trust in the Confirmation and the implied recognition by the tax authorities in previous years, the enterprise has continued to carry out production and operation activities in the western region and formulated corresponding business strategies. In 2025, the tax authorities proposed that the enterprise did not meet the conditions for the application of the preferences, and requested the enterprise to retroactively correct its past tax returns and pay additional taxes and late fees, which is an administrative act that clearly violates the principle of protection of reliance interests, and will have a huge adverse impact on the enterprise's business activities.

Thirdly, it undermines the business environment and market confidence. The practice of retroactive adjustment by the tax authorities will, to a certain extent, undermine the benign levy and payment relationship of mutual trust and cooperation and the predictability of tax policies. Enterprises have been enjoying tax incentives for many years based on NDRC's Confirmation Letter, and the tax authorities have not raised any objection during this period. After many years, the tax authorities unilaterally overturned the previous results of tax administration, which is inconsistent with the law enforcement standards, and is not conducive to the construction of equal and harmonious tax-paying relationship. At the same time, it will also affect the enterprises' judgment on the expectation of the tax policy, and when the market entities have difficulties in forming stable expectation on the long-term effectiveness of the tax preferences, it will inhibit their willingness to invest in the western region in the long term, which is contrary to the current economic policy orientation of "stabilizing investment and promoting growth".

In addition, the practice of retrospective adjustment by the tax authorities has also increased the financial burden of enterprises. At a time when the private economy still needs to be revitalized, the practice of the tax authorities of retroactively adjusting the tax concessions of enterprises over the years will not only greatly increase the tax burden on enterprises, affecting the current and future business development of enterprises, but will also easily exacerbate the operational anxiety of enterprises, forcing them to downsize the scale of production or transfer their investments, and weakening the endogenous impetus of the growth of the local economy.

concluding remarks

In recent years, enterprises enjoying tax incentives have faced severe compliance tests.2025 The National Tax Inspection Work Conference requires tax inspection departments at all levels to continue to play a deterrent role in cracking down and accurately crack down on tax-related offenses in accordance with the law. Last year, the two high tax-related judicial interpretations were also introduced to severely pursue fraudulent tax preferences as a tax evasion crime. Enterprises enjoying various types of tax incentives should be able to correctly identify and declare in a compliant manner. When disputes arise with tax authorities over the application of tax incentives, they should actively cooperate with them, prudently respond to them, defend themselves in accordance with the law and actively seek legal remedies and professional support from tax lawyers.